Expectations for Upgraded Consumer-Customized Financial Services

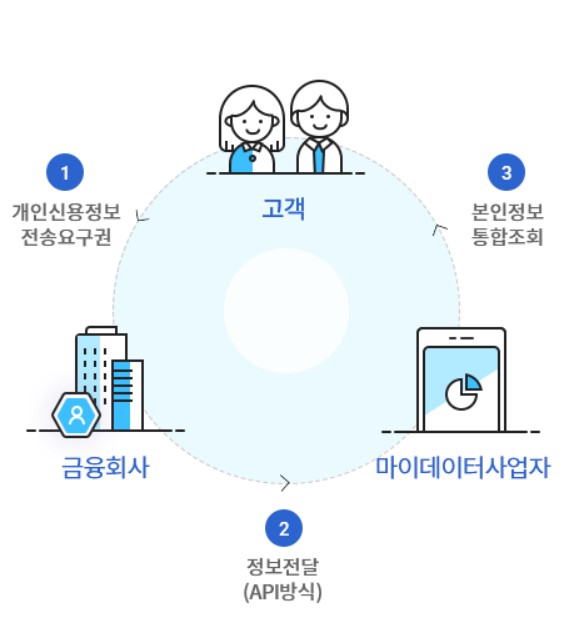

[Asia Economy Reporter Park Sun-mi] On the 5th, the standardized Application Programming Interface (API) method for Personal Credit Information Management Service (MyData) was fully implemented. From this day forward, consumers will be able to access and manage their financial information more safely and quickly. Financial authorities are currently negotiating to expand the provision of public information as well as financial and big tech data, which is expected to further upgrade the customized financial services offered to consumers.

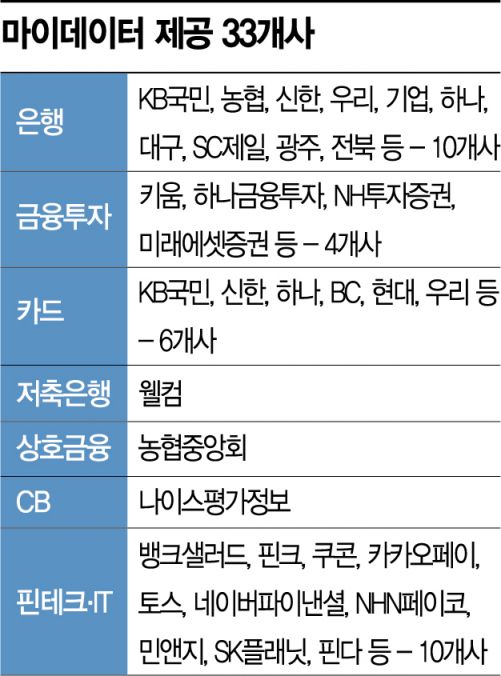

According to financial authorities, 33 companies began providing MyData services using the API method from this day. These include 10 banks such as KB Kookmin, Shinhan, Woori, Hana, and NH Nonghyup, 10 big tech and fintech companies including Kakao Pay, Naver Financial, and Bank Salad, 6 card companies, and 4 securities firms.

Many providers have already been conducting MyData pilot services since last month. It is expected that consumers may not immediately notice significant changes. However, the complete ban on the scraping method, which involved extracting personal information displayed on screens when collecting data from other financial institutions, the stricter information protection and security system reviews, and the approximately tenfold increase in integrated information inquiry speed are tangible changes that consumers will experience.

More Information, Faster, More Convenient and Safer than Before

The amount of information provided will also increase.

Information from 417 regulated financial companies, excluding some loan companies, will be shared. The average number of information providers connected to each MyData operator, including financial institutions and telecommunications companies, is around 100. Among banks, Daegu Bank (183 providers) and Industrial Bank of Korea (151 providers) have the most, while BC Card leads the card industry with 196 providers. Many companies such as Mirae Asset Securities (174 providers), Kiwoom Securities (131 providers), Fink (183 providers), and Finda (123 providers) also connect with over 100 providers.

Previously, only some major financial sector information was accessible, but from this day forward, integrated inquiries will be possible for most financial companies as well as telecommunications, public, and e-commerce transaction details. Additionally, information transmission requests can be made using private certificates instead of the old public certificates, simplifying the identity verification process.

There are still many challenges to overcome for the full implementation of MyData services to be more effective. More unreflected information needs to be opened to improve consumer convenience. Currently, financial authorities are in discussions because public information such as national and local tax payment details, customs payment details, health insurance, civil servant pension, and national pension premium payment details are not provided, except for the National Tax Service’s tax payment certificate. They also see the need to expand access to financial information such as retirement pensions (DB, DC), insurance information where the policyholder and insured are different, and card billing forecast information.

The financial industry agrees that with the full implementation of MyData and more active information exchange, more personalized financial services for consumers will emerge. A bank official said, "More financial information that can be shared is needed," adding, "From the bank’s perspective, comprehensive asset management consulting based on consumers’ financial information will become possible."

What Does Bank Sector MyData Service Look Like?

Shinhan Bank is fully launching its MyData service called ‘MoneyVerse.’

MoneyVerse informs customers of their expected financial schedules and anticipated balances. In addition, it offers ‘MY Calendar,’ which shows schedules for public offerings, apartment subscriptions, and Nike Draws that can be resold, and ‘Point Aggregator,’ which provides a comprehensive view of various points from cards, pay services, and memberships, helping users find spare funds. These features are especially popular among the MZ generation.

To celebrate the full launch of MoneyVerse, Shinhan Bank selected Jung Ho-yeon as the model for the brand concept ‘me+economy,’ which means everything defined by me becomes an opportunity to earn money, and started TV commercials on the 1st of this month. Furthermore, from the 19th of this month, they will hold the ‘MoneyVerse TikTok Challenge’ under the theme ‘A world where everything becomes money, your own MoneyVerse,’ encouraging free expression through dance, rap, acting, and makeup.

KB Kookmin Bank also officially opened ‘KB MyData,’ a lifestyle financial platform that accompanies all aspects of daily life. KB MyData is a service that gathers scattered personal information from various institutions into one place for convenient management.

Through the official opening of KB MyData, the following services are provided: ‘Asset Management Service’ offering tailored solutions; ‘Expense Management Service’ proposing better spending habits through consumption pattern analysis; ‘Goal Challenge’ as a personal financial habit maker called Better Me; ‘Financial Plus’ for easier management of various tangible assets and credit; ‘Money Crew,’ an asset management service utilizing collective intelligence; and ‘If You,’ an asset management simulation supporting goal achievement.

To commemorate the official opening of KB MyData, various events will be held until February 6. All customers who first consent to the MyData service will receive Starbucks coffee coupons, and weekly draws will offer surprise prizes. Customers consenting to three or more sectors will also have a chance to win an iPad Pro.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.