[Asia Economy Reporter Kim Hyewon] It is forecasted that South Korea's exports in the first quarter of next year will continue to show strong performance centered on key items such as semiconductors, automobiles, petroleum products, and ships.

According to the '2022 Q1 Export Industry Business Outlook Survey' conducted by the Korea International Trade Association's International Trade and Commerce Research Institute on 1,260 domestic export companies on the 26th, the Export Business Survey Index (EBSI) for the first quarter of next year was recorded at 115.7. This is an increase from the previous quarter (106.0). An EBSI above 100 indicates that export conditions are expected to improve compared to the current situation.

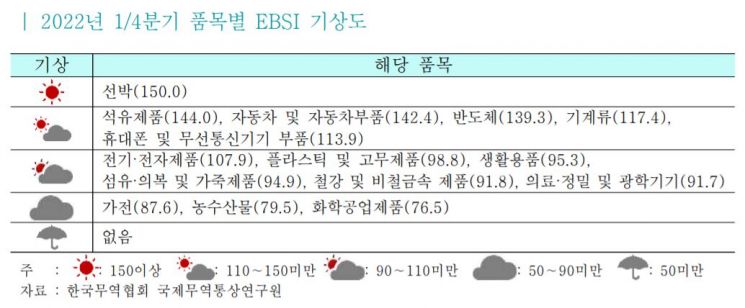

By item, the index was high mainly for key products such as ships (150.0), petroleum products (144.0), automobiles and automobile parts (142.4), and semiconductors (139.3). Researcher Do Wonbin from the Trend Analysis Office predicted that the increase in global import demand due to the adoption of 'With Corona' policies by major countries worldwide will have a positive impact on the exports of these items.

Specifically, petroleum products are expected to benefit from rising international oil prices and the resulting increase in export unit prices. Additionally, as the eco-friendly transition accelerates, exports of domestic ships and automobiles, including automobile parts, which hold an advantage in the liquefied natural gas (LNG) powered ship and electric vehicle sectors, are also expected to increase.

On the other hand, chemical products (76.5), agricultural and marine products (79.5), and home appliances (87.6) are expected to face worsening export conditions compared to the fourth quarter of this year. In particular, chemical products are forecasted to suffer a double blow due to oversupply caused by global production facility expansions and a decrease in demand as China, the largest consumer, increases its self-sufficiency rate.

Among the 10 items evaluating future export conditions, export consultations (116.8), export contracts (112.8), and facility operation rates (103.6) are expected to improve export conditions. Conversely, items such as manufacturing costs of export goods (79.3), international supply and demand situation (84.1), and import regulations and trade frictions (93.3) received many negative evaluations.

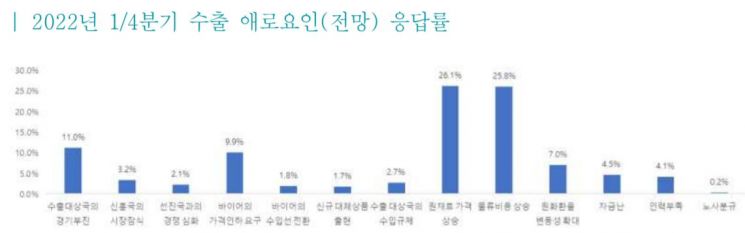

The most frequently cited export difficulties by companies for the first quarter of next year were rising raw material prices (26.1%) and increasing logistics costs (25.8%).

Researcher Do explained, "Recently, international oil prices have surpassed $80 per barrel, and the London Metal Exchange (LME) index, a comprehensive price indicator for non-ferrous metals, has reached an all-time high, intensifying difficulties for companies due to rising raw material prices." He added, "Although sea freight rates, which had sharply increased since the third quarter of this year, have slowed their rise in the fourth quarter, they still remain at high levels, continuing to be an obstacle to exports."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)