[Asia Economy Reporter Jeong Hyunjin] While China is dominating the global display market with liquid crystal display (LCD) technology, South Korea is solidifying its position in the display market based on its competitive edge in organic light-emitting diode (OLED) technology. Amid bleak forecasts that South Korea’s overall market share will soon fall to single digits, the country is adopting strategies to lead the industry with new technologies and maintain its business domain.

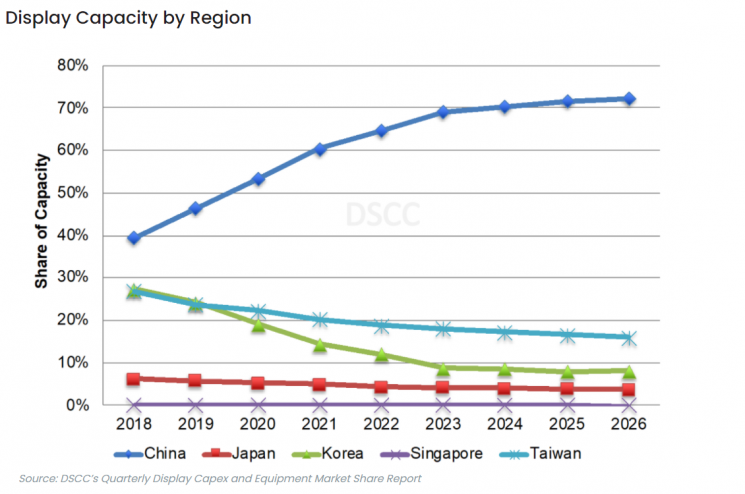

According to the display market research firm DSCC on the 22nd, South Korea’s share of display production capacity is expected to sharply decline from 14% this year to 8% by 2026. China, the industry leader, is projected to expand its display production capacity from 60% this year to 72% next year, with its share in the TV market reaching a very high 82%. Taiwan ranks second with a 20% share this year.

Currently, the global display market is dominated by China, centered on the LCD market. Chinese display companies such as BOE and CSOT have rapidly grown by acquiring LCD businesses and factories from domestic companies. The share of LCD TVs in the overall TV market is expected to increase from 72% last year to 74% in 2024. Although the share is expected to gradually decrease with the expansion of OLED adoption, LCD still holds an overwhelmingly high share, led by Chinese companies.

As a result, the position of Korean companies in the global display market is narrowing. LG Display, which was the industry leader until 2018, is forecasted by DSCC to fall to fourth place with an 8.5% market share in 2026, behind China’s BOE, CSOT, and HKC. Along with LG Display, domestic display companies such as Samsung Display are likely to cease production of LCD panels for TVs next year, which is expected to further reduce their share of total production capacity.

However, Korean companies are expanding their presence in the OLED market. While the overall display market is expected to grow at an average annual rate of 5.1% from this year to 2026, the OLED market is projected to expand at an average annual rate of 16% during the same period, indicating a focus on future growth potential. DSCC expects South Korea’s share of OLED production capacity to be the highest, ranging from 53% to 55% between 2022 and 2026.

LG Display leads the large OLED panel market, while Samsung Display leads the small and medium-sized OLED panel market. DSCC forecasts that in 2026, LG Display will hold the top position with a 34% share of OLED production capacity, followed by Samsung Display with 29%. BOE ranks third with a 13% share. Samsung Display is expected to lead mobile OLED and flexible OLED production capacities with shares of 40% and 29%, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)