Shipping and Shipbuilding Industries Hit by Supercycle

Orders Surge but Wages Fall Due to Recession

"Skilled Workers Leaving for Years

New Hires Not Recruited"

Taxi Industry Also Struggles with Labor Shortage

Seoul Drivers Down 31.4% This Year

Mass Exodus to Delivery Platforms

[Asia Economy Reporters Choi Dae-yeol, Kim Bo-kyung, Bu Ae-ri, Lee Ki-min] "Work is increasing, so we need more people, but there is no one to hire." "You can't make money through labor anyway."

A recent prominent trend in the domestic labor market is the increase in industries experiencing intensified mismatches, where both labor shortages and job-seeker shortages occur simultaneously. As the shock of COVID-19 subsides, some industries have clearly recovered, and shipbuilding and shipping industries have seen a significant increase in workload due to a super cycle after several years, but many places are struggling due to a lack of workers.

In particular, in recent years, real estate assets have risen unreasonably sharply, and with frequent news of quick riches sought in volatile markets such as stocks and coins, this trend has intensified. Among the younger generation, the old notion that working earns money is often dismissed as an outdated way of thinking.

Lim Young-tae, head of the Employment Policy Team at the Korea Employers Federation, said, "Not only the MZ generation (Millennials + Generation Z) but also previous generations are changing their perception of workplaces and jobs from a lifelong issue to a 'position' that can be changed whenever an opportunity arises." He added, "Additionally, the problem of university education not responding promptly to industrial environmental changes has compounded the labor mismatch phenomenon."

Hyundai Heavy Industries dock view.

Hyundai Heavy Industries dock view.

They say it's a super cycle... but who will build the ships?

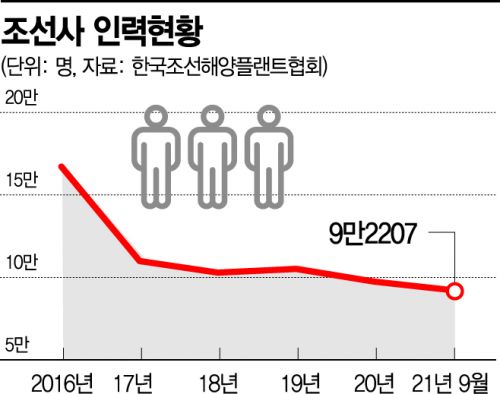

In the industry, the shipbuilding sector, which has seen a workload increase comparable to a 'super cycle,' is complaining about labor shortages as much as the shipping industry. According to Clarkson Research on the 13th, the volume of orders received by domestic shipyards from the beginning of this year to last month was 16.96 million CGT (Compensated Gross Tonnage), similar to the order volume of the previous two years (2019 and 2020).

Considering that shipyards usually secure orders from clients and then start actual construction work about a year later, large-scale manpower should be deployed from the end of this year or the first half of next year. Nevertheless, the difficulty in securing manpower is largely due to the prolonged recession over the past few years, which has lowered wage levels.

A representative from a shipbuilding company in the Yeongnam region said, "The pressure from the primary contractors (large shipbuilders) to reduce unit prices was so strong that many small and medium subcontractors have already disappeared." He added, "Skilled workers have been leaving for years, and new hires have not been replenished, but since the primary contractors have not yet improved profitability, it is not easy to offer wages that meet employees' expectations in the short term."

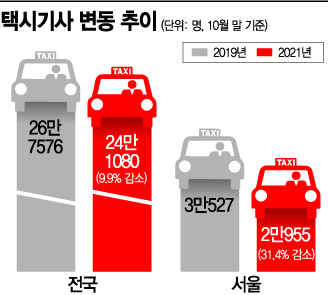

Rising delivery, declining taxis

The taxi industry is also suffering from a shortage of drivers. Seoul City recently partnered with taxi companies to hold its first-ever job fair to recruit drivers. Demand for taxis is overflowing as the year-end gathering season approaches, but the number of drivers operating taxis is rapidly decreasing. According to the National Taxi Transport Business Association Federation, as of October this year, there were 241,080 taxi drivers, about 10% (26,496) fewer than the 267,576 drivers in October 2019 before COVID-19. Especially, the number of corporate taxi drivers in Seoul decreased even more sharply. According to Seoul City, during the same period, the number of corporate taxi drivers dropped from 30,527 to 20,955, a 31.4% decrease.

The taxi driver shortage is due to many taxi drivers leaving for delivery platforms amid prolonged social distancing caused by COVID-19, which made their livelihoods difficult. A taxi industry official said, "Many drivers around me are switching to delivery or quick service platforms." The treatment of drivers also differs significantly. According to the industry, the average wage of taxi drivers is in the low 2 million KRW range, while delivery riders are known to earn as much as 4 to 5 million KRW.

Growing platforms absorb manpower

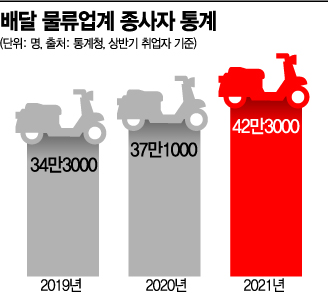

On the other hand, the number of so-called 'gig workers' based on the platform market is increasing. The number of ordinary delivery riders on Baemin Connect, a service of Baedal Minjok, increased from 10,000 in 2019 to 50,000 this year. A delivery industry official said, "Due to the 52-hour workweek system, regular employees who have more time and capacity to work are commonly taking on delivery jobs after work."

The Ministry of Employment and Labor announced last month that the number of platform workers reached 2.2 million, accounting for 8.5% of all employed persons. Nearly half (47.2%) of platform workers are working in their main jobs. They can earn profits by working as much as they want at the times they want, escaping the rigid labor market. This flexible form of labor is possible through short-term contracts or one-time tasks. The increase in gig workers is analyzed as a result of not only the growth of the platform market but also social changes such as valuing individual autonomy and work-life balance culture, minimum wage increases, the 52-hour workweek, and the rise of non-face-to-face transactions.

Gojek Driver Helmet. Gojek started as a motorcycle ride-hailing service in Indonesia and is known to have over 2 million delivery personnel.

Gojek Driver Helmet. Gojek started as a motorcycle ride-hailing service in Indonesia and is known to have over 2 million delivery personnel. The increase in platform workers has become a global trend as the industrial environment changes. In February, the International Labour Organization (ILO) surveyed 12,000 platform workers in 100 countries and estimated that web-based platform labor has tripled and location-based labor such as food delivery has increased more than tenfold over the past decade.

Team leader Lim said, "The rapid increase in the value of financial assets such as stocks and cryptocurrencies compared to earned income also influenced the atmosphere of labor shortages." He added, "Moreover, as the COVID-19 recession prolonged, many workers flocked to gig economy jobs like delivery app riders that allow working at desired times, further intensifying the situation."

He said, "To change workers' perceptions of industries and jobs, companies and universities should collaborate to create related contract departments in shipbuilding, semiconductors, displays, etc., and provide systematic support. Employment flexibility should also be secured by bridging wage gaps between large and small companies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.