As apartment sale and jeonse prices in the Seoul metropolitan area continue to decline simultaneously, anxiety is growing among the 2030 generation who have aggressively purchased mid-to-low priced apartments in the metropolitan area by "Yeongkkeul" (borrowing to the limit). There are increasing concerns that if housing prices enter a full-fledged downward trend beyond a temporary adjustment, this demographic could suffer the most significant impact.

According to the Korea Real Estate Board on the 26th, the proportion of apartment purchases by the 2030 generation in the metropolitan area (Seoul, Gyeonggi, Incheon) was the highest since related statistics were first released in 2019.

In Seoul, the purchase share of the 2030 generation was 31.7% from January to October 2019, increased to 36.5% during the same period last year, and this year it recorded 41.9%, surpassing 40%. Non-Gangnam areas such as 'Nodogang' (Nowon, Dobong, Gangbuk) and 'Geumgwan-gu' (Geumcheon, Gwanak, Guro), where mid-to-low priced apartments are concentrated, saw particularly sharp increases in the 2030 purchase share this year. Nowon-gu recorded the largest increase in Seoul this year, with the 2030 purchase share rising sharply from 37.2% last year to 49.2% this year, a 12 percentage point jump, followed by Gwanak-gu, which rose from 36.2% last year to 47.3% this year, an 11.1 percentage point increase.

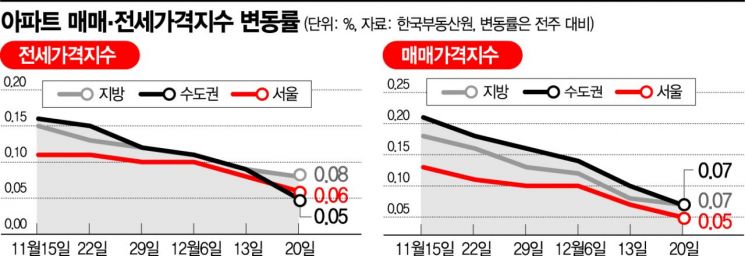

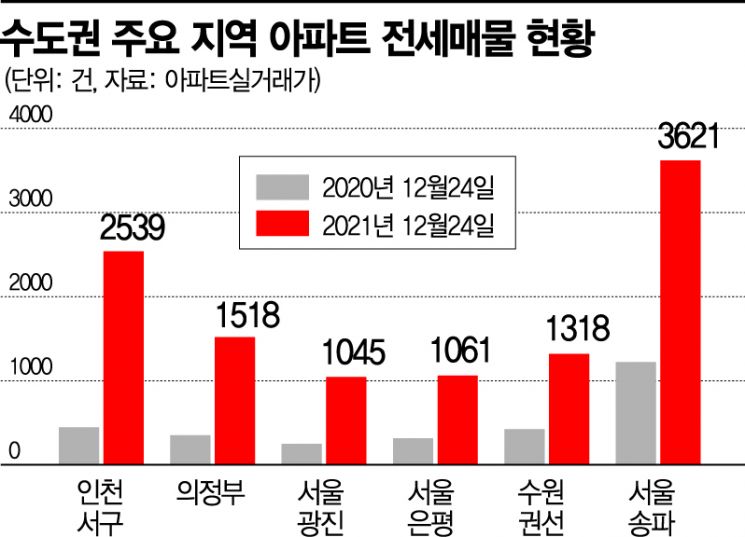

The problem is that apartment sale and jeonse prices in these areas are showing signs of decline.

Last week, apartment prices in Eunpyeong-gu recorded -0.03%, marking the first decline in 1 year and 7 months. Apartment prices in Gwanak-gu and Geumcheon-gu turned flat last week, signaling an imminent drop, while Gangbuk (0.02%), Dobong (0.03%), and Nowon (0.05%) also saw their price increases sharply slow, with a flat or declining trend imminent.

Declining trends have also been observed in cities such as Anyang, Gunpo, and Uiwang. In the Gyeonggi area, where apartment prices surged sharply this year due to positive factors like the Great Train Express (GTX) and new town developments, it is expected that the price drop could be significant in a downturn.

With the presidential election next year increasing policy uncertainties, there are concerns that if housing prices enter a full-fledged decline, the younger generation who have recklessly borrowed through "Yeongkkeul" and engaged in "panic buying" could suffer the most damage.

On the 23rd, the Bank of Korea hinted at the possibility of raising the base interest rate in its December 2021 Financial Stability Report, warning that movements to sell real assets may occur and housing prices could be adjusted accordingly.

The Bank of Korea stated, "Considering the high proportion of real assets held by households in our country and the increase in high-risk households, real household income could significantly decrease," adding, "This could lead to liquidity being secured through the sale of real assets, which may result in adjustments in housing prices."

Recently, as buying momentum has weakened, the housing price decline could accelerate further. The apartment sale supply-demand index in Seoul was 93.9 in the fourth week of December, down from 95.2 the previous week, remaining below 100 for six consecutive weeks, while Gyeonggi Province has shown a decline for four consecutive weeks, indicating a continued transaction slump.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.