[Asia Economy Reporter Park Byung-hee] The U.S. central bank, the Federal Reserve (Fed), expanded its tapering (asset purchase reduction) scale from $15 billion to $30 billion per month last week, accelerating the tightening moves of central banks worldwide. However, concerns are emerging that the uncertainty surrounding central banks' monetary policies may increase due to the Omicron variant remaining a variable. Initially, central banks shifted toward tightening as early analyses showed that the symptoms of the Omicron variant are milder compared to the existing Delta variant, but the impact of Omicron could turn out to be greater than expected. Despite the mild symptoms of the Omicron variant, the number of countries reintroducing lockdown measures, especially in Europe, is rapidly increasing.

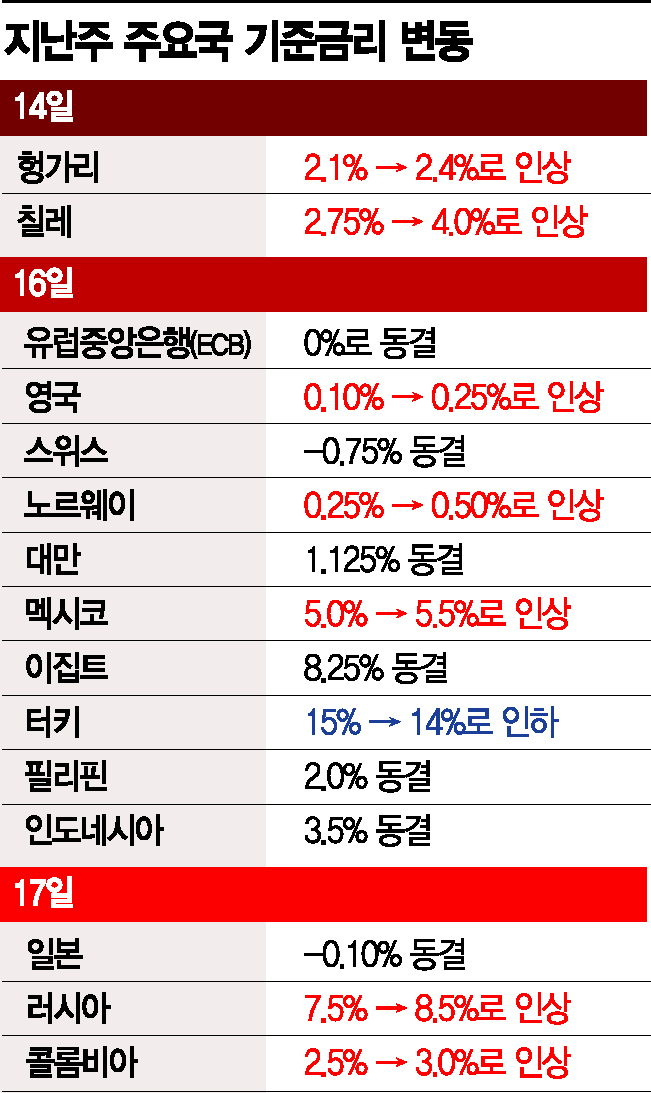

As the Fed expanded the tapering scale, many countries raised their benchmark interest rates last week. The United Kingdom raised its benchmark interest rate from 0.10% to 0.25%, becoming the first country among the Group of Seven (G7) to raise rates since the COVID-19 pandemic. Other countries that raised their benchmark rates include Russia (1 percentage point), Norway (0.25 percentage points), Chile (1.25 percentage points), Mexico, Colombia (both 0.5 percentage points), and Hungary (0.3 percentage points).

The UK was initially expected to keep rates steady due to the emergency declaration amid the spread of the Omicron variant. However, the Bank of England (BOE), the central bank, surprisingly chose to raise rates, indicating that it did not view the Omicron variant as a significant risk. The BOE stated in its minutes, "Based on experience since March last year, although COVID-19 variant shocks have recurred, the impact on gross domestic product (GDP) appears to be diminishing."

The Wall Street Journal (WSJ) analyzed that concerns about the Omicron variant prolonging inflation are growing, leading central banks to change their monetary policy directions.

Unlike the BOE, the European Central Bank (ECB) did not change its monetary policy. It announced that it would end its quantitative easing policy in March next year, but this was according to the original schedule.

ECB President Christine Lagarde said at a press conference after the monetary policy meeting, "It remains highly uncertain whether the Omicron variant will have a greater impact on inflation or deflation." She pointed out that the Omicron variant could suppress consumption, causing an overall economic downturn that lowers prices rather than pushing inflation up.

The ECB forecasted that the consumer price inflation rate would rise from 2.6% this year to 3.2% next year but would fall to 1.8% in 2023 and 2024. It expects the inflation rate to drop below the ECB's monetary policy target again in 2023. This differs from the Fed's outlook, which anticipates long-term inflation. In its economic projections released last week, the Fed predicted that the core Personal Consumption Expenditures (PCE) price index would rise 2.7% next year and remain above the 2% monetary policy target at 2.3% and 2.1% in 2023 and 2024, respectively. Consequently, forecasts for benchmark interest rate hikes next year diverge between the Fed and the ECB. The Fed has signaled three rate hikes next year. Fed Chair Jerome Powell said, "People are learning to live with COVID-19," adding, "The more people get vaccinated, the less impact it will have on the economy." In contrast, ECB President Lagarde maintains that it is uncertain whether the conditions for a rate hike will be met next year.

Anthony Fauci, director of the U.S. National Institute of Allergy and Infectious Diseases (NIAID), warned on the 19th (local time) that the U.S. will face a difficult winter as the Omicron variant spreads rapidly. He said, "One thing we have learned from our experience over the past two years is that this virus is truly unpredictable."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.