Expected 21.7% Increase in Q4 Net Profit Last Year, 'Two Consecutive Quarters of Decline' Anticipated

[Asia Economy Reporter Park Byung-hee] Ahead of the earnings season when U.S. companies' fourth-quarter results for last year will be announced, forecasts suggest a significant slowdown in net profit growth.

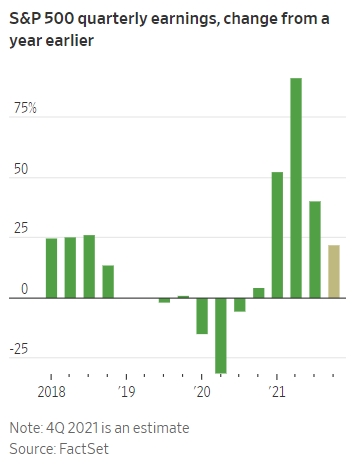

The Wall Street Journal (WSJ) reported on the 9th (local time), citing FactSet Research analysis, that the net profit growth rate of S&P 500 companies for the fourth quarter of last year is expected to be 21.7%. This signals a sharp decline in net profit growth for the second consecutive quarter. The net profit growth rate of the S&P 500 index soared to 91.1% in the second quarter of last year but fell to 39.8% in the third quarter.

With the U.S. central bank, the Federal Reserve (Fed), signaling interest rate hikes, the New York Stock Exchange, which started the new year with a decline, is expected to face another hurdle during the earnings season. The S&P 500 index dropped 1.87% in the first week of the new year, marking its worst start since 2016.

However, regarding the slowdown in fourth-quarter net profit growth, it is expected that the base effect is diminishing.

The reason for the high net profit growth rate in the second quarter of last year was largely due to the sharp decline in net profits in the second quarter of 2019. Right after the COVID-19 pandemic, the net profits of S&P 500 companies plummeted by 31.6% in the second quarter of 2019, leading to a surge in net profits in the second quarter of last year.

On the other hand, in the fourth quarter of 2019, net profit growth (3.8%) was recorded for the first time after the COVID-19 pandemic, so the fourth quarter of last year is considered to have no significant base effect.

The net profit margin of S&P 500 companies is also expected to decline for two consecutive quarters. The net profit margin slowed from 13.1%, the highest since 2008, in the second quarter of last year to 12.9% in the third quarter. It is expected to fall further to 11.9% in the fourth quarter of last year.

Considering the weakening base effect, the slowdown in net profit growth is inevitable, so investors are expected to focus not simply on corporate profits but on what statements management will make about the future business environment. In particular, attention is expected to be paid to the impact of the Omicron variant and cost-related issues such as rising wages and logistics expenses.

Jimmy Chung, Chief Investment Officer (CIO) of Rockefeller Global Family Office, said, "It is a very difficult time for companies to provide future business outlooks," adding, "Costs have generally risen significantly compared to this time last year."

High price-to-earnings ratios (PER) are also a negative factor for the New York stock market. Last week, the PER of the S&P 500 index, reflecting net profit estimates for the next 12 months, was 20.7 times. From 2017 until before the COVID-19 pandemic, the S&P 500 index's PER mainly traded between 16 and 18 times.

If the profit growth rate also declines, the burden of the high PER will inevitably increase. The net profit growth rate of S&P 500 companies this year is expected to be 9.4%, significantly lower than last year's annual growth rate of 45%.

In particular, the PER for IT-related stocks is 27.1 times, which is a heavy burden. For this reason, the Nasdaq index fell 4.53% last week, marking the largest weekly drop since February last year. In contrast, the PERs for energy and financial stocks are relatively low at 11.9 times and 15.2 times, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)