Shinsegae Department Store Q3 Sales Record High with 15% Growth

Hyundai and Lotte Also Recover to Pre-COVID Levels

Top 5 Fashion Sales Reach 1.5529 Trillion Won, Up 22% Year-on-Year

The distribution and fashion industries, which were the hardest hit by COVID-19, saw a strong rebound in the third quarter. The long-delayed consumer sentiment exploded into 'revenge spending,' leading the three major department stores to recover their sales and operating profits to pre-COVID-19 levels. With the phased return to normal life (With COVID-19) resuming commuting and school attendance, the fashion industry, once pushed to the brink, also saw a significant jump in operating profits.

Shinsegae Achieves Record-Breaking Performance

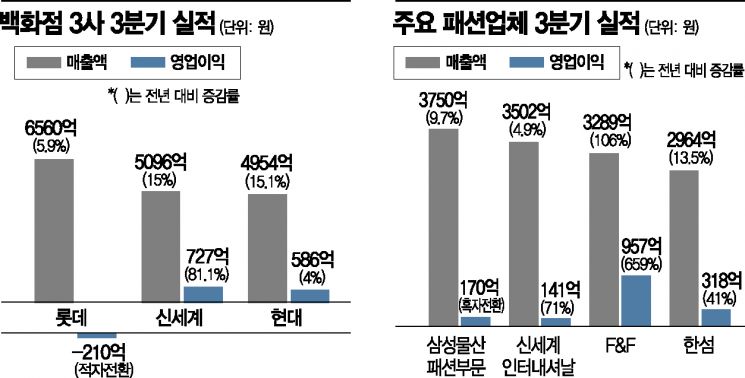

According to the distribution industry on the 10th, Shinsegae Department Store announced third-quarter sales of 509.6 billion KRW, a 15.0% increase from 443.1 billion KRW in the same period last year. Operating profit rose 81.1% to 72.7 billion KRW. Both sales and operating profit marked the highest third-quarter performance ever. Overseas fashion (29.7%) and luxury goods (32.7%) showed strong growth, while previously sluggish women's (15.7%) and men's fashion (19.8%) sales also increased evenly. The effect of new store openings also contributed. The introduction of a mezzanine floor at the Gangnam branch and the opening of the Daejeon Art & Science branch helped improve profits.

Hyundai Department Store recorded third-quarter sales of 495.4 billion KRW and operating profit of 58.6 billion KRW, up 15.1% and 4.0% respectively from the same period last year. Sales of luxury goods (33.6%), sportswear (43.0%), and outdoor wear (32.7%) increased significantly. Considering that the Trade Center branch was closed for over a week in July due to a COVID-19 cluster infection, this performance is regarded as commendable.

Lotte Department Store also saw continued sales growth centered on luxury goods (18.3%) and men's sportswear (10.8%), with third-quarter sales increasing 5.9% to 656 billion KRW. Although it recorded an operating loss of 21 billion KRW, this figure includes 60 billion KRW in voluntary retirement costs for 545 employees.

An industry insider said, "The three major department stores are completely recovering from the slump caused by COVID-19 since last year, based on offline store innovation and stable initial performance of new stores," adding, "With the full resumption of commuting under With COVID-19 and increased outings toward the year-end, the customer attraction effect is expected to continue, so strong performance can be anticipated in the fourth quarter as well."

Fashion Industry Sees "Light at the End of the Tunnel"

The fashion industry, which recorded sluggish results until the first half of the year, posted strong third-quarter results despite the seasonal off-season. Notably, both online and offline performances grew evenly.

The top five fashion companies?Samsung C&T Fashion Division, Handsome, Shinsegae International, F&F, and Kolon Industries FnC Division?posted combined sales of 1.5529 trillion KRW, a 22% increase from 1.2727 trillion KRW in the same period last year. Operating profit surged 663% to 158.1 billion KRW.

F&F showed steep growth. Its third-quarter sales reached 328.9 billion KRW, up 14.2%. Operating profit soared 659% to 95.7 billion KRW. MLB (163%), Discovery Expedition (19%), and MLB Kids (80%) all showed steady growth. Overseas sales, including China, increased significantly. F&F's China subsidiary's sales growth rate compared to the same period last year was about 657%.

Samsung C&T Fashion Division finally escaped the red. It recorded an operating profit of 17 billion KRW in the third quarter, turning profitable. Sales increased 9.7% year-on-year, driven by online malls and strong performances of overseas brands such as AMI, Maison Kitsun?, and Thom Browne.

Hyundai Department Store affiliate Handsome also saw sales and operating profit increase by 14% and 41%, respectively. Kolon FnC has not yet escaped operating losses but significantly reduced the deficit thanks to the popularity of golf brands including Zippo.

Fashion companies, heading into the seasonal peak, expect to recover sales to pre-COVID-19 levels in the fourth quarter. With commuting and school attendance resuming after With COVID-19, sales of high-margin winter outerwear are increasing. A fashion industry insider said, "With expectations for a return to normal life and recovering consumer sentiment, and an earlier-than-usual cold snap, outerwear sales have increased since October," adding, "Since the fourth quarter accounts for 50% of total sales, we are putting everything into the winter season business."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)