Some Banks Face Controversy Over Assigning Employees for MyData Acquisition

Excessive Prize Giving Practices Persist

Consumer Harm Concerns Raised

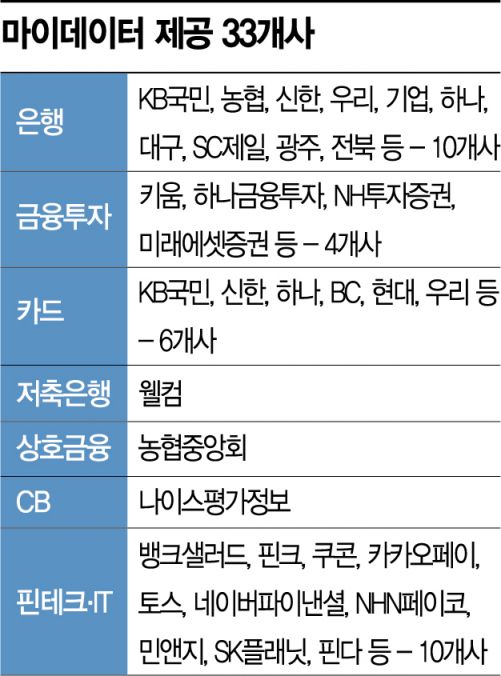

[Asia Economy Reporter Kim Jin-ho] Since the full-scale implementation of the MyData (Personal Credit Information Management Service) on the 5th of this month, competition among commercial banks to attract customers has been overheating. Despite warnings from financial authorities, banks are aggressively recruiting customers to secure a leading position in the promising MyData business. There are concerns that excessive competition and incomplete sales could lead to consumer harm.

According to the financial sector on the 11th, some commercial banks have set quota targets for employees to attract MyData customers. Bank A issued internal guidelines last November during the MyData pilot service, requiring each employee to secure 70 to 80 customers. In the case of Bank B, some branches recently instructed employees to secure 20 customers per day. Consequently, bank employees, fearing penalties such as lower Key Performance Indicator (KPI) scores, reduced bonuses, or hindered promotions if they fail to meet quotas, are desperately trying to boost their performance under duress.

Previously, financial authorities prohibited excessive giveaways and performance quotas during MyData service marketing last year. However, such practices continue covertly, mainly among some banks. To gain an edge in the MyData service, banks are pressuring employees while evading financial authorities' scrutiny.

Given this situation, some employees are using their own money to provide gifticons and other incentives to customers to meet their targets. Additionally, so-called 'reciprocal exchanges' occur within professional communities, where financial industry workers sign each other up. It is also reported that customers applying for loans are frequently pressured to subscribe to the MyData service. A bank official revealed, "Each employee creates a separate QR code and actively encourages acquaintances and customers to sign up via text messages. Although we heard that quotas are banned by financial authorities, nothing has changed internally."

The excessive customer acquisition race has also led to a giveaway competition. Major commercial banks have launched customer attraction campaigns offering Starbucks gift cards, the latest smartphones, luxury wallets, and more, coinciding with the MyData service launch. Shinhan Bank is providing customers who subscribe to the MyData service by the end of this month with a chance to win Gucci wallets and limited-edition Nike sneakers through a lottery. IBK Industrial Bank is also offering prizes such as Chanel wallets and hotel meal vouchers to customers who connect their MyData by the 28th.

The problem is that in the process of excessive customer acquisition, employee quotas and expensive giveaways have overshadowed service differentiation from other financial companies. Particularly, indiscriminate sign-ups are being encouraged even among customers who lack understanding of the service, raising concerns about financial accidents and consumer harm.

A financial sector official stated, "Since the MyData service allows all financial information to be retrieved at once from a single financial institution, there is a risk of chain consumer damage if information leakage occurs, so special caution is required."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)