Chinese Consumers Enthusiastic About Luxury Over Cost-Effectiveness

Dependence Increases While Total Sales Remain Stagnant

[Asia Economy Reporter Lee Seung-jin] Although the domestic cosmetics industry achieved record-breaking sales during China’s largest shopping festival, the “Guanggun Festival (November 11),” their expressions are far from cheerful. While sales of premium products surged significantly, sales of mid-range products?which had been a solid pillar in the Chinese market?are declining.

Smiles Faded Despite Record Sales at China’s Guanggun Festival

According to the beauty industry on the 17th, Amorepacific’s Sulwhasoo Jaumsaeng Essence sales during this year’s Guanggun Festival increased by 325% compared to the previous year, and sales of the entire Sulwhasoo product line rose by 83%. LG Household & Health Care also recorded sales of 370 billion KRW for the Whoo product line during the festival, marking approximately 42% growth year-on-year. Although this represents a recovery of K-beauty performance to pre-COVID-19 levels, the overall situation in the Chinese market is different. Mid-range cosmetics, which had solid sales to the extent that people said “If it’s K-beauty, it will definitely sell,” are being pushed out by domestic brands, causing a rapid polarization in the Chinese beauty market.

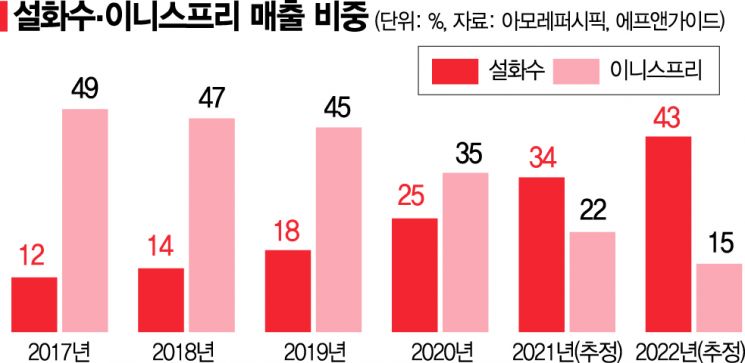

Amorepacific’s mid-range brand Innisfree is a representative example. Innisfree’s sales in China once accounted for nearly 50% of Amorepacific’s total sales, but this year it is expected to drop to 22%, and further down to 15% next year. Conversely, Sulwhasoo’s sales share is expected to surpass Innisfree for the first time this year at 34%, and expand to 43% next year. LG Household & Health Care’s Whoo product line also increased its share of total Chinese sales to 60% this year. Only premium products like Sulwhasoo and Whoo are selling briskly, while mid-range product sales continue to decline.

Impact of ‘Patriotic Consumption’ and ‘Luxury Preference’

The position of mid-range K-beauty products continues to shrink. The older generation in China focuses on “Guochao (patriotic consumption),” while the emerging mainstream consumer group, the “Jiulinghou (born after 1990),” exhibits consumption patterns centered on luxury brands. Additionally, the Chinese government’s regulatory measures to protect domestic cosmetics businesses are negatively affecting the mid-range K-beauty market.

Since implementing the Cosmetics Supervision and Administration Regulations in January, the Chinese government has amended or enacted related laws 12 times, threatening K-beauty companies. Recently, based on the “Measures to Strengthen the Management of Disorderly Fandom,” restrictions have been placed even on celebrity advertisements, causing difficulties for small and medium-sized cosmetics companies that rely on fandoms of Korean Wave stars as their main marketing channel.

A cosmetics industry official said, “While luxury brands maintain high growth, mid-range brands are experiencing sharp sales declines, indicating serious polarization in the Chinese cosmetics market,” adding, “We are re-examining our China business strategy as a response to the ultra-premium market that targets younger generations.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)