[Asia Economy Reporter Minji Lee] Korea Investment Trust Management announced on the 13th that it will list the ‘KINDEX KRX Gold Spot ETF’ on the KOSPI market on the 15th. This is the first time a gold spot ETF is being launched in Korea. Unlike futures, this spot ETF can be invested in through retirement pension or Individual Retirement Pension (IRP) accounts.

Existing gold investment ETFs were all derivative-type products investing in gold futures, so they could not be invested in through pension accounts. According to domestic retirement pension supervision regulations, products whose risk evaluation amount from derivative trading exceeds 40% of total assets cannot be invested in through retirement pensions.

The ‘KINDEX KRX Gold Spot ETF’ tracks the KRX Gold Spot Index, which reflects the gold spot price in the KRX Gold Market operated by the Korea Exchange. It is a currency-exposed product that reflects both the gold price and the USD exchange rate against the Korean won on a daily basis. Investors can effectively invest in both gold and USD simultaneously.

Gold, which is accepted and valued worldwide, is considered a representative safe asset. Its value is not impaired even when inflation rises, making it a tool for inflation hedging. It also has a low correlation with other assets such as stocks or bonds, making it essential for asset allocation to reduce portfolio volatility.

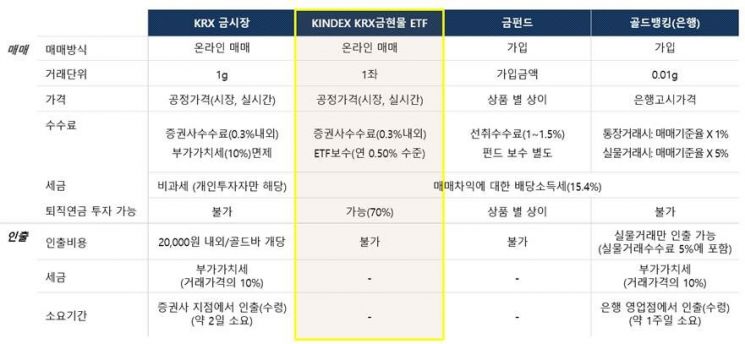

Ways for investors to invest in gold spot include spot trading through the KRX Gold Market, utilizing gold spot ETFs, subscribing to gold funds or gold banking, among others. Capital gains from trading in the KRX Gold Market are not subject to capital gains tax or dividend income tax, offering significant advantages in terms of transaction costs. However, trading gold spot in the KRX Gold Market through retirement pension accounts is not possible, necessitating alternative options.

Jung Sung-in, head of the ETF Strategy Team at Korea Investment Trust Management, explained, “Gold is an indispensable tool in asset allocation strategies that reduce portfolio volatility. We launched the KINDEX KRX Gold Spot ETF to open the way for investment in gold, a representative safe asset and inflation hedge, through retirement pensions.” When investing in ETFs through a general securities account, a 15.4% dividend income tax is applied on trading gains, but investing through pension accounts applies a pension income tax rate of 3.3% to 5.5% at the time of pension receipt.

Korea Investment Trust Management is conducting a unique event to commemorate the first and only gold spot ETF listing in Korea by giving customers pure gold bars. From the 15th to the 28th of next month, customers who hold at least one share of the ‘KINDEX KRX Gold Spot ETF’ and verify their holdings through the event page on the KINDEX ETF website can participate. One first-place winner will be selected by lottery to receive a pure gold bar worth approximately 3 million KRW. Five second-place winners will receive 10g pure gold bars, twenty third-place winners will receive 3.75g pure gold bars, and 500 fourth-place winners will receive Starbucks dessert sets.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.