Determining Whether Vaccine Neutralization Occurs

Triggers Full-Scale Panic Selling in Stock Markets

Spread in Asia Region Also a Key Factor

On the 29th, when the KOSPI started lower due to fears of the Omicron variant of COVID-19, the dealing room of Hana Bank in Jung-gu, Seoul was seen. On that day, the KOSPI opened at 2,906.15, down 30.29 points (1.03%). The won-dollar exchange rate opened at 1,195.5 won, up 2.2 won. Photo by Kim Hyun-min kimhyun81@

On the 29th, when the KOSPI started lower due to fears of the Omicron variant of COVID-19, the dealing room of Hana Bank in Jung-gu, Seoul was seen. On that day, the KOSPI opened at 2,906.15, down 30.29 points (1.03%). The won-dollar exchange rate opened at 1,195.5 won, up 2.2 won. Photo by Kim Hyun-min kimhyun81@

[Asia Economy Reporter Junho Hwang] Will the ‘Omicron Panic Sell’ come? As the new COVID-19 variant Omicron spreads rapidly, anxiety has swept over the stock market. While panic selling has already begun in the U.S. and European stock markets, there are forecasts that this impact will spread to South Korea as well. On the other hand, there are also opinions that it is necessary to shake off this sudden anxiety.

Panic Sell Approaches

On the 26th, panic selling had already started in major stock markets such as the U.S. The U.S. stock market fell more than 2%. France and Germany also dropped more than 4%. In Asia, Japan’s Nikkei (-2.53%) and Hong Kong’s Hang Seng Index (-2.7%) showed similar situations.

In South Korea’s case, due to the impact of the previous day’s base interest rate hike, the effect of Omicron was less reflected, resulting in only a 1.5% decline. As of 9:59 a.m. on the 29th, the KOSPI recorded 2,916.15, down 0.69%. This is considered a relatively strong performance compared to other global advanced stock markets.

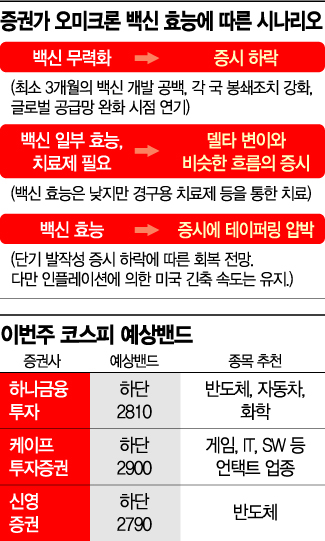

However, the possibility of panic selling occurring in the domestic stock market is also being raised. Soeun Ahn, a researcher at KB Securities, explained, "If the existing vaccines are ineffective against the Omicron variant, there will be a vaccine gap of at least about three months until a vaccine targeting the Omicron variant is developed," adding, "During this period, regardless of the vaccination completion rate, lockdown measures are likely to be strengthened." Jaeman Lee, a researcher at Hana Financial Investment, predicted, "When the Delta variant appeared, the KOSPI fell 7% from its peak," and "Based on this, the expected KOSPI bottom next month is estimated at 2,810."

In the worst case, if Omicron’s transmissibility and severity are confirmed to be high and it spreads to the Asian region, panic selling could become an inevitable sequence. Sangyoung Seo, a researcher at Mirae Asset Securities, warned, "We need to continuously monitor whether it spreads to Southeast Asia and China because it could affect supply chain issues," adding, "If such a worst-case scenario occurs, panic selling could expand."

Need to Shake Off Sudden Anxiety

There are also opinions cautioning against excessive pessimism. First, the U.S. stock market decline occurred during the Thanksgiving holiday period when only the morning session was open, reflecting the actions of a small number of market participants, so it should be viewed differently. Also, Pfizer, a U.S. pharmaceutical company, has started developing a booster shot to respond to Omicron, and Johnson & Johnson and AstraZeneca have obtained variant samples to review their vaccines. Additionally, it is important to note that in South Africa, there are opinions that Omicron symptoms are mild.

Jiyoung Han, a researcher at Kiwoom Securities, analyzed, "It is true that this is a short-term uncertainty factor, but it is not an event that will disrupt the existing market trajectory," adding, "Considering that major governments implemented full lockdowns during the COVID-19 pandemic in March last year, facing the risk of permanent economic damage, it is judged that governments will not implement full lockdowns this time."

Soyeon Park, a researcher at ShinYoung Securities, said, "Although the financial market showed a sharp decline on Friday due to the spread of Omicron, which is several times more infectious than the existing virus, a bigger problem is inflation (leading to early tapering)," adding, "There are vaccines and treatments for variants, but there is no cure for inflation."

Kyoungmin Lee, a researcher at Daishin Securities, forecasted, "There will be short-term shocks, but as the reality of Omicron is confirmed, a technical rebound is possible supported by interest rate stabilization and expectations of a U.S. monetary policy retreat," while also noting, "Looking further ahead, concerns remain in the market about the delay in easing global supply chain bottlenecks due to a surge in confirmed cases, so a time will come when the gap between expectations and reality must be narrowed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.