[Asia Economy Reporter Park Jihwan] As of the end of the third quarter this year, the outstanding balance of derivative-linked securities (ELS·DLS) issued by securities companies slightly decreased compared to the second quarter. This is attributed to the recent decline in the Hong Kong Hang Seng China Enterprises Index (HSCEI) and delays in early redemption, which have dampened demand for derivative-linked securities.

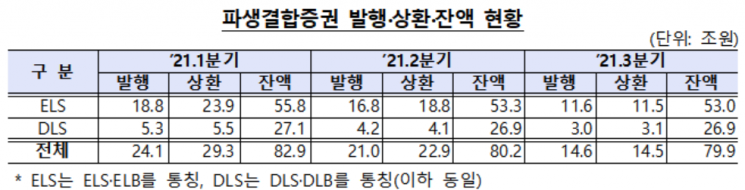

According to the "2021 Q3 Status of Issuance and Operation of Derivative-linked Securities by Securities Companies" announced by the Financial Supervisory Service on the 3rd, the outstanding issuance balance in the third quarter was recorded at 79.9 trillion KRW. This represents a 0.37% (3 trillion KRW) decrease compared to 80.2 trillion KRW in the previous quarter. A Financial Supervisory Service official explained, "New issuance of derivative-linked securities in Q3 was 14.6 trillion KRW, which is even less than 15.8 trillion KRW in Q2 last year right after the COVID-19 outbreak, reflecting the impact of the HSCEI index decline and delays in early redemption that have weakened demand for derivative-linked securities."

In the third quarter, issuance of derivative-linked securities amounted to 14.6 trillion KRW, while redemptions totaled 14.5 trillion KRW. These figures represent decreases of 6.4 trillion KRW and 8.4 trillion KRW respectively compared to the previous quarter.

By type, ELS issuance was 11.6 trillion KRW, down 30.8% (5.2 trillion KRW) from 16.8 trillion KRW in the previous quarter. This decline is due to reduced ELS investment demand caused by the fall in Chinese and Hong Kong stock indices (HSCEI, HSI, etc.). Issuance of index-type ELS decreased by 22.1% (2.9 trillion KRW) to 10.1 trillion KRW, accounting for 87.0% of the total, an increase of 9.8 percentage points.

Stock and mixed-type ELS issuance was 1.5 trillion KRW, down 2.3 trillion KRW from the previous quarter. The domestic stocks included as underlying assets were Samsung Electronics (620 billion KRW), AMD (210 billion KRW), Korea Electric Power Corporation (210 billion KRW), Tesla (190 billion KRW), and Nvidia (130 billion KRW) in that order. The utilization of overseas stocks increased compared to the first half of the year.

ELS redemptions in the third quarter were 11.5 trillion KRW, down 38.8% (7.3 trillion KRW) from the previous quarter. The Financial Supervisory Service explained that this was due to the reference prices of HSCEI-included ELS issued in the first quarter being higher than the stock prices in the third quarter, causing most early redemptions to be delayed.

The outstanding balance at the end of the third quarter was 53 trillion KRW, a decrease of 3 trillion KRW (0.6%) from 53.3 trillion KRW in the previous quarter. The outstanding balances of index and mixed-type ELS by underlying assets were ranked as follows: S&P 500 (25 trillion KRW), Euro Stoxx 50 (21.2 trillion KRW), KOSPI 200 (18.7 trillion KRW), and Hong Kong H Index (15.7 trillion KRW).

DLS issuance in the third quarter was 3 trillion KRW, down 27.7% (1.2 trillion KRW) from the previous quarter. Redemptions were 3.1 trillion KRW, a decrease of 25.3% (1 trillion KRW).

Among the 79.9 trillion KRW outstanding balance of derivative-linked securities as of the end of September this year, the scale (proportion) of self-hedging increased by 3 trillion KRW compared to the previous quarter.

The ELS investment return rate in the third quarter was an annual average of 3.8%, up 0.4 percentage points from 3.4% in the previous quarter. The DLS investment return rate was a 2.2% loss, down 2.0 percentage points from a 0.2% loss in the previous quarter. The average investment period of redeemed ELS in the third quarter decreased by 0.4 years compared to the previous quarter, which is analyzed to have contributed to the increase in the annual average return rate.

Securities companies earned 235.9 billion KRW in profits from issuing and operating ELS and DLS, down 57.6 billion KRW from 293.6 billion KRW in the previous quarter. Due to the decline in HSCEI and KOSPI 200 in the third quarter, securities companies' expected redemption amounts to investors decreased, generating a profit of 1.4777 trillion KRW. However, hedge asset losses of 1.2418 trillion KRW were also incurred.

A Financial Supervisory Service official stated, "In the second half of the year, the Hong Kong H Index repeatedly rose and fell, recording the lowest point of the year in December last year. Although the possibility of investor losses is currently not significant, if the downward trend of the Hong Kong H Index prolongs in the future, the likelihood of delayed early redemption and maturity redemption losses may increase, so caution is needed when investing."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.