Average Survival Rate of Hof Bars 47%

Half May Disappear Within 5 Years at This Rate

Average for Korean Food and Chicken Around 60%

Sales from January to October Last Year 69 Trillion Won

86 Trillion Won in the Same Period of 2019

Declining Trend Even Including Delivery Apps

[Asia Economy Reporter Seungjin Lee] The dining industry is being shaken by COVID-19. As commercial districts collapse and closures continue, more than 10,000 dining establishments nationwide have disappeared over two years. Dining businesses, which had been surviving on loans due to declining sales over the past two years, now face an existential crisis as the Delta variant is followed by the Omicron variant.

Over 10,000 Stores Disappeared Due to COVID-19

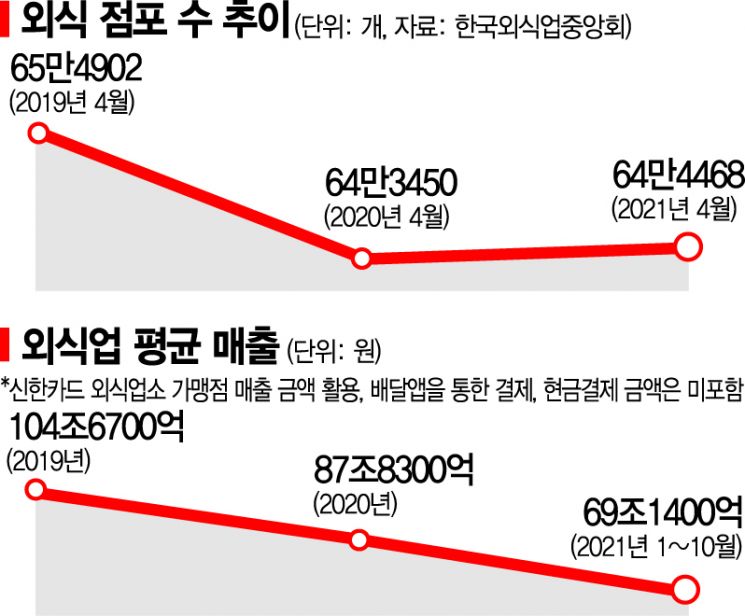

According to data from the Korea Foodservice Industry Research Institute on the 4th, more than 10,000 dining establishments nationwide have disappeared within two years since the outbreak of COVID-19. The number of dining establishments, which reached 654,902 in April 2019, sharply dropped to 643,450 in April 2020, the third month after the COVID-19 outbreak, a decrease of over 10,000. Although the number of dining establishments slightly increased to 644,468 in April last year, it still remains about 10,000 fewer compared to 2019.

Looking at the survival rates by industry in 2021 compared to 2019, the average survival rate of hof and beer dining establishments was only 47%. This means nearly half of hof and beer dining establishments are expected to disappear within the next five years. Other sectors such as Korean, Chinese, and chicken restaurants also showed survival rates around 60%, indicating that the business environment has become difficult due to COVID-19.

As the government announced a two-week extension of the current social distancing measures limiting private gatherings to 4 people and restaurant and cafe operating hours until 9 PM, restaurants in downtown Seoul appeared quiet on the 2nd. Photo by Kim Hyun-min kimhyun81@

As the government announced a two-week extension of the current social distancing measures limiting private gatherings to 4 people and restaurant and cafe operating hours until 9 PM, restaurants in downtown Seoul appeared quiet on the 2nd. Photo by Kim Hyun-min kimhyun81@

Sales Decreased by 17 Trillion Won Over Two Years

Along with the decrease in the number of dining establishments, the overall sales of the dining industry also plummeted. According to ‘The Dining’ analysis service by the Korea Agro-Fisheries & Food Trade Corporation, which estimates total card sales in the dining industry using Shinhan Card’s dining merchant sales data, sales have decreased by approximately 17 trillion won since the outbreak of COVID-19.

From January to October last year, total dining sales amounted to 69.14 trillion won. During the same period in 2019, sales were 86.17 trillion won, showing a decrease of about 17 trillion won. Normally, sales increase in November and December due to year-end gatherings, but last year, strengthened social distancing measures eliminated this year-end boost, suggesting the gap may widen further.

Even considering delivery demand not included in these statistics, the sales decline is significant. According to a sample survey by WiseApp and WiseRetail on payments made by Korean individuals aged 20 and over using credit cards, debit cards, and mobile micropayments on Baedal Minjok and Yogiyo, annual payment amounts were estimated at 7 trillion won in 2019 and 12.2 trillion won in 2020.

The scale of loans for dining businesses has also increased. According to a survey by the Korea Foodservice Industry Research Institute, the average loan amount for dining business owners rose by 33%, from about 32 million won in 2019 to 47.5 million won in 2020.

No Foundation for Recovery

Although difficulties are increasing with dining businesses surviving on debt, there are no signs of recovery. The implementation of ‘step-by-step daily recovery (With COVID-19)’ in December last year raised hopes for a V-shaped rebound, but it stopped after just half a month. The year-end boom was expected, but instead, the strengthening of quarantine measures destroyed the foundation for recovery.

According to the ‘2021 Survey on Dining Business Owners’ Perceptions of Quarantine Policies and Closures’ conducted by the Korea Foodservice Industry Research Institute, 95% of respondents said there was no year-end boom. Additionally, 84.6% of dining businesses responded that the damage caused by the strengthened quarantine measures after the With COVID-19 policy was greater than the damage from earlier quarantine reinforcements. Some self-employed individuals have even announced plans for collective closures. The Korea Federation of COVID-19 Affected Self-Employed (KojaChong) plans to decide on the direction of future collective closures at a meeting held that day.

Experts agree that to alleviate the difficulties faced by self-employed individuals, instead of maintaining the current quarantine measures as they are, it is necessary to extend business hours. Kim Samhee, head of research at the Korea Foodservice Industry Research Institute, said, "Considering the difficulties of self-employed individuals, even if the current policies such as the 4-person limit and vaccination certificate/negative test confirmation system (quarantine pass) are maintained, quarantine relaxation measures that allow extending business hours until midnight should be considered."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)