Targeting Credit and Jeonse Loan Funds, etc.

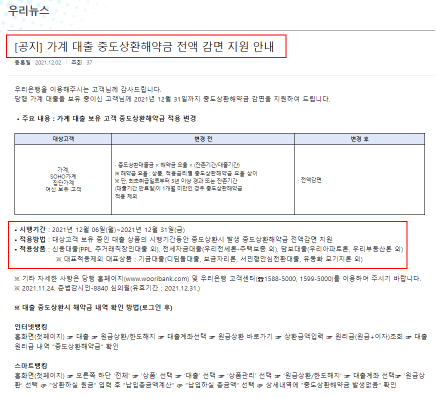

[Asia Economy Reporter Kim Jin-ho] Woori Bank announced on the 6th that it will waive the prepayment penalty in full until the 31st to alleviate the repayment burden on household loan customers.

The applicable targets are credit loans (credit loans for employees of excellent contracted companies, main workplace employee loans, etc.) and jeonse deposit loans (Woori Jeonse Loan, housing guarantee, etc.). ▲Didimdol Loan ▲Bogeumjari Loan ▲Saemin-type Safe Conversion Loan ▲Securitized Mortgage Loan and other fund loans are excluded.

The waiver of the prepayment penalty is a measure taken in the context of total household loan volume management. It is a way to encourage repayment by resolving the inconvenience of customers who cannot repay due to fees even if they have extra money, while also reducing the interest burden on loan customers.

Woori Bank's prepayment penalty waiver is the third after NongHyup Bank and Industrial Bank of Korea. Earlier, NongHyup Bank announced on October 28th that it would waive fees in full for partial or full repayment of household loans until the end of this month. Industrial Bank of Korea also decided to reduce the prepayment penalty by 50% until March next year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.