This Year’s Voluntary Retirement Scale at 2,092+

Approaching 5,000 Including Foreign Firms

Voluntary Retirement Age ↓ Compensation Level ↑

Hiring and Store Numbers Decline Amid Downsizing

[Asia Economy Reporter Song Seung-seop] The number of voluntary retirees at major commercial banks this year is expected to be twice the number of new hires. This is due to a reduction in open recruitment and an increase in voluntary retirement targets. Branch offices and automated teller machines (ATMs) are also rapidly disappearing. While this is seen as an unavoidable survival strategy, concerns about side effects coexist.

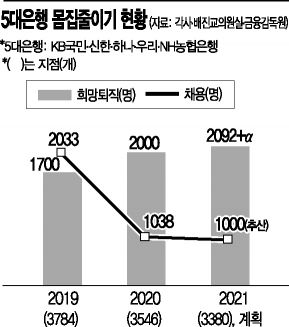

According to the financial sector on the 20th, the number of voluntary retirees at KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup Banks has reached 2,092 so far this year. The number has been steadily increasing from the 1,700 range in 2019 to the 2,000 range last year. About 800 employees left KB Kookmin Bank in January, and Shinhan Bank saw 350 employees leave in two rounds. At NH Nonghyup Bank, a total of 452 employees announced their intention to leave the company from the 19th to the 23rd of last month.

The actual number of voluntary retirees is expected to be higher. Hana Bank had 22 employees leave in the first half of the year, and voluntary retirement applications will be accepted as early as the end of this month or January next year. Woori Bank, which saw 468 employees leave, is accepting voluntary retirement applications from today until the 28th according to labor-management agreement. Combining SC First Bank and Korea Citibank, which have 496 and about 2,300 voluntary retirement applicants respectively, the annual voluntary retirement scale is expected to exceed 5,000, marking a record high.

It is widely expected that the scale of voluntary retirement will continue to increase for the time being. Banks are competitively lowering the eligible age for voluntary retirement. Woori Bank lowered the age from 54 to 46 last year and further reduced it to 41 this year. Employees at the rank of clerk or assistant manager, born in the 1980s, can now apply for voluntary retirement. Compensation levels are also increasing. Citibank offers up to 700 million KRW per person as voluntary retirement pay, along with various gift certificates and scholarships for children. SC First Bank also announced payments of up to 600 million KRW.

Decreasing Staff, Disappearing Branches

On the other hand, the number of new hires is steadily decreasing. According to the office of Bae Jin-kyo, a member of the Justice Party, the number of open recruitment hires at the five major banks is estimated to be just over 1,000 this year. This has continuously declined from 2,945 in 2018, 2,033 in 2019, to 1,038 last year. Most recruitment is focused on digital and IT sectors, with existing banker positions either not being filled or selected through occasional hiring. For instance, Hana Bank and Woori Bank did not conduct open recruitment for new employees this year.

This downsizing is likely to accelerate in conjunction with branch closures. If the physical space for face-to-face services disappears, the demand for staff handling deposit and loan services at counters will inevitably shrink faster. According to the Financial Supervisory Service, the number of domestic bank branches decreased from 7,281 in 2015 to 6,326 as of the first half of this year, a reduction of about 1,000 branches. An additional 143 branches are planned to close in the second half of the year. In particular, the branches of major commercial banks, which have the largest recruitment and workforce scale in the industry, led the decline from 4,314 to 3,380.

ATMs are also noticeably decreasing. According to data submitted by the Bank of Korea to Yoon Kwan-seok of the Democratic Party, 1,769 ATMs nationwide disappeared last year.

While this trend is interpreted as a strategy to counter the emergence of internet-only banks and strengthen digital and IT competitiveness, there are also calls to minimize negative repercussions. Lee Gu-hyung, a researcher at the National Assembly Legislative Research Office, said, “Branch closures are seen as one of the survival strategies banks must choose amid the expansion of financial digitalization,” but warned, “If financial exclusion resulting from this is neglected, some users may be left out of financial services, leading to social problems.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.