8 out of Top 15 Stocks by Price Increase

Wemade Max Soars 1221%

Pharmaceuticals and Biotech at Bottom Ranks

[Asia Economy Reporter Minji Lee] Despite the ongoing impact of COVID-19 this year, stocks themed around the Metaverse and NFT (Non-Fungible Tokens) surged over 1000%, achieving record-breaking returns. In contrast, pharmaceutical and bio companies that soared last year due to vaccine and treatment development prospects have plummeted within a year.

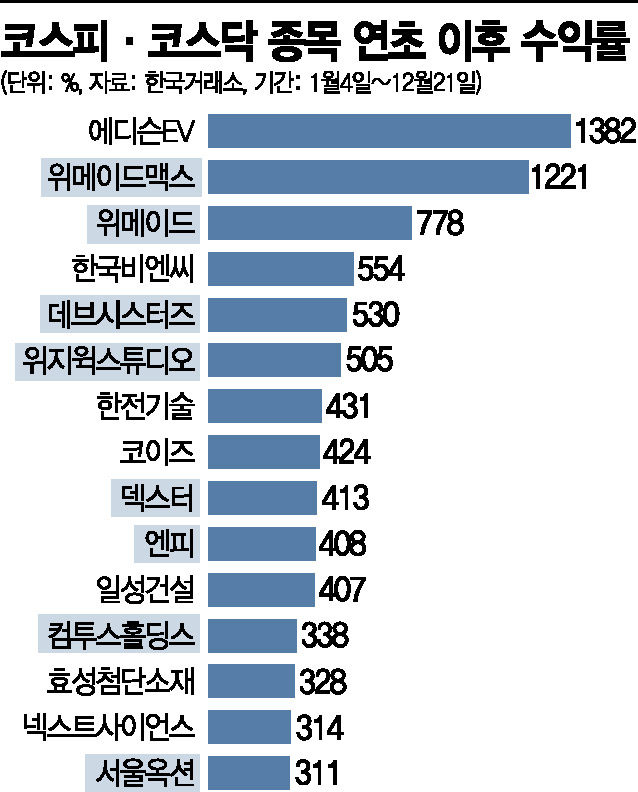

According to the Korea Exchange on the 22nd, among the top 15 stocks with the highest price increases this year (January 4 to December 21) in the KOSPI and KOSDAQ markets, eight were media content companies linked to Metaverse and NFT theme beneficiaries. By stock, there were four game companies (Wemade Max, Wemade, Devsisters, Com2uS Holdings), three content production companies (Dexter, NP, Wysiwyg Studios), and Seoul Auction.

The Metaverse is a fusion of the real and virtual worlds that interact with each other. As non-face-to-face lifestyles became normalized after COVID-19, it expanded across all industries and became the representative theme of this year. NFTs are a system that can prove ownership of content created in these virtual spaces, and since they trigger economic, social, and cultural activities in a world transcending reality, they run parallel to the Metaverse.

The top-performing stock was Wemade Max, a subsidiary of the game developer Wemade. Wemade Max, which ended last year at 2,895 KRW, surged 1,221% to 38,250 KRW as of the previous day's closing price. Wemade followed with a 778% increase during the same period. The global hit of ‘Mir4,’ released in over 170 countries worldwide in August this year, triggered the stock price rise. Based on the rapidly rising global IP Mir IP, Wemade quickly built an NFT and P2E (Play to Earn) ecosystem through the WEMIX platform, leading to further rallies. Additionally, Devsisters (503%) and Com2uS Holdings (338%) also showed steep rises, buoyed by their entry into the NFT business.

Content production companies Wysiwyg Studios, Dexter, and NP posted impressive gains of 778%, 413%, and 408%, respectively. Wysiwyg Studios and Dexter are computer graphics (CG) and visual effects (VFX) technology companies, which increased their investment appeal by actively exploring Metaverse-related business models. NP was recognized as a Metaverse-related stock after establishing an extended reality (XR) subsidiary. A senior official from the asset management industry said, "Several companies that declared business expansion into NFT and Metaverse last month saw their stock prices surge," adding, "Although these are high-value companies, given the significant growth potential of the Metaverse and NFT, it is positive to approach them by carefully selecting stocks rather than considering them as temporary themes."

On the other hand, pharmaceutical and bio stocks that attracted attention last year as COVID-19 treatment and diagnostic kit-related stocks remained at the bottom of this year's returns. Shinpung Pharmaceutical, which rose the most last year on expectations for COVID-19 treatment development, fell 74.7% this year. Although it was included in the KOSPI 200 in July last year after news that the malaria treatment ingredient ‘Piramex’ suppressed COVID-19, the stock quickly plummeted as its effectiveness was found to be negligible. L&K Bio, which surged about 577% last year as a COVID-19 diagnostic kit-related stock, dropped 74%, while Seegene (-32%), MK ICS (-34%), Access Bio (-26%), and Jin Matrix (-60%) also showed significant declines.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.