Based on the Concept of Public Land Ownership... Purpose Taxation Focused on 'Land'

Hospitals Also Hit by Tax Bombshell... Land Tax Estimated from 0 to 14.1 Billion Won

Confusion Inevitable Due to Changes in Tax System Including Double Taxation

Democratic Party presidential candidate Lee Jae-myung is delivering a congratulatory speech at a briefing session on the National Balanced Development and Special Act on Local Extinction held at the Fairmont Ambassador Seoul Hotel in Yeouido, Seoul, on the 28th.

Democratic Party presidential candidate Lee Jae-myung is delivering a congratulatory speech at a briefing session on the National Balanced Development and Special Act on Local Extinction held at the Fairmont Ambassador Seoul Hotel in Yeouido, Seoul, on the 28th. The Real Estate Reform Committee, a direct organization under Lee Jae-myung, the presidential candidate of the Democratic Party of Korea, officially began its activities on the 28th and introduced the 'Land Profit Dividend System,' bringing real estate taxation back to the forefront as a key issue in the presidential election landscape.

Although the Land Profit Dividend System is an unfamiliar term, it is essentially a renamed version of the 'Land Holding Tax' that candidate Lee has repeatedly announced. This appears to be because the term 'tax (稅)' in Land Holding Tax provokes backlash. The system is self-described as a clever measure to redistribute unearned real estate income to all citizens, thereby curbing speculation and alleviating polarization. However, it also faces criticism for dividing the public by taking from 10% and giving to 90%, openly hindering economic activities.

In particular, candidate Lee, who recently proposed easing real estate tax burdens such as temporary exemptions from capital gains tax surcharges for multi-homeowners and reductions in comprehensive real estate tax and other holding taxes, suddenly brought the Land Holding Tax pledge back to the forefront. This has led to criticism in the market that his inconsistent pledges aimed at winning votes are causing public confusion.

◇ Purpose Tax Focused on ‘Land’ Based on the Concept of Land Publicness = The Land Profit Dividend System is a purpose tax designed to secure basic income funding. It requires landowners to pay a certain percentage of the land price as tax. When the Land Tax is introduced, the holding tax system will shift from the existing 'property tax + comprehensive real estate tax' to a 'property tax + land tax' system. In effect, the Land Holding Tax replaces the comprehensive real estate tax.

Details of the Land Profit Dividend System have not yet been disclosed. However, by compiling materials from candidate Lee’s side, one can infer its framework. The Land Profit Dividend System is similar in nature to the comprehensive real estate tax as a holding tax, but unlike the comprehensive real estate tax, which targets high-priced real estate, it taxes all land. The comprehensive real estate tax differentiates real estate into houses, comprehensive aggregated land, and separately aggregated land, applying different tax rates and tax bases accordingly. In contrast, the Land Profit Dividend System excludes buildings and taxes only the land. Homeowners pay tax on the land attached to their houses.

The outline of tax rates, revenue, and purpose has also been drawn. Candidate Lee previously introduced the Land Holding Tax as a representative pledge, stating, "A 1% Land Holding Tax would generate about 50 trillion won," and "If all collected taxes are newly established as a basic income purpose tax distributed equally to the public, about 80-90% of the population would be net beneficiaries receiving more basic income than the tax they pay."

The Gyeonggi Research Institute, the think tank for Gyeonggi Province’s administration and the theoretical supporter of candidate Lee’s ‘basic series’ including basic income, basic loans, and basic housing, designed the Land Holding Tax rate in a range from a minimum of 0.3% to a maximum of 2.5% in a report published last year.

Based on this, a simulation combining the status of domestic landowners shows that out of 22 million households, 2.2 million households (10%) would bear the Land Holding Tax. This is about five times more than the 2% subject to the comprehensive real estate tax. The tax burden also differs significantly. For a four-person single-home household, the comprehensive real estate tax on a 2 billion won house is about 230,000 won, but applying a 1% Land Holding Tax rate results in about 2.26 million won. For a house priced at 3 billion won, the comprehensive real estate tax is about 1.88 million won, while the Land Tax would be about 4.45 million won.

◇ Land Tax from Zero to 14.1 Billion Won... Hospitals Also Hit Hard = The problem is that opposition to the Land Profit Dividend System is considerable. Issues such as fairness, double taxation, and negative impacts on economic activities are being raised.

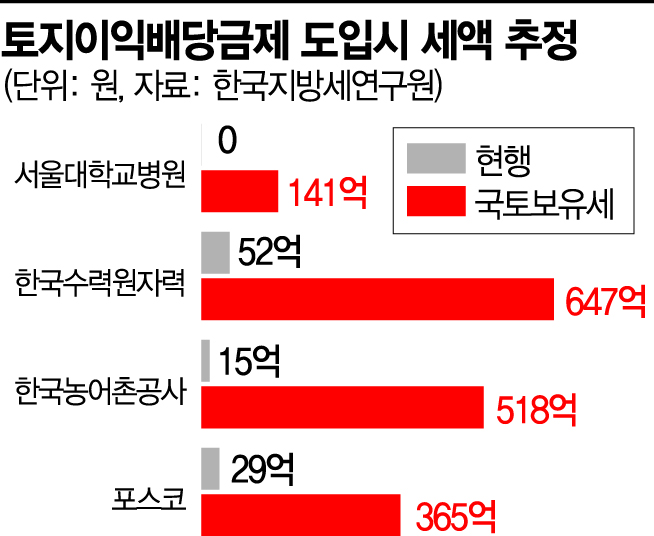

First, abolishing differential taxation by land use is expected to impose a heavy burden on corporate economics overall. This includes increased tax burdens on areas currently subject to low rates (0.07%) such as farmland, pastureland, and forest land, as well as particularly heavy burdens on logistics warehouses and factories that inevitably use large-scale land due to business characteristics. Large conglomerates are very likely to be subject to the highest Land Holding Tax rate (2.5%). According to estimates by the Korea Local Tax Research Institute on changes in land tax amounts after the introduction of the Land Holding Tax, some companies could see their tax burden increase up to 35.7 times compared to the current level.

The institute estimates that Seoul National University Hospital currently does not pay land holding tax under existing laws, but would pay about 14.1 billion won if the Land Holding Tax is introduced. Korea Hydro & Nuclear Power’s tax burden is expected to increase from 5.2 billion won to 64.7 billion won, and POSCO’s from 2.9 billion won to 36.5 billion won. The institute pointed out, "The introduction of the Land Holding Tax inevitably increases the tax burden on large corporations owning a lot of land," and warned, "This could worsen business performance and further negatively affect employment and investment."

◇ Confusion Due to Changes in Taxation System Also Inevitable = If the Land Profit Dividend System is introduced, houses must be split into buildings and land, and tax imposed only on the land portion. There is a possibility that fairness issues will arise in the process of calculating official housing prices.

To avoid double taxation, if candidate Lee’s plan to separate houses into building and land portions and tax only the land portion is to be implemented, property tax must apply only to the building portion. This means the current official housing price and property tax system must be revised. If a taxation system that taxpayers can accept is not presented, tax resistance is likely.

Experts say the bigger problem lies in the holding tax system for houses and apartments. For example, apartment prices vary depending on the floor and whether remodeling has been done, even within the same complex.

Park Sang-soo, Deputy Director of the Korea Local Tax Research Institute, said, "Apartments are built in multiple buildings in the same way, so there could be issues of accuracy and fairness in how building values are assessed," adding, "Currently, the official price assessment method assigns the same individual official price to land, so the key is to accurately calculate the value of individual buildings. Theoretically, this is possible, but it is not an easy task."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.