Steel Negotiations Settled and Initiated with EU and Japan Who Filed WTO Complaint Against US

No Negotiation Started Yet with Korea, Balancing US-China

Golden Time Before First Half of Next Year... Without Agreement, Price Competitiveness Drops and US Market Benefits Lost

"Korea Must Actively Cooperate in US's China Containment Strategy"

[Sejong=Asia Economy Reporter Kwon Haeyoung] It has been confirmed that the United States has allowed an annual 3% increase in tariff-free import volumes through a steel agreement with the European Union (EU). Earlier, the U.S. settled a steel tariff dispute with the EU last month, and upon reviewing the specific terms of the agreement, it turned out to be more favorable than expected. Since the U.S. has also started negotiations with Japan, concerns are rising that if South Korea does not hurry to enter negotiations, the price competitiveness of Korean steel companies in the U.S. market will further decline. In particular, despite domestic large corporations announcing a massive investment plan worth 40 trillion won in the U.S. at the Korea-U.S. summit in May, there are considerable criticisms that the government’s failure to secure even a steel agreement with the U.S., falling behind the EU and Japan, is problematic.

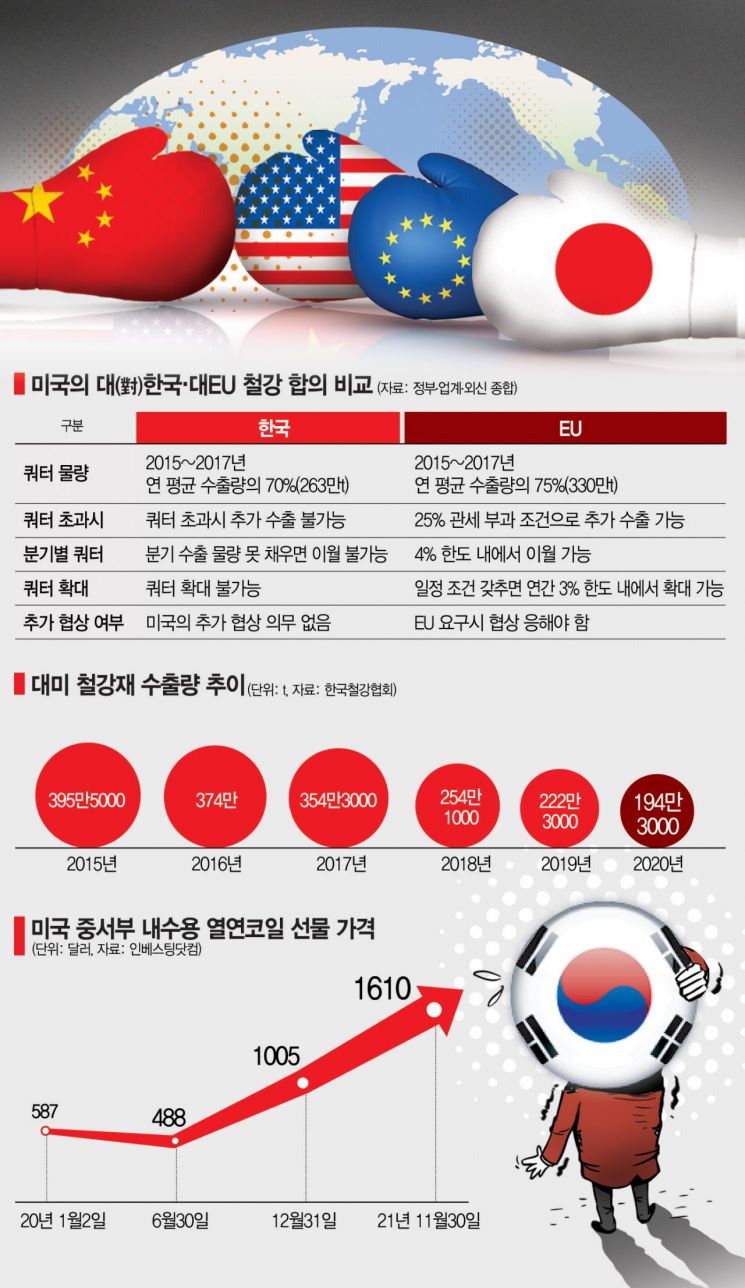

◆ To the EU: "Tariff-free quota expanded by 3% annually, volume rollover allowed"=According to related industries on the 2nd, under the steel dispute agreement with the U.S., the EU can expand its tariff-free export quota to the U.S. by 3% annually if certain conditions such as market conditions are met.

Previously, the Trump administration imposed tariffs and export quota restrictions on foreign steel including from South Korea, the EU, and Japan based on Section 232 of the Trade Expansion Act in 2018. The U.S. and the EU settled their steel tariff dispute last month. Compared to the existing Korea-U.S. steel agreement, the EU’s export conditions to the U.S. are much more favorable.

According to the U.S.-EU steel agreement, the EU can export 75% (3.3 million tons annually) of the average export volume from 2015 to 2017 tariff-free, and this quota can be increased or decreased depending on circumstances. Even if the quota is exceeded, exports can continue without volume restrictions but with a 25% tariff imposed.

On the other hand, South Korea receives a tariff-free quota of 70% (2.63 million tons annually) of the average export volume from 2015 to 2017, which is 5 percentage points lower than the EU. Additionally, no additional exports are allowed beyond the quota, and there is no possibility of quota expansion.

The EU can rollover up to 4% of unused quota to the next quarter if it fails to meet the quarterly quota, which is also not possible for South Korea. Another difference is that the U.S. must enter additional negotiations if the EU requests, but there is no such negotiation obligation with South Korea.

A steel industry official said, "With steel prices soaring due to increased steel demand in the U.S., it is expected that the U.S. will settle steel disputes with Japan under similar conditions as with the EU," adding, "If South Korea fails to reach a steel agreement at a level similar to that of the U.S.’s allies, the EU and Japan, the competitiveness of Korean steel companies in the U.S. market will inevitably decline."

◆ 'Anti-China alliance' EU and Japan enjoy U.S. steel benefits... South Korea, caught between U.S. and China, only watching the negotiation golden time tick away=There are considerable concerns inside and outside the government that the U.S. may lack the will to negotiate steel disputes with South Korea, unlike with the EU and Japan. The U.S. government is strengthening its encirclement of China across economic and security sectors including supply chains, and the recent steel dispute agreements and negotiation initiations with the EU and Japan are part of this China containment strategy. U.S. President Joe Biden described the steel tariff dispute agreement with the EU as a measure to restrict "dirty Chinese steel." The rationale is that China is not making carbon reduction efforts and is causing oversupply, and the U.S. intends to block other countries from processing and exporting Chinese steel.

The U.S.-EU steel agreement includes the term "non-market," and the U.S.-Japan steel agreement initiation document includes the term "China." South Korea, which has maintained an ambiguous stance between the U.S. and China, may face a decline in the U.S.’s willingness to negotiate, and there is also analysis that the South Korean government feels burdened to explicitly mention China when entering steel dispute negotiations with the U.S.

Although Korea-U.S. steel dispute negotiations have not even started, there is a widespread view that the first half of next year is the "golden time" for negotiations. Trade experts point out, "South Korea will be unsettled due to the March presidential election next year, and the U.S. may be more passive in negotiations fearing loss of votes from manufacturing workers ahead of the November midterm elections," adding, "The Korea-U.S. steel dispute negotiations must be completed before the first half of next year."

In the U.S., there are also many opinions that Section 232 steel tariffs need to be eased, especially for industries such as automobiles. According to Investing.com, the price of hot-rolled coil futures for domestic use in the U.S. Midwest surged from $488 per ton at the end of June 2020 to $1,610 per ton as of November 30 this year, more than tripling in a year and a half. Consequently, the operating profit margin of major U.S. steel companies in the second quarter reached the 30% range, nearly double that of POSCO (17.3%). With steel demand soaring and steel prices skyrocketing, demand companies inevitably face heavy burdens, leading to calls for increased imports.

To resolve the Korea-U.S. steel issue, it is suggested that South Korea should cooperate more actively with the U.S.’s China containment strategy. Professor Jeong In-gyo of Inha University’s Department of International Trade said, "While the EU and Japan, actively participating in the U.S.’s China containment efforts, have reached steel dispute agreements, South Korea, which maintains an ambiguous stance of 'not fully aligning with the U.S. nor China,' has failed to secure even a steel agreement," emphasizing, "As economic damages become real amid escalating U.S.-China conflicts, the South Korean government must actively join the U.S.’s moves."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.