[Samsung's Decision on US Semiconductor Investment]

Announces Record-High Investment This Year

LG Energy Solution Considers Additional Factory

SK and Ford to Build Two More Joint Factories

[Asia Economy Reporter Choi Dae-yeol] The pace of investment by South Korean companies, including Samsung Electronics, in the United States is accelerating. This is the result of the reconstruction plans initiated under former President Donald Trump and continued by the current Joe Biden administration becoming more concrete, aligning with the interests of Korean companies competing on the global stage, particularly in advanced IT and eco-friendly business models.

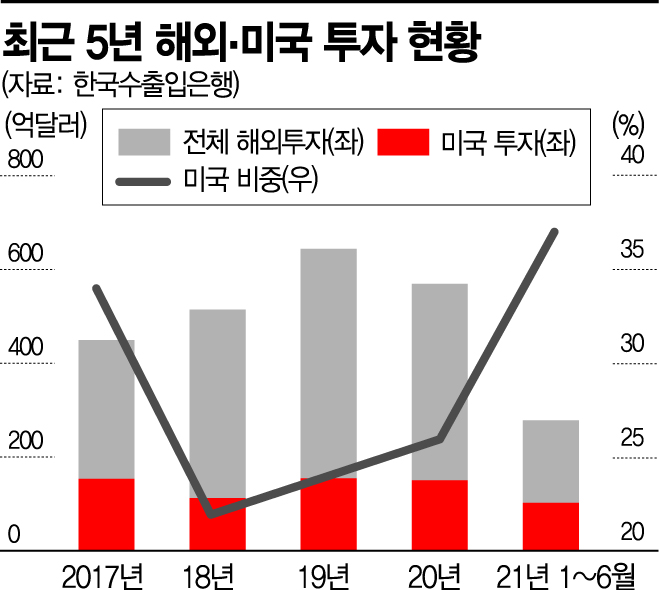

According to the Export-Import Bank of Korea on the 24th, South Korea's investment in the U.S. amounted to $10.281 billion in the first half of this year. Local investments, which had slowed due to COVID-19, are gradually picking up speed, and it is expected that by the end of the year, the record high of 2019 ($15.42 billion) will be surpassed.

Alongside semiconductor investments centered on Samsung and SK, battery investments are also active. LG Energy Solution has finalized two joint factories with General Motors (GM) and one joint factory with Stellantis, and is considering building one or two additional independent factories. SK, which established electric vehicle battery plants in Georgia over the past two to three years, has decided to build two more joint factories with Ford.

Samsung SDI is also forming a joint venture with Stellantis. The top three U.S. automakers have all partnered with Korean battery companies. Batteries, along with semiconductors, are sectors that President Biden has instructed to review supply chains, recognizing the need to secure domestic supply chains from an economic security perspective. From a corporate standpoint, since battery production facilities in the U.S. are insufficient, direct local investment is seen as the best way to increase market share.

Andy Beshear, Governor of Kentucky, USA, is speaking at an event announcing the joint factory investment plan between SK and Ford last September.

Andy Beshear, Governor of Kentucky, USA, is speaking at an event announcing the joint factory investment plan between SK and Ford last September. They are also actively entering the energy sector. As new power sources like hydrogen gain attention and the share of renewable energy such as solar and wind increases, the paradigm surrounding the energy industry is completely changing. Domestic companies’ investments tend to focus on acquiring related technologies or environmentally friendly fields with high growth potential. Plug Power, acquired by SK earlier this year, is a company competitive in hydrogen utilization technologies such as water electrolysis and plans to expand its business not only in the U.S. but globally.

PSM, a U.S. power equipment company acquired by Hanwha Impact (formerly Hanwha Total Petrochemical), is noted for its hydrogen co-firing technology using existing gas turbines. Hydrogen co-firing is a facility that allows mixing hydrogen with existing natural gas equipment, which can immediately increase utilization at low cost, and the industry expects demand to grow during the energy transition process.

SK E&S has invested $600 million over the next two to three years to acquire Key Capture Energy, a grid solutions company. This business links energy storage systems (ESS) with AI technology to compensate for the instability of renewable energy power supply, and it is a field expected to see significant growth not only in the U.S. but worldwide.

SK E&S's acquired US grid solution company Key Capture Energy (KCE) operates an energy storage system (ESS) facility in Texas

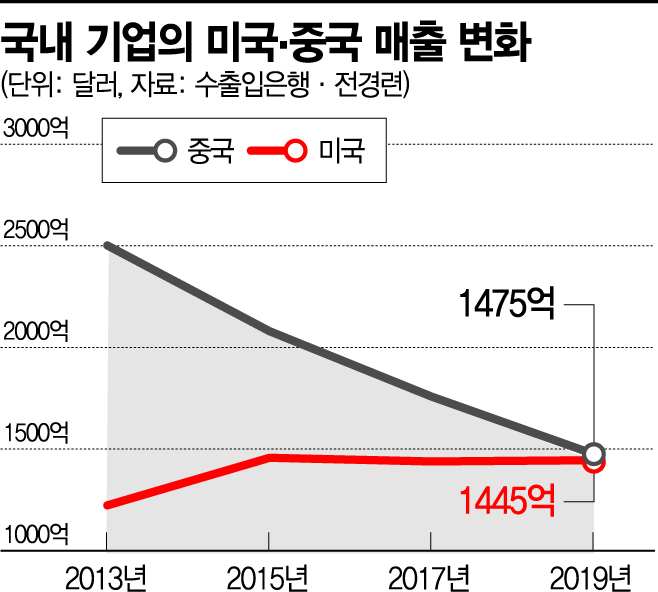

SK E&S's acquired US grid solution company Key Capture Energy (KCE) operates an energy storage system (ESS) facility in Texas China is geographically close and has an economic structure centered on manufacturing that aligns well with South Korea’s, making it the largest country in terms of trade and workforce scale. However, recent trends show the U.S. is re-emerging. According to an analysis by the Federation of Korean Industries (FKI) of South Korea’s exports and investments in the U.S. and China, exports to China increased by about 7% over the past five years compared to the previous five years, while exports to the U.S. increased by 18% during the same period.

South Korean companies’ overseas investments have also seen the U.S. rise to the top since 2017, widening the gap. As of the first half of the year, the U.S. accounted for 37% of total overseas investments, an 11 percentage point increase from the previous year. An analysis of sales from 20 to 30 companies operating in both the U.S. and China by the FKI estimated that sales in the U.S. surpassed those in China last year.

Kim Bong-man, head of international cooperation at the FKI, said, "The Biden administration is strongly driving the reconstruction of supply chains for key items based on America First policies, so direct investment and exports to the U.S. are likely to increase further."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.