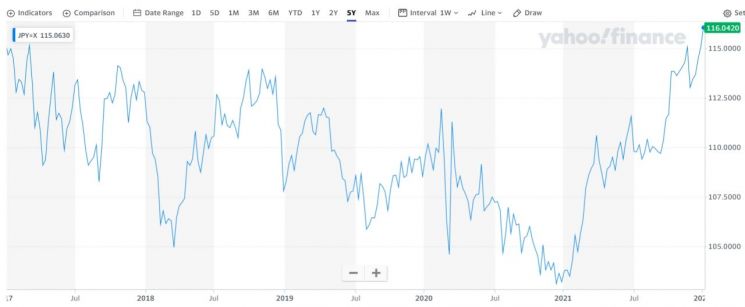

[Asia Economy Reporter Park Byung-hee] The dollar-yen exchange rate surpassed the 116 yen mark per dollar, pushing the dollar's value against the yen to its highest level in five years, according to major foreign media reports on the 4th (local time).

As expectations spread that the impact of the Omicron variant on the global economy will be limited, market attention is shifting from the Omicron variant to the tightening policies of the U.S. central bank, the Federal Reserve (Fed). While the Fed is expected to proceed with its planned tightening measures, the Bank of Japan (BOJ) is forecasted to maintain its stimulus stance for the time being, resulting in a trend of dollar strength and yen weakness.

On that day, the dollar-yen exchange rate rose to 116.34 yen per dollar, marking the highest dollar value since January 11, 2017. The dollar's value against the yen increased by about 0.7% compared to the previous trading day, showing five consecutive days of strength against the yen.

The Omicron variant, which was expected to be a variable in the Fed's tightening path, is increasingly seen as having little impact on the global economy. Abdihamid Mahamud, the WHO's COVID-19 Emergency Response Team situation manager, stated at a press briefing that there is growing evidence that symptoms of the Omicron variant are relatively milder than previous variants.

Lee Hartman, a foreign exchange analyst at MUFG, explained the background of the dollar's strength by saying, "As fears about the impact of the Omicron variant on the global economy diminish, interest in central banks' interest rate hikes is increasing again." He added that the expectation that the BOJ will maintain its current interest rate is also a reason for the rising dollar value against the yen.

Expectations are also spreading that the timing of the Fed's interest rate hikes will accelerate. According to the CME FedWatch tool from the Chicago Mercantile Exchange (CME), foreign media reported that the probability of the Fed raising the benchmark interest rate by at least 0.25 percentage points at the March monetary policy meeting has exceeded 60%. Neel Kashkari, president of the Federal Reserve Bank of Minneapolis, known as a dove, also stated on the same day that two interest rate hikes would be necessary this year.

The British pound is also showing strength. This is because the Bank of England (BOE) is expected to raise its benchmark interest rate again next month. The BOE raised the benchmark rate from 0.1% to 0.25% last month. The pound rose to a two-year high against the euro and a two-month high against the dollar.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.