[Asia Economy Reporter Kwangho Lee] The Financial Consumers Federation announced on the 29th the selection of the 'Top 10 Financial Consumer News' that had the greatest impact on financial consumers this year.

This year's Top 10 Financial Consumer News are ▲ Enforcement of the Financial Consumer Protection Act ▲ End of the zero interest rate era ▲ Record-high household debt ▲ KOSPI 3000 stock investment boom ▲ Speculative investment frenzy in alternative assets ▲ Banks' record-high profits ▲ Three internet-only banks system ▲ Consumer victory in life insurance immediate annuity lawsuit ▲ Surge in indemnity insurance premiums ▲ Acceleration of ESG (Environmental, Social, Governance) management.

On March 25, the Financial Consumer Protection Act (FCPA), which stipulates six major principles that financial product sellers must comply with in their business operations, was enforced. Financial companies expanded and reorganized departments related to financial consumer protection and established institutional measures to protect financial consumers' rights, such as supplementing product brochures to reduce disputes and damages caused by incomplete sales. However, there are still many shortcomings in protecting financial consumers, and supplementary amendments including class action lawsuits, punitive damages, and burden of proof reversal have been proposed in the National Assembly. It is expected that a more robust FCPA will be implemented upon revision.

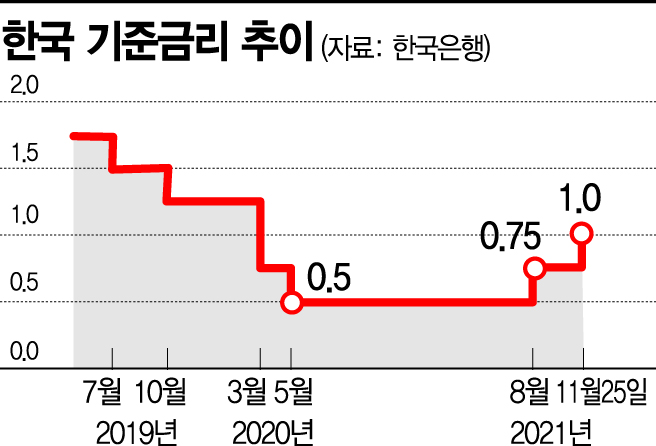

The Bank of Korea's Monetary Policy Committee raised the base interest rate twice by 0.25% in August and November to resolve overheating in household debt and asset values amid a recovery in the export-driven real economy, raising the base rate from 0.50% to 1.0%, thus ending the zero interest rate era. The base rate is expected to be raised once or twice more next year, and with loan interest rates rising sharply, the financial burden on low-income households struggling with debt is expected to worsen.

Household debt increased significantly amid the spread of the COVID-19 pandemic. In addition, borrowing to invest (debt investment) and borrowing with all possible means (Eonggeul) loans surged. However, the government imposed total volume and debt service ratio (DSR) loan regulations to curb the bubble and reduce risks from household debt exceeding GDP and growing rapidly. This led to a loan crisis causing confusion among real demand borrowers, restricted competition among financial companies, and sharply increased loan interest rates, raising concerns about the proliferation of credit delinquents and a surge in vulnerable households.

At the beginning of the year, the KOSPI surpassed the 3000 mark, reaching 3100, 3200, and hitting an intraday high of 3316.08 on June 25, a record high, with a closing high of 3305.21 on July 6. The KOSPI, which had fallen to the 1450 level in March last year due to the COVID-19 pandemic shock, surpassed 3000 within a year, supported by over 10 million individual investors known as Donghak Ants. The stock investment boom driven by the KOSPI rise has caused concerns about reckless investments such as debt investment and Eonggeul loans, but the rise in KOSPI has significantly improved the returns of financial investment products linked to the stock index, showing many positive aspects. Institutional improvements are needed to enable wealth accumulation through financial assets.

Many young people invested in virtual assets, which have no price fluctuation limits, as a means of asset formation. Along with the rise of Bitcoin, an investment frenzy occurred. The virtual asset market grew to become the world's third largest, surpassing the KOSPI market, driven solely by operators and investors. With the full enforcement of the Special Financial Transactions Information Act (Special Act on Reporting and Using Certain Financial Transaction Information) on September 25, exchanges came under legal regulation. Although taxation was postponed for one year, investment income is taxable. Like the U.S. Securities and Exchange Commission (SEC) approving Bitcoin futures exchange-traded funds (ETFs), Korea should recognize virtual assets as financial investment products and actively prepare investor protection measures.

Excluding the Korea Development Bank, domestic banks recorded a net profit of 12.9 trillion won in the first three quarters, 1.3 trillion won more than last year's net profit of 11.6 trillion won. Banks increased interest rates by reducing discounts on additional interest rates due to loan regulations and market interest rate rises, differentiating interest rates based on loan amounts, and differentiating online and counter loan interest rates, resulting in record-high profits. In October, the interest rate spread between deposits and loans was 2.17%, representing excessive profits at the expense of consumers' pockets.

In October, the comprehensive financial platform company Toss launched as an internet-only bank to reduce polarization in the credit business and promote mid-interest loans, reorganizing the system into three internet-only banks. Although it handled 500 billion won in loans within 10 days and then stopped due to total household loan volume regulations, contrary to consumer benefit expectations, it should contribute to increasing consumer welfare by providing high-quality financial services through fair competition with existing KakaoBank and K Bank. Meanwhile, existing banks are accelerating digital finance but expanding unmanned branches and significantly reducing physical branches, increasing inconvenience for digitally vulnerable groups such as elderly consumers.

In the joint lawsuit for the return of unpaid immediate annuity payments by life insurance companies, Samsung Life, the largest in scale following Mirae Asset, Dongyang, and Kyobo Life, was ruled in favor of consumers. Although the plaintiff's victory was expected, life insurance companies have ignored the Financial Supervisory Service's payment orders and compensated only a small number of consumers participating in lawsuits, engaging in litigation tactics to complete the statute of limitations. Life insurance companies should promptly fulfill their promises to consumers by voluntarily paying unpaid immediate annuity amounts.

Since 2015, indemnity insurance premiums have been raised almost every year except once, and premiums will increase again next year due to high loss ratios. Consumers are frustrated by the annual premium hikes. Especially consumers with renewal cycles of 3 to 5 years bear the burden of sudden premium increases. Insurance companies should not easily raise premiums blaming loss ratios while leaving controllable factors such as excessive business expenses, insurance leakage, and adverse selection unaddressed, which are the fundamental causes of high loss ratios.

COVID-19 has increased the need for sustainable management among companies. Since the performance of sustainable management is difficult to compare through financial figures or information, it has taught that decision-making should not harm the common standards of Environment and Social aspects or Governance. While companies' goals were previously technological innovation for profit pursuit, through the uncertain COVID era, they have prioritized human safety and protection. Innovative technology for industrial development remains important, but companies are now focusing on solving environmental and social issues, raising expectations for consumer-oriented corporate management.

Kang Hyung-gu, Secretary General of the Financial Consumers Federation, said, "Although 2021 continues to be a difficult year due to the COVID-19 pandemic, it was a milestone year for financial companies with the full enforcement of the Financial Consumer Protection Act. We hope it becomes an opportunity to prioritize the protection of financial consumers' rights and realize a financial powerhouse."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.