Ahead of Next Year's Regulations, Flood of Supply

Advantages Include Easy Transactions in Large Complexes and Price Defense

As the year-end approaches, large-scale complexes are being launched nationwide, creating an unprecedented sales battle. This is unusual considering that the December sales market is typically classified as an off-season. With loan regulations set to tighten further next year and the uncertainty increasing ahead of the major political event of the presidential election, construction companies appear to be rushing to sell before the market declines.

According to real estate research firm Realtoday on the 10th, the total number of apartments supplied nationwide this month reaches about 72,000 units. This includes pre-sale, newlywed hope town, and rental units, but excludes non-residential products such as officetels. Among these, general sale units also reach about 63,000 units.

Based on general sale units, the metropolitan area accounts for 25,542 units (40.8%), while the provinces account for 37,016 units (59.2%). The region with the largest supply is Gyeonggi-do, with 16,545 units (26.4%) across 22 complexes. This is followed by Gyeongbuk with 9,862 units (8 complexes, 15.8%), Incheon with 8,162 units (8 complexes, 13%), and Gyeongnam with 4,324 units (6 complexes, 6.9%).

The reason behind this year-end sales boom, which defies the December cold wave, is attributed to regulatory impacts. From next year, balance payment loans will also be included in the borrower's total debt service ratio (DSR) calculation. The government announced in its household debt management plan released last October that from January next year, DSR regulations will apply to individuals with total loans exceeding 200 million KRW, and from July, those exceeding 100 million KRW. Additionally, from next year, complexes that issue a resident recruitment announcement and sell will have balance payment loans included in the DSR regulation. An industry insider said, "Due to concerns about demand contraction caused by loan regulations, construction companies are rushing to sell within this year."

However, as warnings arise that the market has reached a turning point, experts advise against 'blind subscription.' Careful financial planning and consideration of price increases after sales are necessary. Experts particularly point out that if the market outlook is uncertain, one should first examine the size of the complex. Large-scale complexes tend to defend prices better even in a declining market compared to smaller complexes.

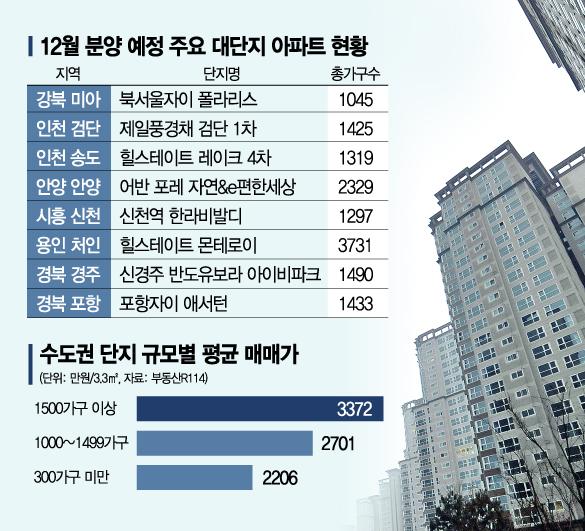

When a large complex is developed, infrastructure such as transportation networks, schools, green spaces, and commercial areas are evenly established, greatly improving the overall infrastructure. Also, with a larger number of households, transactions are easier and price assessment is more advantageous. In fact, large-scale complexes tend to have higher average prices. According to Real Estate R114, as of last month, the average apartment price per 3.3㎡ in the metropolitan area was highest for complexes with over 1,500 households at 33.72 million KRW. Compared to complexes with fewer than 300 households (22.06 million KRW), this is about 52% higher. Complexes with 1,000 to 1,499 households averaged around 27.01 million KRW.

Another advantage of large-scale complexes is the ability to save on fixed costs such as maintenance fees. According to the Apartment Management Information System, as of September, the maintenance fee for complexes with over 1,000 households in the metropolitan area was 1,164 KRW per ㎡, which is more than 20% cheaper than the 1,487 KRW for small complexes (150-229 households).

Year-end sales of large complexes with over 1,000 households are mainly concentrated in the metropolitan area. Jeil Construction plans to sell ‘Jeil Punggyeongchae Geomdan 1st Phase’ in Geomdan New Town, Incheon. It consists of 1,425 units with exclusive areas of 84 and 111㎡. Hyundai Construction is preparing to sell ‘Hillstate Monteroi’ in Yongin, with 3,731 units (exclusive areas 59-185㎡). The consortium of Gyeonggi Housing and Urban Corporation and DL E&C plans to sell ‘Anyang Urban Foret Jayeon & e-Pyeonhansesang’ (2,329 units) in Anyang. In Seoul, GS Construction will sell ‘Buk Seoul Xi Polaris,’ a complex of 1,045 units, in Mia-dong, Gangbuk-gu. In the provinces, Hanwha Construction will sell ‘Hanwha Forena Cheonan Nota?’ with 1,608 units in Cheonan, Chungnam. Bando Construction plans to sell ‘Shin Gyeongju Bando Yubora Ivy Park’ with 1,490 units in Gyeongju, Gyeongbuk.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.