Outstanding Balance of Technology Finance Loans at 310.9 Trillion KRW by the End of September

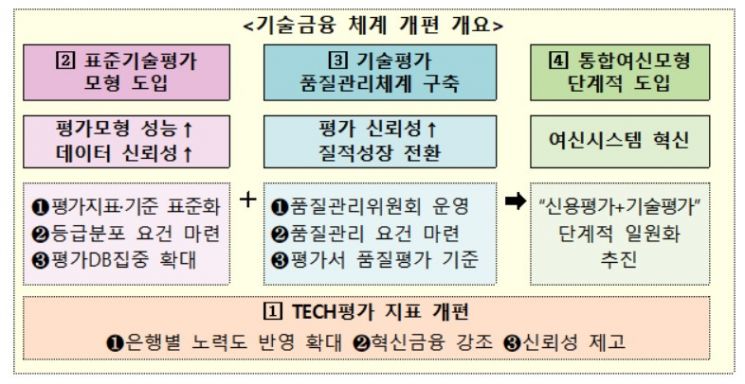

[Asia Economy Reporter Park Sun-mi] Financial authorities are revamping the system by reorganizing the performance evaluation indicators for technology finance and standardizing evaluation items and criteria to activate technology finance in the banking sector.

On the 28th, the Financial Services Commission announced that it will evaluate the technology finance performance indicators focusing on the growth rate of technology finance performance so that banks that have somewhat delayed the promotion of technology finance can have their efforts reflected. In addition, it plans to expand indicators related to intellectual property rights (IP) and the New Deal to induce the expansion of innovative financial supply. The new evaluation indicators will be applied starting from the evaluation of performance in the first half of next year.

In response to some criticisms that evaluation indicators and criteria differ by evaluation agencies such as TCB (Technology Credit Rating) and banks, resulting in a lack of consistency, the financial sector will develop a standard technology evaluation model through IT development starting January next year to enhance the reliability of the technology evaluation system. Considering default discrimination power, 28 important indicators will be set as standard items, and evaluation criteria will also be standardized. Evaluation basis data by institution will be centralized at the New Credit Information Center and continuously used for future model improvements.

Since maintaining the quality of technology evaluation is essential to sustaining the reliability of the technology finance system, from January next year, quality management of technology evaluation reports by banks and TCB will also be conducted. The Quality Management Committee (operated by the New Credit Information Center), composed of industry experts, will objectively review the quality of technology evaluations semiannually, and incentives will be differentially provided including result disclosure according to the evaluation quality review results (excellent, average, insufficient).

Furthermore, in the mid to long term, the technology evaluation will be internalized into the credit system so that having ‘technological capability’ can improve the ‘credit rating.’ The integrated credit model will be promoted step-by-step in three stages.

The balance of technology finance loans has shown a high growth trend of more than 40 trillion KRW annually, increasing from 205.5 trillion KRW at the end of 2019 to 266.9 trillion KRW at the end of 2020, and 310.9 trillion KRW as of the end of September this year, establishing itself as a new credit practice. Since its introduction in 2014, technology finance has quantitatively expanded significantly by supplying funds to small and medium enterprises with high technological capability and future growth potential through the efforts of all banks.

Technology finance has shown practical effects in terms of interest rates and limits, pure credit loans, and support for promising technology sectors and startup companies. Compared to the average interest rate of general SME loans, the interest rate is 0.14 percentage points lower, and the limit is also expanded by an average of 220 million KRW. Funds are actively supplied not only to companies in promising technology sectors such as semiconductors and energy but also to startup companies with relatively weak collateral and creditworthiness.

Meanwhile, to continuously expand funding focused on technology and innovation, the financial authorities evaluated the technology finance performance of banks semiannually. Among large banks in the first half of this year, Industrial Bank of Korea and Hana Bank were rated excellent, and among small banks, Gyeongnam Bank and Busan Bank were rated excellent. Industrial Bank of Korea continued to expand technology credit loans mainly through IP-backed loans, and Gyeongnam Bank maintained its top position among small banks by focusing on movable collateral loans and technology-based investments.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.