Institutional orders surpass 100 trillion won... KakaoBank 4 times 2,585 trillion won

Equal and proportional allocation half each... "Must check competition rate until the end"

[Asia Economy Reporter Minwoo Lee] This year’s largest initial public offering (IPO) LG Energy Solution has attracted unprecedented attention. It is estimated that institutional investors’ order amounts exceeded 1 quadrillion won, which is 4.5 times the KOSPI market capitalization. With general investors’ expectations also soaring, intense “scramble competition” is expected as they vie to be allocated more shares. How much to invest to make a meaningful impact

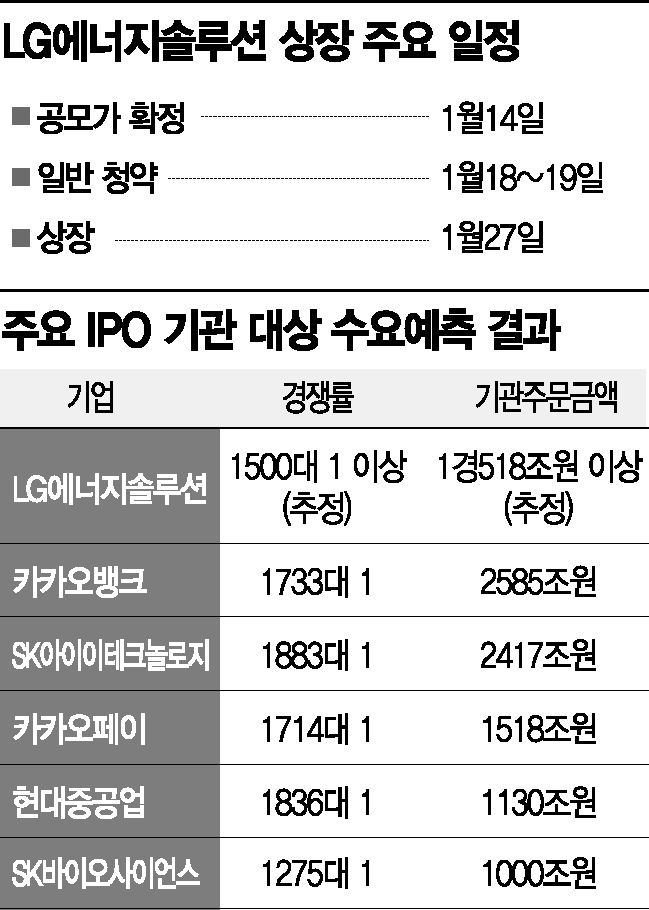

According to the financial investment industry on the 13th, about 1,700 institutions participated in LG Energy Solution’s demand forecast for institutional investors held on the 11th and 12th. Most of them reportedly placed orders for the maximum quantity available at the top end of the public offering price range, 300,000 won. The competition ratio is estimated to have exceeded 1,500 to 1.

Therefore, the order amount is believed to have surpassed the record high of 1 quadrillion won. When multiplying the institutional investor allocation of 23,375,000 shares by the top end of the public offering price range of 300,000 won and the expected competition ratio of 1,500 to 1, the total reaches 1,518 trillion won. This is 4.5 times the KOSPI market capitalization of 2,201 trillion won based on the previous day’s closing price. It far exceeds the previous largest order amount of KakaoBank’s 2,585 trillion won. However, this is not the actual amount deposited. A senior official in charge of IPOs at a securities firm explained, “This is not money that has actually been transferred or recorded in the system, but an amount reflecting aggressive intentions to receive even one more share,” adding, “It means the popularity is fierce.”

Since popularity among institutions has been verified, the subscription competition for general investors scheduled for the 18th and 19th is also expected to be intense. The quantity allocated for general subscriptions is 25-30% of the total public offering shares (10,625,000 to 12,750,000 shares). Half of this is allocated by equal distribution and the other half by proportional distribution. The equal distribution method divides the shares equally among all investors, while the proportional method allocates shares based on the number of shares subscribed and the deposit amount.

After the ban on multiple subscriptions, KakaoBank had the highest number of subscription cases at about 1.86 million. Since at least 5,312,500 shares will be allocated through the equal distribution method in LG Energy Solution’s subscription, even if more than 2 million subscriptions are received, investors can expect to receive 2 to 3 shares through equal allocation.

Assuming a 25% allocation, the number of shares per securities firm is highest at KB Securities, the lead manager, with 4,869,792 shares. Co-managers Daishin Securities and Shinhan Financial Investment each secure 2,434,896 shares. These three firms are allocated more than 90% of the total subscription shares. Four firms participating as underwriters?Mirae Asset Securities, Hana Financial Investment, Shin Young Securities, and Hi Investment & Securities?are each allocated 221,354 shares.

Daishin Securities, Shin Young Securities, and Hi Investment & Securities require investors to open accounts by the 17th, the day before subscription, while KB Securities, Shinhan Financial Investment, Mirae Asset Securities, and Hana Financial Investment allow participation even if accounts are opened on the subscription day. Assuming a public offering price of 300,000 won, the subscription deposit for the equal distribution method requires 1.5 million won (minimum unit 10 shares, subscription deposit rate 50%).

A securities firm official said, “Theoretically, KB Securities, which has a large allocation, may have an advantage in the proportional method, but the key is the competition ratio,” adding, “It is advantageous to carefully check the preferential conditions of each securities firm and apply to the one with the lowest competition ratio after monitoring until the last moment.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.