35.12% Change Compared to IPO Price

Giant Step Rises 943.10%

[Asia Economy Reporter Song Hwajeong] As the IPO boom continues with a rush of listings this year, setting record-breaking public offering achievements, rookie stocks have also shown favorable returns.

According to the Korea Exchange on the 11th, among 111 newly listed stocks this year, 102 rookie stocks with a public offering price (excluding split listings, relistings, etc.) showed an average price change rate of 35.12% compared to their offering price. Among them, 67 stocks currently trade above their offering price, while 35 stocks are below.

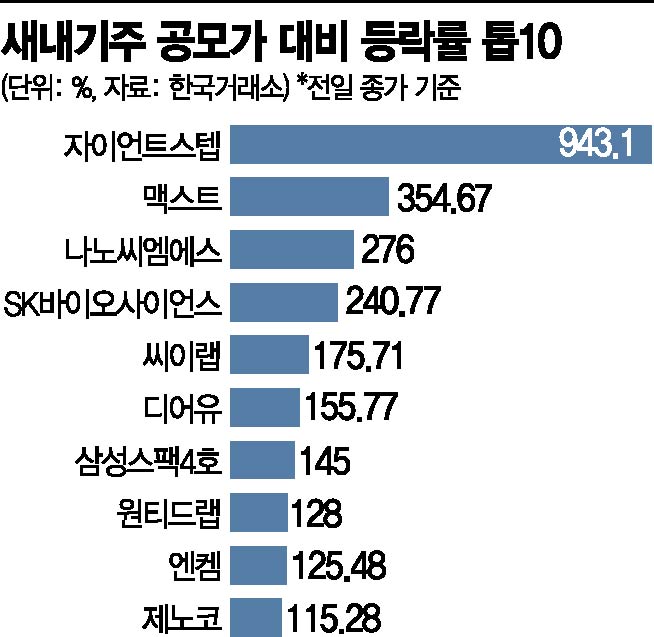

The stock with the largest increase was Giantstep, rising 943.10% compared to its offering price. Following were Maxst (354.67%), Nano CMS (276%), SK Bioscience (240.77%), CE Lab (175.71%), DearU (155.77%), Samsung SPAC 4 (145%), Wanted Lab (128%), Enchem (125.48%), Genoco (115.28%), and PNH Tech (104.44%), all more than doubling their offering price.

On the other hand, Jin System fell the most, dropping 47% compared to its offering price, followed by Hancom Lifecare (-44.53%), S&D (-40.36%), Geninus (-39.25%), and C&T Seongjin (-39.22%), showing significant declines.

Among the highly anticipated major stocks this year, SK Bioscience recorded the largest increase, while Hyundai Heavy Industries rose 85%, Kakao Pay 67.22%, SK IE Technology 53.55%, and Kakao Bank 50.26%, all significantly outperforming the average change rate. Conversely, Krafton fell 2.71%.

As the stock market has recently shown weakness, the performance of public offering stocks has somewhat stalled, with clear differentiation among individual stocks. For example, GeoElement and IT Eyes, which were listed simultaneously, showed contrasting trends as of 9:30 AM: GeoElement rose 17% from its opening price, while IT Eyes declined 22.38%. Both companies set their opening prices at twice their offering prices, 20,000 KRW and 28,600 KRW respectively. Similarly, DearU and Bitnine, listed the previous day, showed divergent performances on their first day: Bitnine fell 25.25% from its opening price, whereas DearU rose 27.88%. Researcher Park Jongseon of Eugene Investment & Securities said, "In the first half of this year, almost all stocks' offering prices were set at the upper end of the expected band, but last month, it was split evenly. General investors are aggressively investing in promising stocks and decisively avoiding others, so this selective trend among stocks is expected to continue into the second half of the year and next year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.