National Tax Collection Act Amendment Bill Submitted to the National Assembly

Banking Sector "Reducing Branches..." Complexity

[Asia Economy Reporter Kiho Sung] As the political sphere pushes for national tax payments via simple payment methods such as Naver Pay and Kakao Pay, the banking sector is expressing mixed feelings. Since local taxes are already paid through these payment platforms, the likelihood of national tax payments being approved is high. Banks, which need to reduce the number of branches despite concerns about losing customers, have little ground to oppose this.

According to the National Assembly on the 23rd, Yoon Kwan-seok, a member of the Democratic Party of Korea, recently took the lead in proposing a partial amendment to the National Tax Collection Act reflecting this content. Yoon stated, "Including prepaid electronic payment methods as a means of payment for national taxes or compulsory collection fees will enhance taxpayer convenience and contribute to encouraging sincere payment of national taxes."

Currently, local taxes can be paid via simple payment methods. The fintech industry, through business agreements with the Ministry of the Interior and Safety, local governments, and the Korea Financial Telecommunications & Clearings Institute, has been sending local tax bills for 17 metropolitan local governments since July 2019. This system notifies users of various local taxes such as property tax and resident tax, as well as traffic fines and penalties, through the platform and allows payment via simple payment methods. This is why the possibility of passing national tax payments via simple payment methods is gaining traction.

Recently, prepaid electronic payment methods based on mobile applications have seen a surge in average daily usage amounts, increasing more than sevenfold from 65.9 billion KRW in 2017 to 467.6 billion KRW last year. According to Nasmedia, as of the end of last year, domestic simple payment usage rates reached 73.8% for Naver Pay and 68.8% for Kakao Pay.

The fintech and banking industries have opposing views on national tax payments via simple payment methods. The fintech sector, which sees a high likelihood of approval, welcomes it as a way to attract customers. A representative from the Korea Fintech Industry Association said, "This legislation appropriately reflects changes in payment methods from the perspective of user convenience in tax payments," adding, "The association actively welcomes it." On the other hand, the banking sector argues that enabling tax payments via simple payment methods raises concerns about customer attrition. A banking official explained, "Typically, tax collection at branches takes between 15 to 30 minutes. Tax collection at branches should be viewed not as a profit-making activity but as part of customer service."

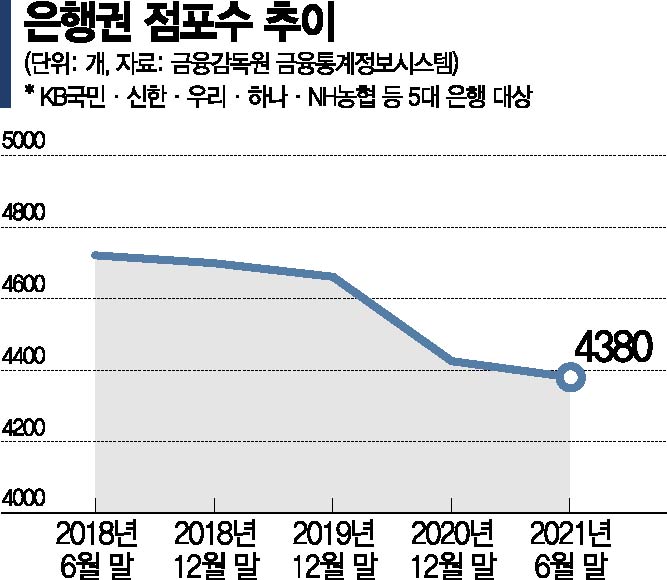

The issue is that banks, which need to slim down branches due to the acceleration of non-face-to-face services, have been reducing branches recently, making outright opposition difficult. According to the Financial Supervisory Service’s Financial Statistics Information System, the number of branches of the five major banks?KB Kookmin, Shinhan, Woori, Hana, and NH Nonghyup?remained similar from 4,699 at the end of 2018 to 4,661 at the end of 2019. However, with the spread of COVID-19 last year, there was a sharp decline. The number dropped by 236 to 4,425 at the end of last year and further shrank to 4,380 as of the end of June this year.

Banks are actively encouraging tax payments via mobile banking. KB Kookmin Bank recently revamped its mobile app to provide a button that allows users to move directly from local tax bill notification content to the payment screen.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.