Lump-Sum Repayment Loan Maturity Extension 247.4 Trillion Won

It has been identified that the support for deferring principal repayment on loans for small and medium-sized enterprises (SMEs) and self-employed individuals affected by COVID-19 has exceeded 1 million cases from April last year to October this year. The financial burden has increased to the extent that the deferred interest alone amounts to 230 billion KRW, highlighting the urgent need for measures to ensure a 'soft landing.'

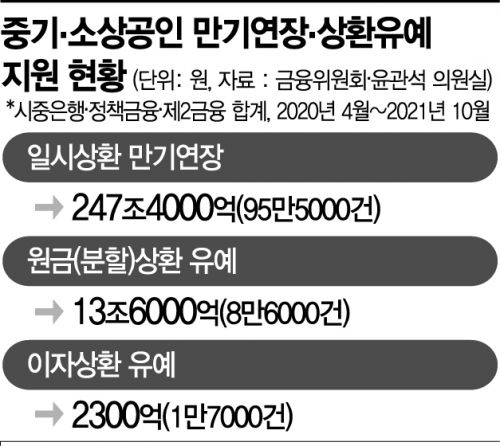

According to data analyzed by Yoon Kwan-seok, a member of the National Assembly's Political Affairs Committee from the Democratic Party of Korea, submitted by the Financial Services Commission on the 14th, the support for maturity extension and repayment deferral during this period was approximately 1.06 million cases (including overlapping and multiple supports).

The number of loan contracts that received maturity extension support for lump-sum repayment loans was 955,000 cases (247.4 trillion KRW). The support for principal repayment deferral on installment loans and interest repayment deferral on both lump-sum and installment loans were 86,000 cases (13.6 trillion KRW) and 17,000 cases (230.1 billion KRW), respectively. Compared to the end of January this year, loans with extended maturity increased twofold in nine months, and the amount of beneficiary loans increased 2.6 times.

The government and financial authorities implemented measures to extend loan maturities or defer interest repayments as part of financial support for SMEs and small business owners affected by COVID-19, starting in April last year when the impact of COVID-19 became serious. These measures have been extended three times in six-month intervals and are set to end in March next year.

There are ongoing concerns that if those who received support fail to recover their repayment capacity after the measures end, a significant portion of the supported loans will become non-performing. This is because these loans are likely to be classified as 'COVID survival loans.'

The rapid increase in loan amounts for self-employed individuals further heightens concerns. According to the Bank of Korea, the total outstanding loans from deposit banks to self-employed individuals in the third quarter of this year increased by 11.1 trillion KRW from the previous quarter, reaching 429.6 trillion KRW. This is the largest increase since the second quarter of last year (21.2 trillion KRW) when the impact of COVID-19 became serious, and the second-largest increase since the fourth quarter of 2018, when related statistics have been recorded.

At the end of last month, the outstanding loans to the self-employed from the five major banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?rose by 2.9 trillion KRW from the previous month to 298.7476 trillion KRW, approaching 300 trillion KRW. These banks continue to see an increase in self-employed loans at a pace of about 2 trillion KRW per month.

Professor Oh Jung-geun of Konkuk University's Department of Economics pointed out, "It will be difficult for the economy to recover enough for self-employed individuals and others to secure the capacity to repay loans by the time the measures end. After that, their loan amounts could be classified as non-performing loans, which will inevitably increase the overall financial burden."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.