Single-Homeowners' Breathing Room Tightens in Geumjeong... "Legislative Use Raises Distrust in Real Estate Policy" Criticism Also Raised

[Asia Economy Reporter Kim Min-young] With the ruling party and government raising the capital gains tax exemption threshold for single-home households, the tax burden on disposing of houses priced over 900 million KRW and up to 1.2 billion KRW, as well as high-priced home owners, is expected to significantly decrease. However, while this measure has a positive aspect of easing the burden for single-home owners, there are also criticisms that it has only increased distrust in real estate policies by being a law amendment aimed at winning votes.

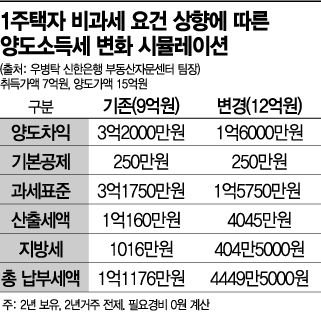

Asia Economy requested Woo Byung-tak, head of the Real Estate Advisory Center at Shinhan Bank, on the 6th to estimate the capital gains tax burden for a single-home owner who bought a house for 700 million KRW, met the 2-year residence and 2-year holding requirements respectively, and then sold it for 1.5 billion KRW. The result showed that the tax burden would be reduced to less than half.

According to the simulation, applying the current exemption threshold of 900 million KRW requires a total payment of 111.76 million KRW. Among the 800 million KRW capital gain, the taxable capital gain is 320 million KRW, and the amount after deducting the basic exemption (2.5 million KRW) is taxed at a 40% rate. However, if the exemption threshold is raised to 1.2 billion KRW, the taxable capital gain decreases to 160 million KRW (tax rate applied at 38%), and the capital gains tax payable drops to 44.495 million KRW. This results in a tax saving effect of as much as 67 million KRW. Under the current Income Tax Act, when calculating capital gains tax for a single-home household, the taxable capital gain is calculated by subtracting the basic exemption and long-term holding special deduction from the capital gain, and then the capital gains tax is determined by multiplying the tax base by a rate of 6 to 45%.

If Mr. A held the house for more than 3 years and received a 20% long-term holding special deduction, the tax burden would be further reduced. Applying the current exemption threshold of 900 million KRW, Mr. A would have to pay 84.623 million KRW in capital gains tax, whereas if the threshold is raised to 1.2 billion KRW, he would only need to pay 31.9275 million KRW. The minimum long-term holding special deduction rate is 20%, which applies to those who have held for 3 years (12%) and resided for 2 years (8%).

Meanwhile, as the ruling party and government decided to advance the application date of the revised capital gains tax exemption threshold from January 1 next year to mid-this month, homeowners are generally postponing transactions or trying to align the payment date with the enforcement date. Mr. B, who was scheduled to complete a house sale by the end of this month, said, "The payment date is on the 28th of this month, and I am anxiously wondering if I can receive the capital gains tax exemption benefit within this month," adding, "Depending on the capital gains tax, the amount of money in hand differs by tens of millions of KRW, so I am considering adjusting the payment date according to the enforcement date of the capital gains tax exemption threshold revision."

However, in the market, despite this measure, the heavy capital gains tax on multiple-home owners remains in place, and excessive loan regulations continue, so it is difficult to expect a rapid increase in supply. Additionally, as the government and ruling party completely reversed their policies ahead of the election, criticism is mounting that real estate taxes are being used politically to gain votes.

Seo Jin-hyung, president of the Korea Real Estate Society (professor at Gyeongin Women's University), said, "This is not a policy improvement for the people but a political use of legislation that only causes confusion in the real estate market," adding, "It has only fueled conflicts among people about to engage in housing transactions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.