[Asia Economy Reporter Ji Yeon-jin] Next year, the domestic e-commerce industry is expected to continue its deficit competition, prompting calls for a cautious approach to the initial public offerings (IPOs) of companies such as SSG.COM and Market Kurly.

According to KTB Investment & Securities on the 19th, the operating losses of distribution companies' online businesses, excluding major platform companies, are expanding this year. Coupang, which had reduced its deficit ahead of its listing, is expected to record an operating loss of 1.6 trillion won this year. SSG.COM and Lotte ON are estimated to record 107 billion won and 143 billion won, respectively.

NAVER Shopping and Kakao Commerce are projected to post operating profits of 501 billion won and 278 billion won, respectively, this year. The profitability gap with traditional distribution companies is interpreted as being influenced by advertising businesses based on large platform traffic and KakaoTalk’s unique sense of belonging and convenience utilized in its gifting service. The expansion of market share by internet companies with business models and moats different from the traditional distribution commission fee model is seen as one axis of the expanding deficit competition within the e-commerce market.

Moreover, the sales growth rate of global e-commerce companies is slowing down. In the United States, where economic reopening was faster than in Korea, Amazon’s combined retail sales growth rate recorded 8% in the third quarter. This is a significant slowdown from 50% in the first quarter and 22% in the second quarter of this year. This is interpreted as a result of increased offline consumption following the transition to the With-Corona phase and the high base effect from last year.

The domestic e-commerce market is also expected to show a similar trend to global companies. Coupang recorded a sales growth rate of 48% in 3Q21, which slowed down compared to 68% in the first half of this year. Although Coupang has stated that it is not concerned about short-term growth rates (over the next six months), the financial investment industry views a slowdown in sales growth rate next year as inevitable.

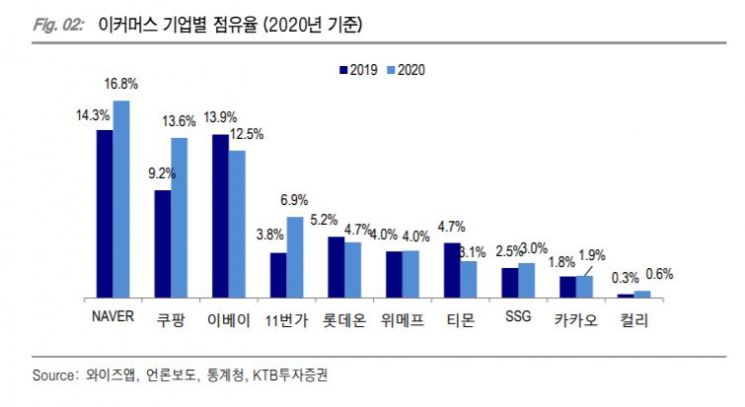

With E-Mart’s acquisition of eBay Korea, the market share of the top three companies, including NAVER and Coupang, increased (from 37.3% in 2019 to 45.9%), but the prevailing view is that competition intensity will rather increase. Jinwoo Kim, a researcher at KTB Investment & Securities, said, "The stock prices of e-commerce companies listed this year have fallen by an average of 30% compared to their IPO prices," adding, "Considering the differences in e-commerce penetration rates between countries and the slowdown in growth rates of e-commerce companies, a cautious approach is necessary for Korean e-commerce companies awaiting IPOs next year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.