2021 KDI Second Half Economic Outlook

[Sejong=Asia Economy Reporter Son Seon-hee] The Korea Development Institute (KDI) projected South Korea's economic growth rate for 2022 at 3.0%. It forecasted that domestic demand will begin to recover in earnest from next year and advised that fiscal policies aimed at economic stimulus should be gradually scaled back. Additionally, it mentioned the 'China risk' arising from the recent shortage of urea solution and the slowdown in China's economic growth.

According to the '2021 Second Half Economic Outlook' released by KDI on the 11th, KDI maintained its economic growth forecast for next year at 3.0%, the same as the projection made in the first half of the year. This is slightly higher than the Organization for Economic Cooperation and Development (OECD) forecast of 2.9%, but 0.3 percentage points lower than the International Monetary Fund (IMF) forecast of 3.3%. The economic growth rate for this year was revised upward by 0.2 percentage points from the previous forecast of 3.8% to 4.0%.

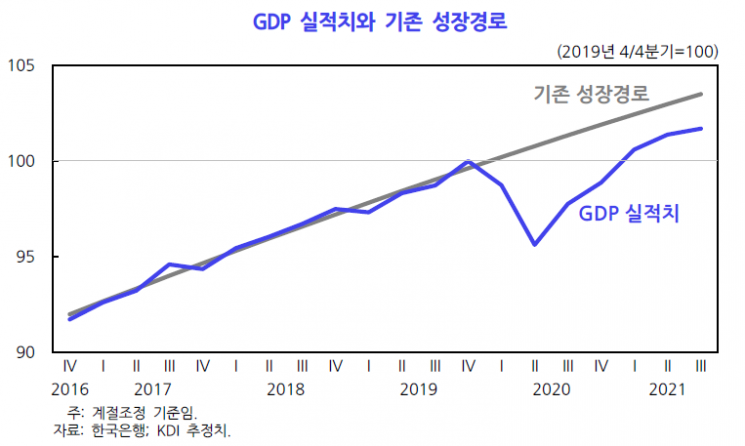

Heo Jin-wook, head of KDI's Economic Outlook Division, described the current economic situation as follows: "The economy is recovering moderately, but recently the recovery has somewhat stalled due to the resurgence of COVID-19 and global supply chain disruptions," adding, "The gap from the previous growth trajectory has also slightly widened again."

He continued, "The weakening global economic recovery, rising raw material prices, and logistics disruptions are also constraining the recovery of our economy's exports and investments," and analyzed, "Despite strong growth in semiconductors, exports of goods are slowing down mainly due to contraction in automobiles caused by parts supply shortages."

Nevertheless, Heo stated, "Considering the overall domestic and international economic conditions, we judge that the economy will continue to recover, especially in the service sector, despite increased external risks in manufacturing," and added, "Based on widespread vaccination, the transition of the quarantine system to a phased return to normal life has created conditions for a rapid rebound in private consumption, centered on face-to-face service industries."

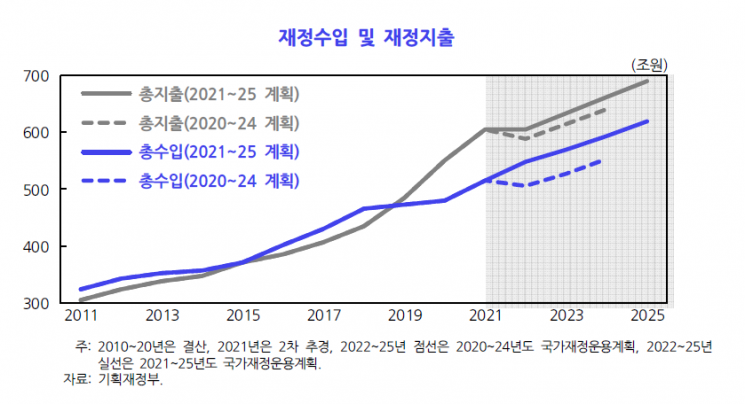

In particular, Heo emphasized fiscal policy, saying, "It is desirable to gradually reduce the measures taken for economic stimulus and focus support on vulnerable groups that were severely impacted by the COVID-19 crisis." Regarding monetary and financial policies, he added, "It is necessary to gradually normalize the accommodative policy stance to reduce financial instability caused by the rapid increase in private debt."

KDI forecasted a 3.0% growth rate for the domestic economy next year, assuming international oil prices will hover around $70 per barrel. Based on this, it predicted that the consumer price inflation rate next year will be around 1.7%.

As an external risk factor, KDI pointed to the 'China risk.' Heo expressed concern, saying, "If the imbalance in raw material prices and logistics disruptions prolong, or if the growth of the China-centered global economy slows down, the recovery of our economy could be delayed," and warned, "If China's power shortages and corporate liquidity crises worsen, negative impacts could spread to our economy, which is highly dependent on exports to China."

He also added that if the recent prolonged shortage of urea solution continues, it could exert considerable downward pressure on the Korean economy.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.