2021 Tax Law Amendment Follow-up Enforcement Decree Amendment Proposal

[Sejong=Asia Economy Reporter Son Seon-hee] The detailed scope of the 'National Strategic Technologies' that the government strategically fosters from economic and security perspectives has been finalized to a total of 34 technologies across three major fields: semiconductors, secondary batteries, and vaccines. Although hydrogen-related technologies, which had attracted attention, were excluded from the National Strategic Technologies, they were newly added under the existing new growth and core technologies category.

On the 6th, the Ministry of Economy and Finance announced the '2021 Tax Law Amendment Follow-up Enforcement Decree Amendment' containing these details. This enforcement decree amendment is intended to establish specific details for implementing the tax law passed during last year's regular National Assembly session.

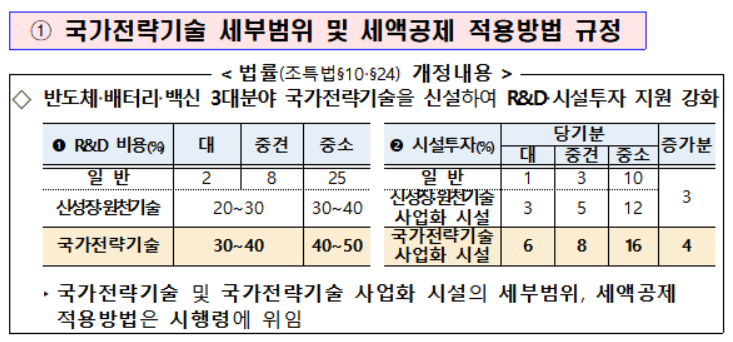

For technologies designated as National Strategic Technologies, tax credits of 30-40% for large and medium-sized enterprises and 40-50% for small and medium enterprises are provided on related research and development (R&D) and facility investments. Additionally, tax credits of 6% for large enterprises, 8% for medium-sized enterprises, and 16% for small and medium enterprises are provided for related commercialization facilities. The scope includes facilities jointly recognized by the Ministry of Economy and Finance and the Ministry of Industry through the review of the New Growth and Core Technology Deliberation Committee.

However, if a National Strategic Technology facility also produces some general products, the cumulative production volume of National Strategic Technology products must be '50% or more' from the investment completion date until the end of the next three tax years to receive the tax credit. If it falls below 50%, the credited tax amount and equivalent interest must be repaid.

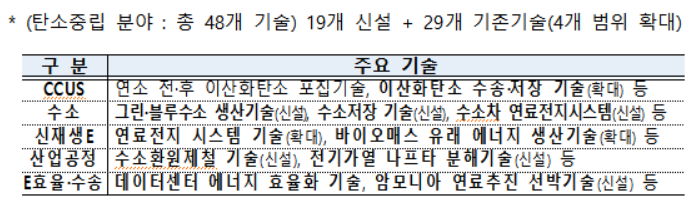

Although the government announced on the 20th of last month that it would consider including hydrogen-related technologies as National Strategic Technologies, this was not applied in the current enforcement decree amendment. However, carbon-neutral related technologies, including hydrogen, were included in the new growth and core technologies category. In addition to the existing 29 carbon-neutral related technologies, 19 new technologies were added, totaling 48 technologies. Tax credits of 20-30% for large and medium-sized enterprises and 30-40% for small and medium enterprises apply.

Furthermore, to support the activation of the hydrogen economy, the flexible tax rate on natural gas used for hydrogen production was reduced from the previous 42 KRW/kg to 8.4 KRW/kg.

A Ministry of Economy and Finance official stated regarding the inclusion of hydrogen as a National Strategic Technology, "Considering supply chain risks and technological trends, we intend to continuously review whether this field requires temporary focused support due to its importance from a national security perspective," adding, "We plan to continue reviewing this going forward."

In particular, technologies related to scarce metals and key items with vulnerable supply bases, such as rare earth elements and urea solution?which recently experienced shortages?were included in the new growth and core technologies category due to the urgent need for national R&D and production. Conversely, technologies with low commercialization and effectiveness, such as compressed expanders for liquefied natural gas carriers and frame lightweighting and functionalization technologies, were removed due to decreased necessity for support.

Additionally, to revitalize domestic demand and improve the business environment, the government relaxed the requirements for changing business types eligible for the family business inheritance tax credit and expanded the scope of eligible industries. Even if the heir changes the business type within the 'major category' of the standard industrial classification table, it will be recognized as a family business if operated for more than 10 years. Also, 'kindergartens' under educational services were added to the scope of industries eligible for the family business inheritance tax credit.

Regarding the system that provides 100% income tax and corporate tax reductions for five years and 50% for two years when companies that had expanded overseas return to Korea, the criteria were relaxed. The deadline for relocating business sites to Korea after transferring, downsizing, or closing overseas business sites was extended from one year to two years.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)