Integration of High-Frequency MobileHome App Features into KB Pay

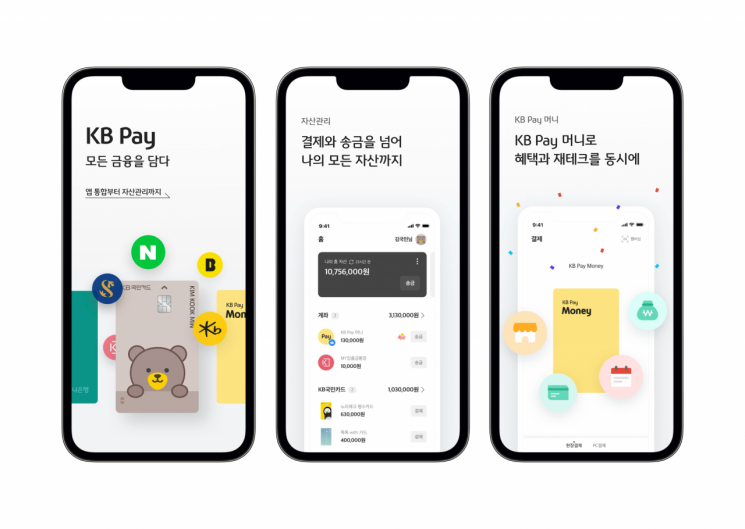

[Asia Economy Reporter Ki Ha-young] KB Kookmin Card announced on the 12th that it has completely revamped 'KB Pay' by integrating the main functions of its mobile home application (app).

This renewal marks the starting point of integrating major functions into a single app. The main functions provided in the KB Kookmin Card mobile home app, such as payment, card issuance, and reporting, are incorporated into KB Pay to offer a user environment and experience (UI·UX) optimized for the customer's usage flow.

Additionally, new services have been added to enhance convenience, including KB Pay Money, a prepaid payment method that supports remittance and payment, instant payment via timeline, and Dutch pay, which allows cost sharing.

KB Kookmin Card customers can now use key services directly through the KB Pay app that were previously available on the mobile home app, such as checking scheduled payment amounts, instant payment, installment payment, changing installment months, card issuance, checking usage limits, changing payment dates and accounts, updating personal information, card usage registration, and theft/loss registration and cancellation services.

The newly introduced KB Pay Money is a prepaid payment method that supports remittance and payment and can be charged via accounts, Pointree, gift certificate points, etc. Linked with open banking, it offers 'Collecting Account Balances,' which allows bulk remittance from small-balance accounts to KB Pay Money, and an 'Auto-Collect Service' that automatically accumulates a targeted amount from the user's account to KB Pay Money when paying with KB Pay under certain conditions such as selected cards and merchants.

As part of strengthening synergy within the KB Financial Group's mobile platform and enhancing open payment competitiveness, the KB Securities check card can now be registered in KB Pay and used as an online and offline payment method, improving the service.

A KB Kookmin Card official stated, "Based on future scalability and openness, we plan to collaborate with various partners to grow into a true open payment-based 'comprehensive financial platform' that transcends industry boundaries."

Meanwhile, KB Kookmin Card is also holding an event to coincide with the KB Pay renewal launch. Until the 31st of this month, customers who participate and complete designated missions using the new KB Pay services?charging KB Pay Money, instant payment of payment amounts, and Dutch pay functions?will receive 2,000 points per mission, up to a maximum of 6,000 points.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.