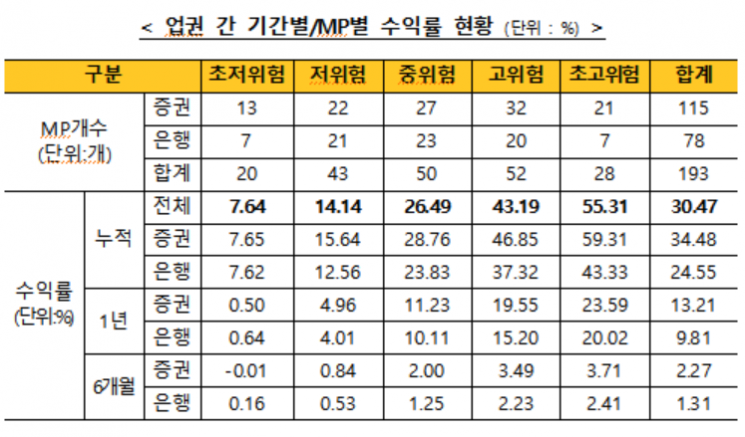

[Asia Economy Reporter Minji Lee] The Korea Financial Investment Association announced on the 30th that the cumulative return of discretionary Individual Savings Account (ISA) model portfolios (MP) as of the end of October this year was recorded at an average of 30.47%. This is a 0.52 percentage point increase from the cumulative return of 29.95% at the end of September.

An official from the Korea Financial Investment Association stated, "The global stock markets experienced adjustments due to inflation concerns, but rebounded mainly in the U.S. last month supported by solid corporate earnings, leading to an increase in the cumulative return of discretionary ISA."

By risk type, the returns were 55.31% for ultra-high risk, 43.19% for high risk, 29.49% for medium risk, 14.14% for low risk, and 7.64% for ultra-low risk. Since launch, out of a total of 193 MPs, about 84%, or 162 MPs, recorded returns exceeding 10%.

The average cumulative return by company ranked Meritz Securities first with 41.19%. This was followed by Daishin Securities (39.15%), Kiwoom Securities (38.5%), and KB Securities (37.98%). Among individual MPs, Kiwoom Securities’ Basic Investment Type (ultra-high risk) topped the list with a cumulative return of 120.49%.

Looking at the top companies by risk type, in the high-risk category, Hyundai Motor Securities’ 'Income Seeking Type A2 (Developed Countries Type)' MP, which invests 100% in overseas equity funds, achieved a return of 92.63% since launch. In the medium-risk category, NH Investment & Securities’ 'QV Neutral A' MP, investing 29% in overseas equity funds, 18.8% in domestic bond funds, and 16.2% in MMFs, recorded a return of 38.84% since launch. In the low-risk category, Daishin Securities’ ‘Global Low-Risk Wrap’ MP, investing 24.8% in overseas equity funds, 24.7% in overseas bond funds, and 24% in RP, achieved a return of 22.49% since launch.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.