Tens of Thousands Nationwide Engage in Click Battle for Non-Regulated, Resale-Permitted Products

"This is my 200th time verifying my identity on my phone. Is this application even being accepted?"

At 9 a.m. on the 16th, the no-priority subscription application website for an officetel being sold in the Daejeon area opened, but the server immediately crashed. This was due to a flood of applicants nationwide trying to apply simultaneously. Since then, various real estate-related communities and open chat rooms have been flooded with complaints that "subscription applications are not being processed." The developer extended the subscription deadline, originally set for 5 p.m. that day, to midnight. However, as server access issues continued, the developer ultimately extended the deadline once more to 5 p.m. on the 17th. They apologized, stating, "Due to a surge in no-priority subscription applicants, delays in processing are occurring," and "We are taking measures to ensure smooth application processing." While it is not uncommon for subscription deadlines to be extended due to heavy traffic on the application website several times this year, it is unusual for the deadline to be extended twice.

Non-residential products exempt from government regulations are suffering from an influx of investors seeking short-term price gains. Even non-end users are applying in the hope of winning the subscription and reselling the rights for tens of millions of won in profit, leading to hundreds of thousands of applications for each subscription complex.

This year, the frenzy in the income-generating real estate market, such as officetels and residential hotel facilities, has been led by properties that allow resale. Due to loan regulations and increased property taxes, the barriers to purchasing apartments have risen, causing interest to shift toward relatively more accessible products. In popular areas, it has become standard for officetels or residential hotel facilities to receive over 100,000 subscription applications.

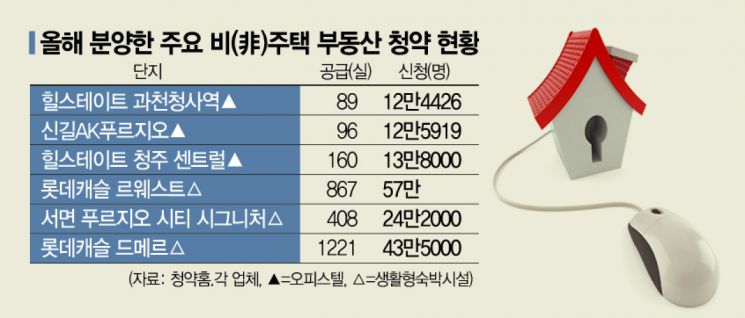

Last month, the ‘Hillstate Gwacheon Government Complex Station’ officetel in Byeolyang-dong, Gwacheon-si, Gyeonggi Province, attracted 124,426 applicants for just 89 units. The average competition rate was 1,398 to 1, the highest ever recorded for officetels according to the Korea Real Estate Board. In the same month, the ‘Singil AK Prugio’ officetel in Singil-dong, Yeongdeungpo-gu, Seoul, also drew 125,919 applicants for 96 units. Both were priced well over 900 million won, earning the reputation of ‘officetels more expensive than apartments,’ yet demand was overwhelming.

Residential hotel facilities also achieved blockbuster success. The ‘Lotte Castle Le West’ in Gangseo-gu, Seoul, received 575,950 applications for 867 units. In Busan, the ‘Seomyeon Prugio City Signature’ attracted about 240,000 applicants for 408 units, and the ‘Lotte Castle De Mer’ drew about 430,000 applicants for 1,221 units.

Unlike apartments, these products share the common feature of not being subject to resale restrictions on subscription rights. No subscription savings account is required, and officetel subscription rights are not counted toward the number of houses owned, allowing non-homeowners to maintain first-priority apartment subscription eligibility. Loans for officetels also have a higher loan-to-value ratio (LTV) of 70%, compared to apartments.

There are calls to impose resale restrictions and mandatory residence requirements on officetels and similar properties to reduce social waste caused by the subscription frenzy and stabilize the market. However, such measures are considered unlikely to be a fundamental solution. The current phenomenon is a balloon effect caused by apartment regulations; regulating non-regulated products would only lead to a second balloon effect. Professor Shim Gyo-eon of Konkuk University’s Department of Real Estate said, "While measures like resale restrictions may help suppress short-term demand, in the long term, they are more likely to shrink transactions and further reduce supply, causing adverse side effects."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.