Record High Price of 82.7 Million Won... More Than Doubled in Four Months

Market Cap Size Comparable to Apple, MS, Amazon, Google

Liquidity Inflow Due to Eased China Risk and Inflation Hedge

[Asia Economy Reporters Minwoo Lee and Byungseon Gong] The price of Bitcoin, the leading cryptocurrency, has once again reached an all-time high, approaching the mid-80 million KRW range. This is attributed to Bitcoin ETFs being listed on the U.S. stock market, thereby bridging the traditional market, as well as the emergence of concrete use cases for cryptocurrencies such as non-fungible tokens (NFTs), which have led to cryptocurrencies being formally recognized as assets.

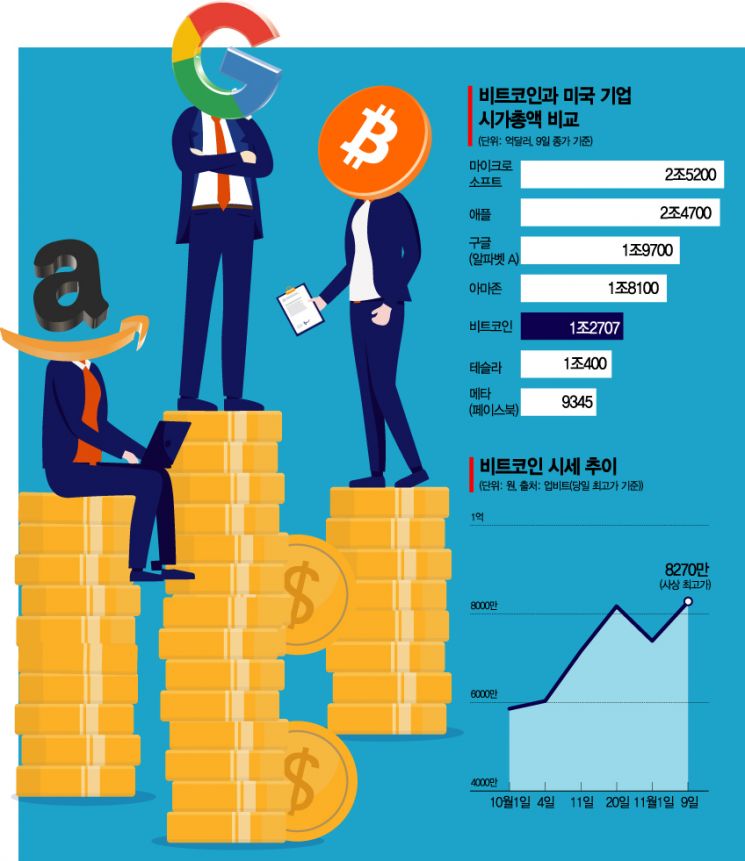

According to the domestic cryptocurrency exchange Upbit on the 10th, Bitcoin's price recorded an all-time high of 82.7 million KRW the previous day. This surpassed the previous record of 81.99 million KRW set on April 14, about seven months ago. Compared to the low of 33.9 million KRW on June 22, the price has more than doubled in just four months. As of 11:15 a.m. on the same day, the price was slightly down to 81.01 million KRW from the peak. Until the end of September, Bitcoin's price hovered around 50 million KRW, but it began to rise sharply last month following news that a Bitcoin ETF would finally be listed on the U.S. stock market. On the 20th of last month, it surged to 81.75 million KRW, soaring approximately 30 million KRW in just over 20 days. This is interpreted as reflecting expectations of its inclusion as a regulated asset.

◆Size Comparable to 5th Largest U.S. Market Cap= Amid this rapid rise, Bitcoin's market capitalization has come to rival the top companies in the U.S. stock market. As of the 9th (local time), Bitcoin's market cap stood at $1.2707 trillion (approximately 1,499 trillion KRW), ranking it 5th in the U.S. stock market behind Microsoft ($2.52 trillion), Apple ($2.47 trillion), Google (Alphabet A shares, $1.97 trillion), and Amazon ($1.81 trillion). It has already surpassed Tesla ($1.04 trillion) and Meta, Facebook's parent company ($934.5 billion).

On the 8th, when Bitcoin hit its all-time high (local time), the U.S.'s first Bitcoin ETF, the ProShares Bitcoin Strategy ETF (BITO), closed up 8.41%. Ethereum, another leading cryptocurrency alongside Bitcoin, also reached a record high of 5.83 million KRW that day. Globally, concerns over inflation have increased, leading to liquidity flowing into the crypto asset sector as a hedge. The trend of recognizing crypto assets as a store of value has strengthened amid signs of bond price declines.

The expectation that cryptocurrencies will be actively utilized beyond just Bitcoin has also acted as a positive factor. Metaverse (extended virtual worlds) and NFTs have already become hot topics in domestic and international stock markets, causing related companies' stock prices to fluctuate.

◆Reduced China Risk + Inflation Hedge= The China-related risks that caused volatility have diminished. In May alone, when Chinese regulators pressured cryptocurrency mining companies, Bitcoin's price dropped nearly 30 million KRW within a month. However, as cryptocurrency mining companies relocated to North America, Bitcoin prices have become less susceptible to Chinese pressure. Joo Ki-young, CEO of CryptoQuant, explained, "The hash rate, which is the computational power generated mainly by Bitcoin mining in China in the past, is now concentrated in the U.S.," adding, "China is currently in a position where it cannot significantly influence the cryptocurrency market."

As the market accepts Bitcoin as a hedge asset against inflation, some forecasts predict it could reach 100 million KRW. According to the U.S. economic media CNBC on the 8th (local time), the major U.S. investment bank JP Morgan expects Bitcoin to rise to $146,000 (approximately 172.13 million KRW) in the long term. Cathie Wood, CEO of Ark Investment, predicted Bitcoin could reach $500,000 within five years.

However, there are also views that it will be difficult for Bitcoin to reach 100 million KRW within this year. This is because it has surged more than 50% since last month, increasing the likelihood of a correction. CEO Joo said, "Leverage investments betting on Bitcoin's rise by borrowing money from brokerage firms are estimated to be at an all-time high," adding, "Even if a correction is short, if a large number of investors are forcibly liquidated, a price decline is inevitable."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.