[Asia Economy Reporter Lee Seon-ae] Hyundai Construction's operating profit for the fourth quarter of 2021 is understood to have fallen short of market expectations. However, this year is expected to be a turning point for a rebound. As expectations for performance normalization rise, the financial investment industry views that the beginning of full-scale topline growth will be confirmed.

According to Hanwha Investment & Securities on the 8th, Hyundai Construction's consolidated sales for the fourth quarter of last year increased by 18.1% year-on-year to 5.1 trillion KRW, and operating profit rose by 130.5% to 207.2 billion KRW. This figure is 17% lower than the market consensus operating profit of 250.7 billion KRW.

Song Yu-rim, a researcher at Hanwha Investment & Securities, explained, “Total sales are estimated to have recorded a double-digit high growth rate due to growth in housing sales and a strong recovery in overseas sales,” adding, “The reason operating profit falls short of market consensus is that despite the reversal of the Singapore Marina South bond call cost (about 60 billion KRW), a large-scale allowance for doubtful accounts is expected to be reflected at some overseas sites.”

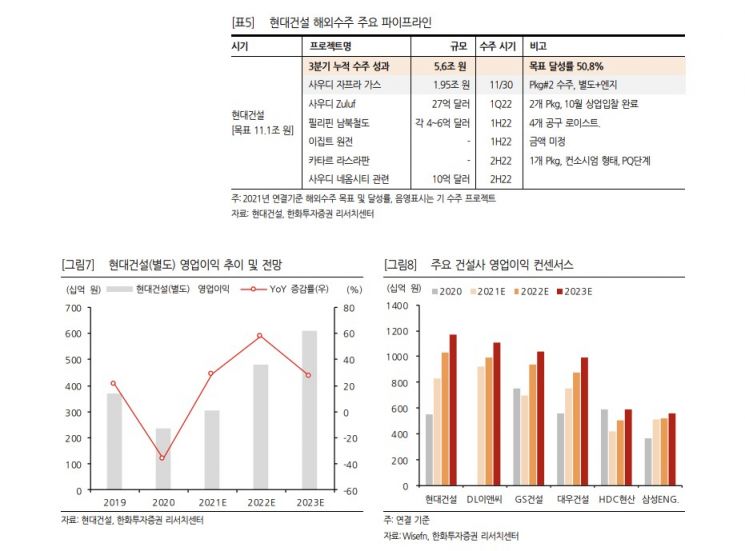

Last year, on a separate basis, new orders are understood to have exceeded the annual target of 14 trillion KRW, reaching the mid-16 trillion KRW range. Among these, housing orders amounted to about 10 trillion KRW, marking an all-time high. Last year's supply of pre-sale units was about 27,000 units on a separate basis, significantly exceeding the previous year's 20,000 units, and this year's pre-sale plan is also judged to have considerable room for increase. Researcher Song emphasized, “Since major projects are positioned in the overseas order pipeline, this year's performance is expected, and above all, sales rebound is strongly appearing, raising expectations for performance normalization.”

He said, “The target price for Hyundai Construction (72,000 KRW) was calculated by applying a target multiple of 1.1 times to the 12-month expected book value per share (BPS),” adding, “Although the recent supply and demand have negatively affected due to the sluggish stock price in the construction industry and the listing of Hyundai Engineering, it is necessary to remember that the impact of supply and demand is not permanent and the fundamentals are better than ever.” He continued, “Currently, Hyundai Construction's stock price is at a 12-month forward price-to-earnings ratio (PER) of 10.3 times and a price-to-book ratio (PBR) of 0.7 times,” and added, “We maintain a top pick investment opinion within the sector.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)