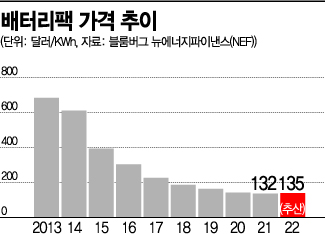

[Asia Economy Reporter Byunghee Park] It is forecasted that electric vehicle (EV) battery prices will halt their decade-long decline and slightly rebound this year. This is due to the significant increase in battery demand driven by expanded EV production, which is expected to continue causing supply-demand imbalances for key battery raw materials such as lithium, cobalt, and nickel.

According to Bloomberg New Energy Finance (NEF), lithium-ion battery pack prices exceeded $1,200 per kWh in 2010 but fell to $132 last year, about one-tenth of the previous level. Bloomberg NEF expects battery prices to slightly rise to $135 per kWh this year, as prices of lithium, cobalt, and nickel?the main materials of cathode active materials that account for 30% of battery costs?have surged significantly.

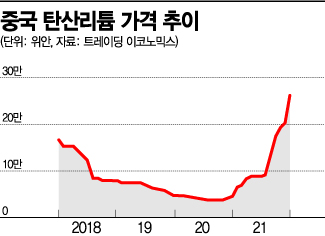

The price of lithium carbonate in China, the world's largest battery producer, recently reached 261,500 yuan per ton, more than five times higher than a year ago.

The London Metal Exchange (LME) cobalt price in the UK has doubled over the past year and is currently trading at $70,208 per ton. Nickel prices have risen 12% in the past month. On the 12th, nickel prices increased by up to 4%, reaching $22,745 per ton, the highest in 10 years.

As EV sales increase, supply is struggling to keep up with demand. Bloomberg NEF expects global EV sales, which reached 3.1 million units last year, to rise to 5.6 million units this year.

With battery demand rising accordingly, LME nickel inventories have been declining for 51 consecutive days. Nickel inventories in China are also at an all-time low of 4,859 tons. The International Energy Agency (IEA) projects that if the Paris Climate Agreement targets are met, nickel demand will increase 19-fold by 2040.

S&P Global Market Intelligence forecasts that lithium carbonate supply will increase from 497,000 tons last year to 636,000 tons this year, but demand will also rise from 504,000 tons to 641,000 tons, indicating a continued supply shortage.

Due to the spread of the Omicron variant and supply chain disruptions, expanding supply remains challenging. Australian mining companies are struggling to increase their workforce, which was reduced during the COVID-19 pandemic, and have yet to restore production capacity to pre-pandemic levels.

In the case of cobalt, supply instability persists because major producing countries such as South Africa and the Democratic Republic of Congo were epicenters of the Omicron variant spread. Chinese companies processing lithium into lithium carbonate experienced production setbacks last year due to power shortages.

As securing raw materials becomes more difficult, automakers have rolled up their sleeves to directly secure raw materials.

U.S. electric vehicle manufacturer Tesla Motors recently signed a six-year contract to purchase 75,000 tons of raw materials, including refined nickel, from domestic mining company Talon Metals. Tesla plans to receive nickel produced at Talon Metals’ Tamarack mine in Minnesota. BMW signed a $113 million contract with Moroccan mining company Managem to supply cobalt for five years. Volkswagen also signed a lithium supply contract with Vulcan Group last month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.