Economic Uncertainty Grows, Only 31% Invested in Q1-Q3 This Year

Facility Investment Index Also Negative Consecutively

Companies Turning Eyes Overseas

[Asia Economy Reporter Jang Sehee]#1. Domestic Company A, which produces semiconductors, is not considering large-scale domestic investments such as expansion. This is because they judged that uncertainties are very high due to external risks such as the global supply chain and the US-China conflict, as well as various regulations and political events like the presidential election overlapping. A company official said, "We have no choice but to approach large-scale investment decisions such as expansion conservatively."

#2. The same situation applies to Company B, a construction company. A representative of Company B stated, "The rise in raw material prices is also a burden, but we have to wait and see how the new government's social overhead capital (SOC) investment policy will change next year, so we can only remain cautious."

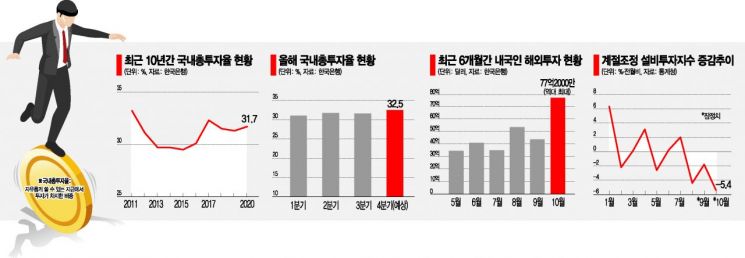

◆Will the investment trend that lasted for a year and a half break?= Domestic investment is on the verge of declining again after one year. Despite the COVID-19 situation last year, the gross domestic investment rate was 31.7% last year, up 0.4 percentage points from 2019, but this year, it slightly decreased to 31.6% in the third quarter compared to the previous quarter.

The gross investment rate is an indicator calculated by including all investment elements such as construction investment, facility investment, intellectual property product investment, and changes in inventory. If a company has 1 million won of freely available funds, it means that 310,000 won was spent on investment.

To exceed last year's annual investment rate (31.7%), the remaining fourth quarter must show 32.5% or higher.

Recent sluggish investment is interpreted as a result of a combination of domestic and international factors. Global risks such as the spread of the Omicron variant, global supply chain issues, and rising raw material prices, as well as various regulations that suppress corporate management, have made companies hesitant to invest. However, considering that overseas investment by domestic companies recorded an all-time high until October this year, it seems that domestic risks have had a greater impact on investment sentiment than external risks.

The government and the ruling party have pushed forward with policies such as raising the minimum wage and introducing the 52-hour workweek despite opposition from the business community. This year, the Serious Accidents Punishment Act was also passed and is set to be implemented early next year. The current administration's pro-labor policies have negatively affected corporate investment.

The relatively lower tax incentives for investment compared to other countries are also cited as a reason for sluggish domestic investment. Professor Andonghyun of Seoul National University's Department of Economics stated, "Investment incentives such as tax benefits are less than those overseas, and policy uncertainty is very high." He believes that companies are expanding overseas considering tax benefits depending on the industry.

For this reason, there is growing consensus that it will be difficult for investment to increase significantly in the fourth quarter of this year. Looking at the facility investment index, it decreased for three consecutive months: -4.4% in August, -1.8% (provisional) in September, and -5.4% (provisional) in October.

A Bank of Korea official explained, "Due to external risks, construction investment and facility investment are still in a poor state," adding, "In the case of construction investment, it can rise somewhat through fiscal execution." This means that aside from artificially boosting investment through the year-end execution of SOC projects, there is no way to stimulate the private sector to exceed last year's investment scale.

◆If domestic investment decreases, jobs will also 'plummet'= A decline in domestic investment negatively affects the virtuous cycle of economic growth. The chain of increased production and consumption through investment, leading to reinvestment, could be broken.

Professor Lee Inho of Seoul National University's Department of Economics said, "Investment is an indicator that shows predictions about the future economy," adding, "If both production and employment do not increase, it becomes difficult to create a virtuous economic ecosystem." Professor Hong Woohyeong of Hansung University's Department of Economics said, "When corporate investment decreases, labor demand also decreases," and "Ultimately, the biggest problem is the reduction of jobs." If companies do not invest to increase production, it is also difficult to create private employment. He also noted, "Facility investment decisions are made with a view of several years ahead, and companies do not seem to expect the economy and investment conditions to improve."

There are also opinions that corporate investment conditions need to be reexamined. The Bank of Korea previously stated in 'Key Characteristics and Effects of Overseas Direct Investment' that "To prevent industrial hollowing out caused by local market entry of manufacturing production systems, it is desirable to realize support for the return of overseas companies to Korea," and "Policy efforts are needed to support market diversification for small and medium-sized manufacturing companies operating overseas."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.