Betting on Future ICT Industry Blockchain and Metaverse as the First Investment Destination

[Asia Economy Reporter Seulgina Cho] SK Square, which spun off from SK Telecom as an investment specialist company, is investing approximately 90 billion KRW in the virtual asset exchange Korbit, becoming the second-largest shareholder. It is also acquiring a 40% stake in Onmind, a company possessing 3D digital human production technology. By selecting blockchain and metaverse as its first investment destinations after the spin-off, this move is seen as a step to secure a leading position in future ICT fields.

On the 29th, SK Square announced that it chose Korbit, Korea’s first virtual asset exchange, and Onmind, a subsidiary of Kakao affiliate Neptune, as its first investment targets simultaneously with its re-listing on the Korea Composite Stock Price Index (KOSPI).

◆ Becoming Korbit’s Second-Largest Shareholder... Full-Scale Launch of Metaverse Business

First, SK Square will invest about 90 billion KRW in Korbit to acquire approximately 35% of its shares, becoming the second-largest shareholder after the largest shareholder NXC. Korbit is the second virtual asset operator in Korea to complete registration with the Financial Intelligence Unit under the amended Enforcement Decree of the Act on Reporting and Using Specified Financial Transaction Information, and is one of the four major domestic virtual asset exchanges that allow KRW trading alongside Upbit. It is also affiliated with Nexon, one of Korea’s largest game companies.

SK Square expects that simply holding shares in Korbit will increase its net asset value. The scale of domestic virtual asset trading has already grown rapidly to surpass the KOSPI. From January to September this year, the cumulative domestic virtual asset trading volume was about 3,584 trillion KRW, exceeding the KOSPI trading volume by more than 450 trillion KRW during the same period.

In particular, SK Square made the investment in Korbit to secure a leading position in the ICT Next Platform area, which can bring social innovation. The virtual asset exchange business is now entering the institutional legalization stage and is expected to become a key pillar of innovative platform businesses in the future.

SK Square and Korbit plan to use this investment as an opportunity to enhance services so that more virtual asset investors can obtain accurate and reliable investment information and trade safely. Through this, a stable growth foundation is expected to be established not only for the virtual asset trading market but also for related derivative industries.

There is also great synergy expected from the metaverse business collaboration with Korbit.

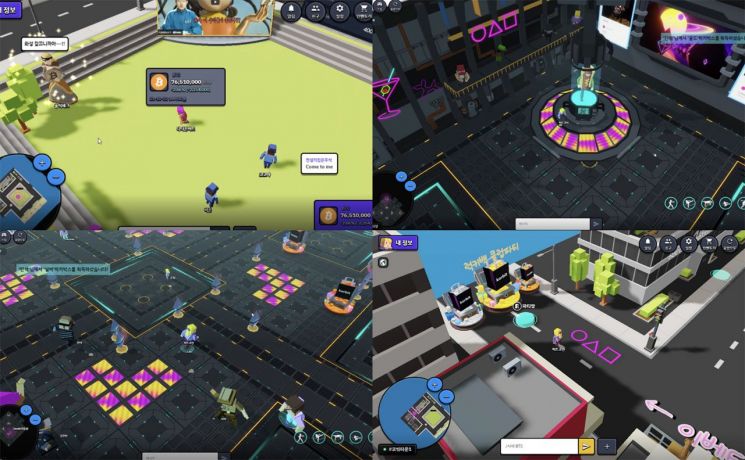

In addition to virtual asset trading services, Korbit operates an NFT (Non-Fungible Token) trading market and the metaverse virtual asset exchange ‘Korbit Town.’ This business model enables the construction of an innovative metaverse ecosystem by linking with SK’s metaverse platform Ifland, content platforms FLO and WAVE, and app market One Store.

For example, by linking Ifland and Korbit Town’s metaverse-virtual asset exchange, Ifland users will be able to easily purchase or trade virtual goods. It will also be possible to conveniently purchase and own virtual assets created based on the intellectual property (IP) of content owned by WAVE, FLO, and One Store through the NFT trading market.

Cooperation to expand Korbit’s core virtual asset exchange business will also be strengthened. By introducing SK’s phone number-based integrated login service and DID (Decentralized Identifiers)-based simple authentication service, an environment will be built where investors can safely and conveniently use Korbit anytime. Promotions through various marketing channels such as SK’s T Membership and T Universe will also be expanded.

◆ Acquisition of 40% Stake in Onmind... Producer of Digital Human ‘SUA’

SK Square decided to invest 8 billion KRW in Onmind, a 3D digital human production company affiliated with Kakao, acquiring a 40% stake (including common shares and convertible preferred shares).

Onmind, established in April 2020, is an unlisted company incorporated as a subsidiary of Neptune under Kakao Games in November of the same year. Based on its proprietary 3D digital human implementation technology and real-time rendering technology, it is expanding partnerships and cooperation with global top companies in the graphics field such as Unity and AMD. Its parent company, Neptune, is a company leading the diversification of future-oriented businesses in the gaming industry, including e-sports, MCN (Multi Channel Network), metaverse, and digital humans.

The 3D digital human ‘SUA’ produced by Onmind is rapidly emerging as a new metaverse celebrity, signing an advertising model contract with Unity Korea. Since most digital humans are implemented in 2D, Onmind’s 3D method, which goes a step further, is receiving significant attention in the industry.

SK Square expects that the investment in Onmind will create great business synergy with metaverse platform Ifland and content platforms FLO and WAVE, similar to Korbit. For example, digital human technology can be used to implement more realistic avatars on the metaverse platform Ifland or to create attractive virtual influencers.

Moreover, by combining the music and OTT platforms of FLO and WAVE with Onmind’s digital humans, high profits can be expected in the entertainment business. It is feasible to create digital human celebrities and nurture them as popular artists through FLO and WAVE.

Since exchanging shares worth 300 billion KRW with Kakao in 2019, SK has maintained a strategic partnership. This year, the alliance has expanded to the metaverse field following several cooperative achievements, including the establishment of a 20 billion KRW ESG joint fund and joint development of a large-scale AI model (GPT-3).

◆ SK Square Investment Marks a New Starting Point for the ‘SK Metaverse Ecosystem’

The background of this investment is the judgment that it is necessary to create ecosystems for blockchain and metaverse and to secure a leading position in future ICT fields that will become part of and an extension of daily life. This is why SK Square’s investment is seen as placing the SK metaverse ecosystem at a new starting point.

SK Square’s blueprint is to solidify the metaverse ecosystem by integrating Korbit’s virtual asset exchange, NFT trading market, and metaverse exchange with Onmind’s 3D digital human technology, encompassing SK’s existing platforms such as Ifland, FLO, WAVE, and One Store.

Additionally, within this metaverse ecosystem, they are considering creating an economic system where users can trade various virtual goods such as avatars, virtual spaces, music, and videos, and linking it with the virtual asset exchange to enable users to cash out virtual goods anytime.

Yoon Poong-young, CIO of SK Square, stated, “SK Square will continue to invest in ICT areas that lead future innovation, such as blockchain and metaverse, and will become an attractive investment specialist company.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.