Year-End Controversy Over Indemnity Insurance Settled for Now

Government Strengthens Management of Non-Covered Items

Industry Urges Urgent Shift to 4th Generation

[Asia Economy Reporter Oh Hyung-gil] The issue of insurance rate hikes, which heated up the insurance industry at the end of the year due to news that premiums for indemnity health insurance would increase by an average of 14% starting this year, has been settled for now. Although 35 million indemnity insurance subscribers have to bear the burden of premium increases, there are evaluations that this is merely a temporary measure rather than a fundamental solution.

The government needs to promptly strengthen management of non-reimbursable items in line with the enhancement of health insurance coverage, and the insurance industry is being urged to transition existing subscribers to the 4th generation products.

According to the government and industry on the 3rd, premiums for the 1st generation old indemnity insurance (sold until September 2009) and the 2nd generation standardized indemnity insurance (sold from October 2009 to March 2017) have increased by an average of 16% this year. The 3rd generation new indemnity insurance will see an average increase of 8.9% as the temporary discount benefits applied until last year have ended.

The reduction effect on indemnity insurance payouts due to the health insurance coverage enhancement, known as "Moon Care," which promotes the "coverage of non-reimbursable items," has fallen short of expectations.

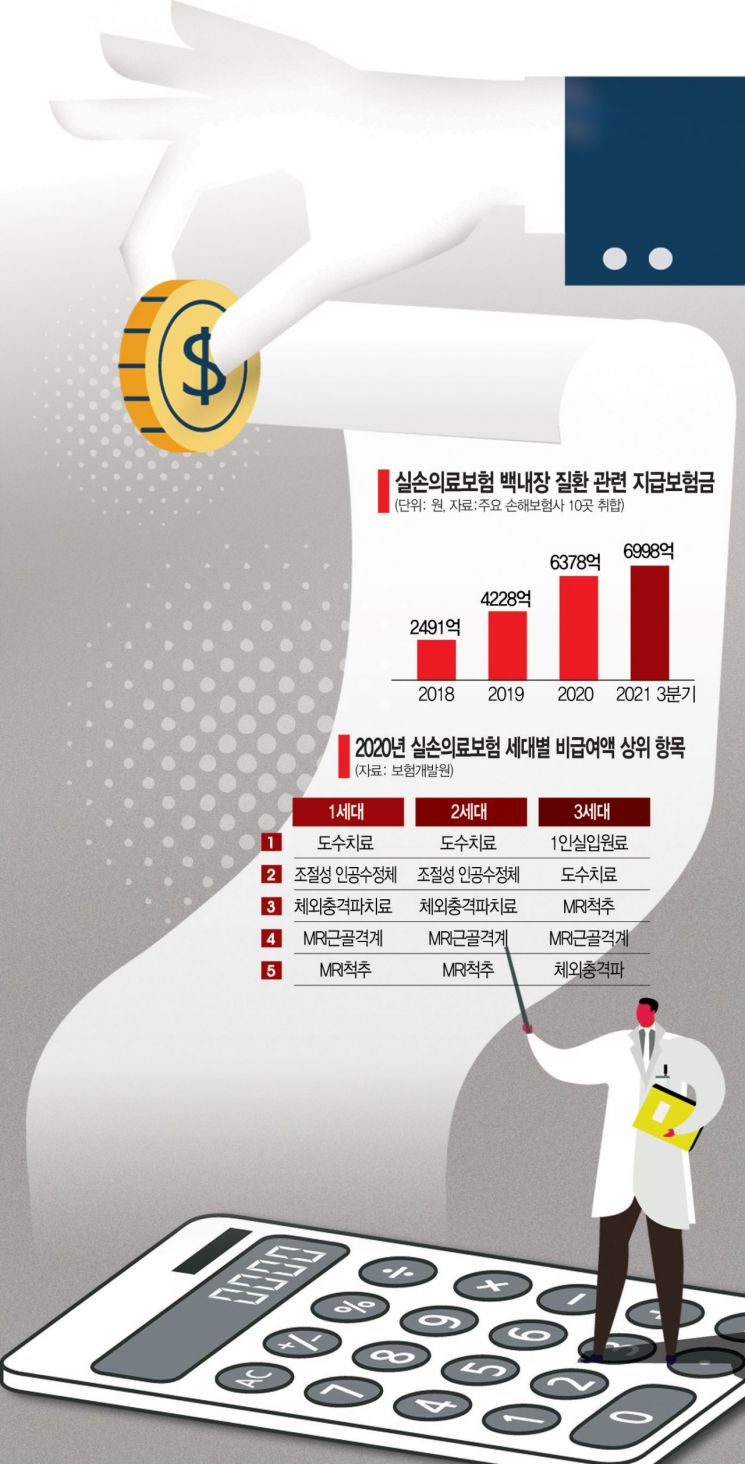

According to research conducted by the Korea Institute for Health and Social Affairs and the Korea Insurance Research Institute, the government has covered items such as female reproductive organ and anterior ultrasound, skin suture liquid adhesive, dupilumab (allergic disease treatment), durvalumab (urothelial carcinoma treatment), and ocular measurement tests from November 2019 to December 2020.

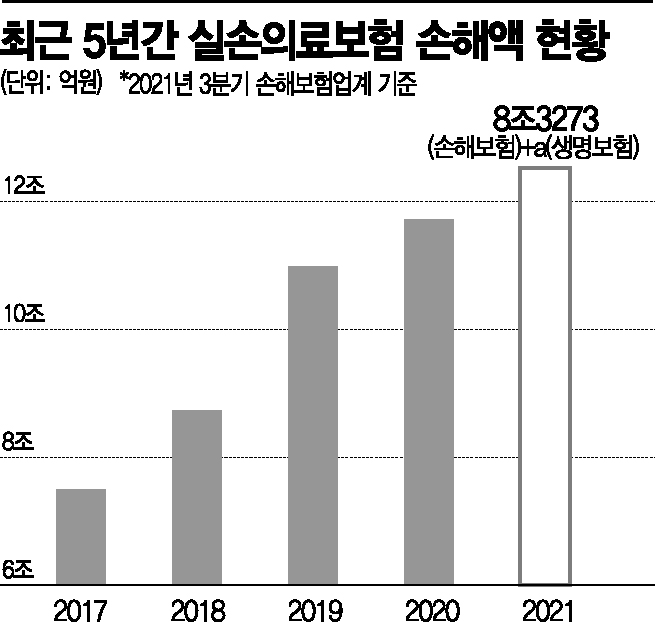

For these items, a reduction effect of 210.9 billion KRW in indemnity insurance payouts occurred in 2020, which is only about 1.79% of the total indemnity insurance payouts of 11.8 trillion KRW. This result falls short of the authorities' expectations that insurance companies would see a reduction in indemnity insurance payouts due to the expanded implementation of Moon Care.

Although switching to 4th generation promises 'half-price' premium discounts

The cause lies in medical institutions shifting costs to new non-reimbursable items following the coverage of major items.

For example, in the case of cataracts, when the insurance industry decided through a standard contract revision in 2016 not to cover multifocal lens costs, the price of multifocal lenses decreased but measurement test costs increased significantly. Also, when measurement test costs were covered in September 2020, the claimed amount for multifocal lenses in contracts before January 2016 sharply increased.

This is why there are demands to investigate and disclose the cost information of non-reimbursable items so that medical institutions cannot arbitrarily set non-reimbursable prices. Jung Sung-hee, a research fellow at the Korea Insurance Research Institute, pointed out, "We need to enhance the public's right to know and establish guidelines for socially acceptable non-reimbursable prices and usage."

Although premiums have risen, insurance companies are also under severe pressure. This is because it is far from sufficient to lower the loss ratio of indemnity insurance, which is approaching 140%. The Korea Insurance Research Institute predicted that the cumulative loss of indemnity insurance will reach 4 trillion KRW this year.

There is no adequate incentive to encourage existing subscribers to switch to 4th generation products. If they switch to 4th generation indemnity insurance within the next six months, premiums will be discounted by 50%, but for a 40-year-old male, this only amounts to about 5,000 KRW off per month. For subscribers of 1st and 2nd generation products with no or low deductibles, this level of premium discount is not an attractive enough benefit to switch products.

An industry official said, "Not only is the sustainability of indemnity insurance being threatened, but if premium increases make it difficult to maintain insurance, consumer protection will also become difficult," adding, "Innovative system improvements such as premium differentiation in contract conversion are necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)