Baemin Users Decrease by 6% Over Three Months

Coupang Eats Grows 20% and Yogiyo Recovers to 8 Million Users

The ‘delivery three-way battle’ among Baedal Minjok (Baemin), Yogiyo, and Coupang Eats is intensifying once again. Until now, Baemin had been far ahead, while second-place Yogiyo had faltered amid processes such as its sale, allowing Coupang Eats, which emphasized ‘single-order delivery’ where one delivery rider handles one order, to chase the leading group. However, after Yogiyo was acquired by a consortium including GS Retail and completed its reorganization, Coupang Eats’ offensive has grown stronger, changing the dynamics. Baemin has also quickly built a single-order delivery service network to defend its market position, but the gap with second and third place is steadily narrowing. With delivery demand continuing to rise due to special quarantine measures, competition is expected to become even fiercer.

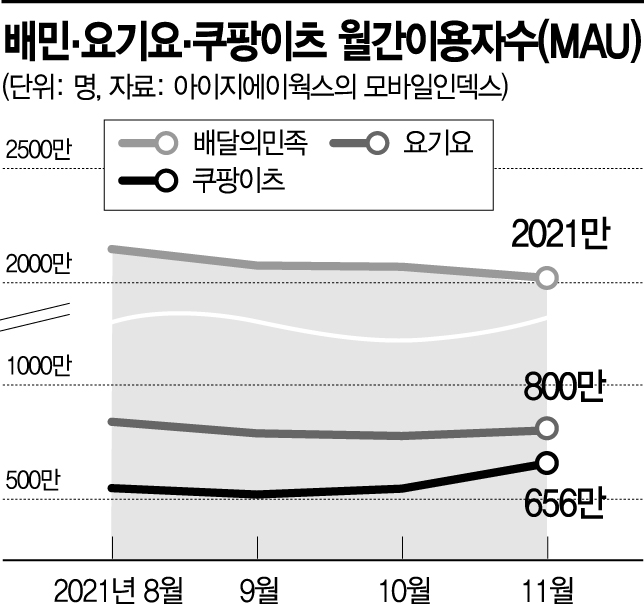

According to Mobile Index by data company IGAWorks on the 7th, last month’s monthly active users (MAU) of Baemin, Yogiyo, and Coupang Eats on Android and iPhone (iOS) smartphones were 20.21 million, 8.01 million, and 6.56 million respectively. Baemin’s users increased to 21.48 million in August this year when the full-scale single-order delivery battle began, but have since shown a slight decline for three consecutive months. Over these three months, 1.26 million users were lost, representing a 6% decrease.

Meanwhile, Coupang Eats’ users increased by 20% during the same period. After recording 5.48 million users in August, the single-order delivery competition intensified, causing a slight drop in September, but steady growth was maintained in October and November. Coupang Eats’ user growth graph, which had been suppressed by Baemin’s single-order delivery offensive, returned to its main trajectory within a month. Yogiyo also recorded 8.38 million users in August, declined afterward, but recovered to the 8 million range in November after launching a new subscription service and intensifying marketing.

In a situation where Baemin can no longer be confident of a solo run, the three companies are neck and neck in the user acquisition race. Especially with large-scale discount events and volume offensives approaching year-end, industry consensus is that it is difficult to predict how the market landscape will change. Baemin is actively defending its market position by, among other measures, piloting an extension of delivery hours for its single-order delivery service ‘Baemin1’ until 2 a.m. in a total of 26 administrative districts, including 23 districts in Seoul, Gwangmyeong-si, Uijeongbu-si, and Hanam-si.

The three-way battle among delivery apps extends beyond service competition to securing delivery riders. Sufficient delivery rider recruitment is necessary to handle the increased orders at year-end and maintain service quality. This is why each delivery platform is focusing on improving delivery riders’ compensation and treatment. An industry insider said, “The delivery market shows a clear ‘multi-homing’ tendency where users selectively choose apps depending on various discounts and promotions. With delivery orders increasing toward year-end, competition among companies to capture users will become even more intense.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)