Recent Art Investment Method Among MZ Generation: 'Jogak Investment'

Lee Ufan's 'From Line' Ownership Divided into 790,000 Shares

1,576 Buyers... Free Viewing and Sales of Artwork Possible

Rapid Increase in Platform Investment Firms Since 2018 Introduction

Famous Artist's Work Achieves 600% Return in 48 Days

"Not a Quasi-Financial Investment but a New Alternative Investment Method"

Kim Hyungjun, CEO of Tessa, "Must Carefully Review Transaction Details"

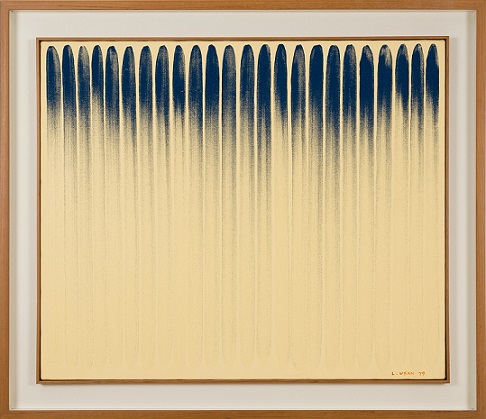

Tessa's 'From Line' (1979) by Lee Ufan, which was fully sold out through a public offering on the 19th.

Tessa's 'From Line' (1979) by Lee Ufan, which was fully sold out through a public offering on the 19th.

[Asia Economy Reporter Donghyun Choi] As art prices have recently soared to unprecedented levels, 'art fractional investment' is emerging as a new investment method. With small amounts, investors can own and freely trade high-priced artworks by famous artists such as Marc Chagall, Andy Warhol, and Keith Haring, making it popular among the MZ generation (Millennials + Generation Z) who are highly interested in 'ArtTech' (art + finance). As the investment accessibility is easier than galleries or auction markets, platforms attracting fractional investments are rapidly growing.

Own and Appreciate Masterpieces for the Price of Coffee

Art investment platform TESSA conducted fractional investment in a domestic artist's work on the 19th. The artwork was ‘From Line’ (1979), a representative piece by Lee Ufan, a master of Dansaekhwa (monochrome painting), with a public offering price of 790 million KRW. The ownership was divided into 790,000 shares by splitting the artwork into 1/1000 fractions, and the public offering was conducted. The minimum investment amount was only 1,000 KRW. The artwork sold out in less than a day after the offering began. Except for the 15,800 shares held by TESSA itself, all 774,200 shares were sold to 1,576 investors.

What can investor A, who bought just three shares of ‘From Line’ for the price of a 3,000 KRW coffee, do? First, if they want to see the artwork in person, they can visit TESSA’s permanent gallery ‘Untitled’ in Sangsu-dong, Seongdong-gu, Seoul. Viewing is free with ownership of even one share. Owners can also sell their shares on the market like stocks. For example, the ‘The Cure’ (2014) series by British contemporary artist Damien Hirst, which TESSA offered and sold out in February, had a public offering price of 1,000 KRW per share but currently has a market price 20% higher at 1,200 KRW.

Fractional Investment Heats Up... Competitors Springing Up

Art fractional investment was first attempted in Korea in October 2018 when Art & Guide introduced Kim Whanki’s ‘Sanwol’ (1963). Since then, various platform companies such as TESSA, Art Together, Pica Project, and Daily Museum have emerged. Seoul Auction also launched a fractional investment platform called SOTWO through its subsidiary Seoul Auction Blue this year.

Since launching its fractional investment service, Art & Guide has conducted fractional investments worth approximately 21.2 billion KRW (109 cases) over about three years. On Art & Guide, investors can participate in fractional investments ranging from 10,000 KRW to as much as 10 million KRW depending on the artwork price. The platform owns and manages the physical artworks, and when prices rise to a certain level, it sells the works and distributes profits to shareholders. Art & Guide has sold 64 artworks it has offered so far and paid about 7 billion KRW to investors. The average holding period is 303 days, with an average return rate of 35.4%.

The more popular the artist, the faster the platform liquidates the artwork, resulting in good liquidity. Art & Guide offered Moon Hyungtae’s ‘Diamond’ (2017), which has recently attracted attention from the MZ generation, at 3 million KRW on July 28 and sold it for 21 million KRW on September 14. The return rate achieved in just 48 days was 600%, which annualized amounts to an astonishing 4,563%. The monochrome master Park Seo-bo’s ‘Myobeop’ (2018) also started a joint purchase at 350 million KRW in April and sold for 500 million KRW, recording a 42.9% return in 56 days. An industry insider said, “Public offerings of popular artists’ works close within minutes of opening,” adding, “Among the MZ generation, word of mouth spreads quickly, and for artists nearing the end of their lives, scarcity accelerates the process of achieving target returns and liquidation.”

"Not a Similar Financial Investment Business but a New Type of Alternative Investment"

As fractional investment gains popularity, some in the financial sector have recently raised concerns about potential violations of the Capital Markets Act by platform companies, calling for regulation. They argue that the method of raising funds from unspecified many and distributing profits resembles collective investment contracts requiring prior approval under the Capital Markets Act. However, the industry has rebutted this as a misinterpretation.

Kim Hyungjun, CEO of TESSA, who founded the company in April last year and has been operating the fractional investment service for 1 year and 7 months, said, “Investment contract securities collect funds from many to purchase assets, but fractional investment is a structure where the company pre-purchases artworks and resells them to many.” He added, “Investors’ deposits are also managed separately in segregated accounts.” He further explained, “If the physical artwork is lost or damaged, investors may suffer losses, but in such cases, the purchase price at the time of the offering plus a 10% profit is guaranteed,” adding, “Separate insurance is also subscribed for the artworks.”

CEO Kim expects the market to grow further as the entry speed of the MZ generation into fractional investment is explosively increasing. However, he advised investors to carefully examine the investment stability of artworks before deciding. He said, “It is important to check how recognized the artist and artwork are and how many times they have been traded in auctions or markets,” adding, “For novice investors, it may be a good strategy to choose blue-chip artists with auction histories of at least 100 times a year.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)