Hana Financial Investment Report

[Asia Economy Reporter Minji Lee] Although concerns about economic slowdown are growing due to the spread of the 'Omicron' variant, an analysis suggests that if the fatality rate remains low, it will not be a factor hindering the pace of interest rate hikes.

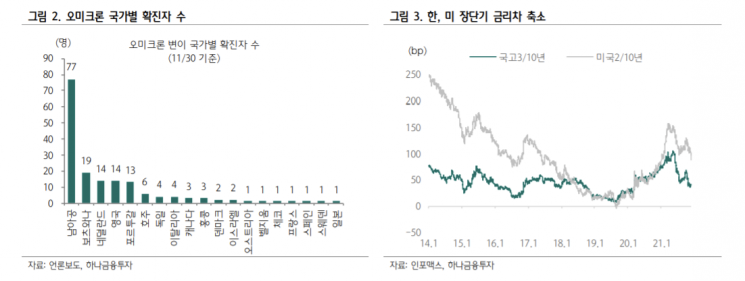

According to the financial investment industry on the 2nd, amid concerns over the spread of the Omicron variant, the US 10-year Treasury yield fell sharply by about 20 basis points to 1.45% over the week, and the 3-year and 10-year Korean government bond yields also dropped by 19bp and 21bp respectively. Currently, Federal Reserve (Fed) Chair Jerome Powell has stated that he will discuss whether it is appropriate to accelerate the end of asset purchases at the December FOMC meeting, viewing this as a time to move away from describing inflation as temporary. This statement has led the market to believe that the number of rate hikes next year may increase due to accelerated tapering. Researcher Miseon Lee of Hana Financial Investment explained, “The spread of Omicron not only affects the slowdown in growth but also worsens labor shortages and supply chain issues, increasing inflationary pressures,” adding, “From the Fed’s perspective, it will not be easy to delay the normalization of monetary policy.”

To determine whether the Bank of Korea will change the pace of interest rate hikes, it is necessary to assess the extent of restrictions on economic activities and the real GDP contraction caused by the Omicron outbreak. Considering past cases of the Delta variant, strict restrictions on movement and business hours directly impacted the domestic economy but had little effect on curbing the spread. Given the upcoming presidential election in March next year, the likelihood of repeated strong measures restricting economic activities is low. Especially if the fatality rate of Omicron is low, it is expected not to affect the pace of base rate hikes. Researcher Lee said, “Although growth expectations may be somewhat lowered, if the fatality rate is low, concerns will ease, and bond yields will rebound mainly in the short-term segment.”

It is anticipated that, as with previous variant outbreaks, interest rates will sharply decline initially as growth expectations fall, then concerns will ease with the introduction of vaccines, and discussions on base rate hikes will begin. Researcher Miseon Lee analyzed, “However, if government measures or worsening global supply chain issues cause next year’s economic growth rate to fall below the mid-2% range annually and fail to close the GDP gap, confidence in additional rate hikes in the second half after the first quarter will weaken, leading to a decline in yields across all maturities, with long-term yields falling more sharply and the yield curve flattening.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.