8.17 Million Taxpayers Subject to 2021 2nd Half VAT Final Return...6.4% Increase YoY

Deadline for Payment Extended to March 31 for Sole Proprietors with Decreased Sales

[Sejong=Asia Economy Reporter Kim Hyunjung] The National Tax Service (NTS) will unilaterally extend the value-added tax (VAT) payment deadline by two months for 620,000 individual business owners whose sales have decreased due to COVID-19 quarantine measures. In addition, business owners experiencing management difficulties due to disasters, restructuring, or sharp sales declines can actively receive approval if they apply for deadline extensions.

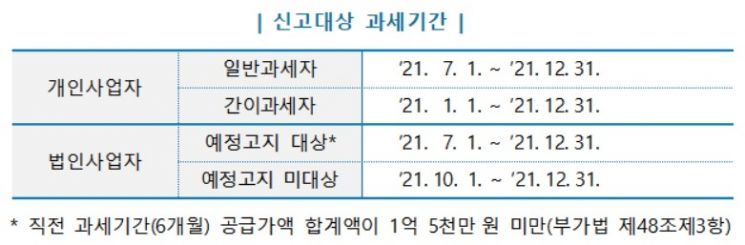

On the 5th, the NTS announced that individual and corporate taxpayers must pay VAT for the taxable period's business performance by the 25th of this month. The number of filers is 8.17 million, a 6.4% increase compared to last year's confirmed filers (7.68 million). Corporate taxpayers number about 1.13 million, and individual business owners about 7.04 million.

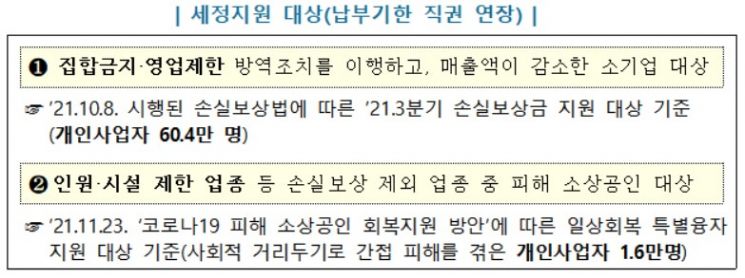

Among them, 620,000 individual business owners whose sales decreased due to quarantine measures such as gathering bans and business restrictions to prevent the spread of COVID-19 infections will have their payment deadline extended by two months until March 31. The targets include 604,000 small businesses subject to gathering bans and business restrictions with decreased sales, and 16,000 small business owners excluded from loss compensation in sectors with personnel and facility restrictions. These were respectively eligible for third-quarter loss compensation support last year and special loans for daily recovery in November. Only the payment deadline is extended; filing must be done by January 25, and a separate notice will be sent to eligible recipients on the 6th.

The NTS also plans to actively approve payment deadline extensions within three months for business owners experiencing management difficulties due to disasters, restructuring, or sharp sales declines if they apply. This includes businesses in employment crisis areas, special industrial crisis response areas, and special disaster zones. Applications can be submitted online (Hometax, Sontax) or by mail without visiting the tax office.

The exemption for simplified taxpayers' payment tax amount has been raised from the previous 30 million KRW to less than 48 million KRW due to tax law revisions. If the total supply price during the taxable period (one year) is less than 48 million KRW, only filing is required without tax payment.

Furthermore, the NTS plans to promptly review applicants to support export and investment and improve liquidity for small and medium-sized enterprises, making early payments by the 28th of this month, before the Lunar New Year holiday. This is 12 days earlier than the statutory payment deadline of February 9.

Small business owners (with sales of 1 billion KRW or less in the previous year) and businesses with a sharp sales decline (30% or more compared to the previous period) who file for general refunds will receive their refunds by February 15 if there is no suspicion of improper refunds.

To facilitate filing, customized assistance materials will be additionally provided through the Hometax 'Filing Assistance Service' for 1 million business owners, and an integrated inquiry service will be newly established to check necessary tax information on a single screen. Additionally, the mobile (Sontax) simplified filing target will be expanded to all business owners (excluding zero-rated businesses). In particular, a visible ARS simplified filing service will be provided to real estate rental businesses with the same previous period and lease details and to non-performing businesses.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.