Financial Trends

[Sejong=Asia Economy Reporter Son Seon-hee] As of the end of October, the progress rate of national tax revenue was reported to be close to 100%. With two months remaining until the end of the year, the government has virtually achieved its annual national tax revenue target. There are also forecasts that the annual excess tax revenue may exceed the government's estimate (19 trillion won).

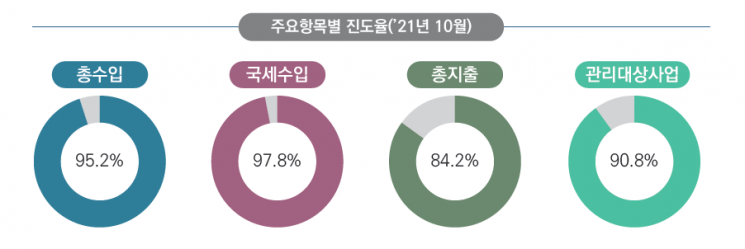

According to the fiscal trend announced by the Ministry of Economy and Finance on the 9th, national tax revenue from January to October this year totaled 307.4 trillion won, an increase of 53.7 trillion won compared to the same period last year. The progress rate compared to the annual national tax revenue forecast (314.3 trillion won) presented during the second supplementary budget is 97.8%.

Looking at national tax revenue for October alone, it decreased by 6.2 trillion won compared to the same month last year, marking the first monthly decrease this year. This is due to tax support measures for small business owners affected by quarantine measures amid the COVID-19 pandemic. To ease the burden on individual business owners in restricted sectors, the government deferred the payment of value-added tax originally due in October to January next year. The payment deadline for the installment of corporate tax prepayments for small and medium-sized enterprises was also extended from October to January next year.

Nevertheless, thanks to the continued economic recovery, all three major tax categories?income tax, corporate tax, and value-added tax?increased compared to last year. In particular, corporate tax and value-added tax have already exceeded a progress rate of 100%. Corporate tax collected up to October amounted to 67.3 trillion won, showing a progress rate of 102.6%, and value-added tax also collected 71.9 trillion won, with a progress rate of 103.6%. These represent increases of 14.4 trillion won and 5.8 trillion won respectively compared to last year.

Income tax reached 96.3 trillion won by October, with a progress rate of 96.8%. The main factors are the continued boom in the asset market and an increase in the number of employed persons, which led to higher capital gains and earned income taxes.

Fund revenue also reached 158.6 trillion won by October, recording a progress rate of 92.7% compared to the supplementary budget. This is the highest level since monthly statistics on fund revenue began in 2011. With employment recovery, the number of social insurance subscribers such as national pension and employment insurance increased, resulting in related revenue of 64.7 trillion won, a 5% increase compared to last year (61.5 trillion won).

Total expenditure up to October was 509.2 trillion won, an increase of 40.7 trillion won compared to the same period last year. The progress rate was similar to last year's at 84.2%.

With both national tax and fund revenues increasing, the integrated fiscal balance deficit narrowed to 19.3 trillion won. Compared to last year’s deficit of 59 trillion won, this represents a reduction of nearly 40 trillion won. If this tax revenue improvement trend continues, the year-end deficit is expected to improve significantly compared to the government’s forecast (90.3 trillion won deficit).

As of October, central government debt stood at 939.6 trillion won, including 841.9 trillion won in treasury bonds, 82.9 trillion won in housing bonds, and 11.7 trillion won in foreign exchange stabilization bonds.

Deputy Minister of Economy and Finance Ahn Do-geol stated, "The integrated fiscal balance deficit has been reduced to about one-third compared to the previous year," and added, "With a reduction of 2.5 trillion won in treasury bond issuance using excess tax revenue, national debt is expected to decrease by a total of 6.2 trillion won this year." He also emphasized, "In a situation where economic improvement is affected by global supply chain disruptions and the spread of COVID-19 variants, the role of fiscal policy must continue to support achieving the growth rate target."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.