Korea Real Estate Board November Nationwide Housing Price Trends Released

Housing Sale Price Increase Slows in Seoul and Capital Area, Provinces

Jeonse and Monthly Rent Similar... Impact of Interest Rate Hikes and Housing Price Peak

Last month, the rate of increase in housing sale, jeonse (long-term lease), and monthly rent prices in Seoul and the metropolitan area all narrowed. While some areas such as Gangnam continue to see record-high transactions, most regions experienced a slowdown in price growth due to a decrease in transactions. This is interpreted as the effect of a sharp decline in buying demand following interest rate hikes and strengthened loan regulations.

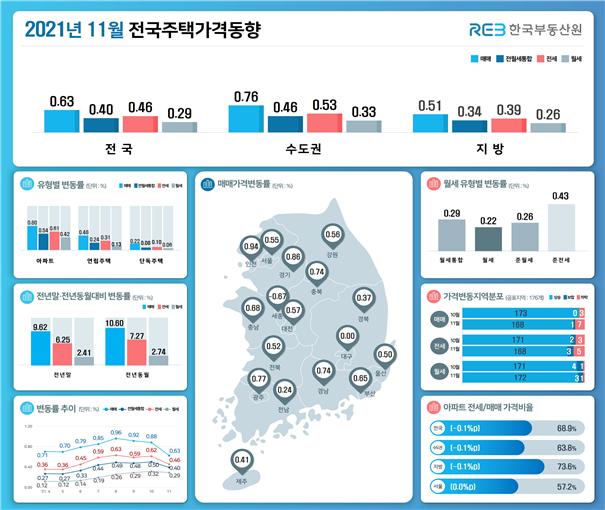

According to the nationwide housing price trend report released by the Korea Real Estate Board on the 15th, the comprehensive nationwide housing sale price index rose by 0.63% last month, narrowing from 0.88% in the previous month. Similar trends were observed in the metropolitan area (1.13% → 0.76%), Seoul (0.71% → 0.55%), and other provinces (0.67% → 0.51%). Notably, Sejong fell by 0.67%, deepening its decline from -0.11% the previous month.

In Seoul, the Gangnam area, where high-priced complexes are concentrated, showed higher growth rates. Seocho-gu (0.92%) rose due to record-high transactions in some popular complexes, Songpa-gu (0.84%) increased mainly in large complexes in Garak and Jamsil-dong, and Gangnam-gu (0.73%) rose primarily in key complexes in Gaepo-dong and Samsung-dong with school district demand. Yongsan-gu (0.79%) and Mapo-gu (0.65%), where remodeling and redevelopment projects are anticipated, also saw relatively significant increases, while Nowon-gu (0.58%) rose mainly in mid- to low-priced areas.

Gyeonggi-do (0.86%) saw increases mainly in mid- to low-priced complexes, and Incheon (0.94%) rose in areas with expectations of transportation improvements. However, due to the impact of interest rate hikes and strengthened household loan management policies, buying sentiment weakened, leading to a narrower rate of increase compared to the previous month.

The nationwide comprehensive housing jeonse price rose by 0.46%, also slowing from 0.62% in the previous month. The metropolitan area (0.75% → 0.53%), Seoul (0.48% → 0.39%), and other provinces (0.50% → 0.39%) all showed a slowdown.

In Seoul (0.39%), prices rose mainly in key complexes with good residential conditions such as school districts and mid- to low-priced older buildings. Yeongdeungpo-gu (0.51%), Dobong-gu (0.48%), Songpa-gu (0.47%), Gangdong-gu (0.46%), and Yangcheon-gu (0.45%) saw significant increases. Gyeonggi-do (0.62%) experienced relatively larger increases in jeonse prices in mid- to low-priced complexes.

In other provinces, the rate of increase also narrowed due to loan regulations, but Ulsan (0.85%) and Chungbuk (0.67%) saw substantial rises in jeonse prices. Sejong (-0.05%) shifted from rising to falling prices due to fatigue from rapid price increases and the impact of new housing supply.

The nationwide comprehensive monthly rent price increase rate was 0.29%, down from 0.32% the previous month. The metropolitan area (0.38% → 0.33%) and Seoul (0.25% → 0.23%) saw a narrowing in the rate of increase, while other provinces (0.26%) maintained the same level as the previous month.

In Seoul, monthly rents rose significantly in station-area complexes in Seocho, Dobong, and Songpa-gu. Gyeonggi-do (0.40%) saw increases mainly in Siheung and Anseong cities, where there is a perception of relative undervaluation or expectations of residential environment improvements.

In other provinces, Ulsan (0.76%) showed signs of supply shortages, causing instability in jeonse prices. Daejeon (0.42%) and Busan (0.32%) also saw increases mainly in key complexes, but Sejong (-0.04%) experienced price declines due to accumulated jeonse listings and decreased demand for monthly rent.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)