Korea Economic Research Institute, Comparative Analysis of Corporate Tax Credits and Exemption Rates in Korea, the US, and Japan

[Asia Economy Reporter Kim Heung-soon] There is a claim that the level of tax support for Korean companies is less than half that of American and Japanese companies, which could negatively affect the competitiveness of Korean firms.

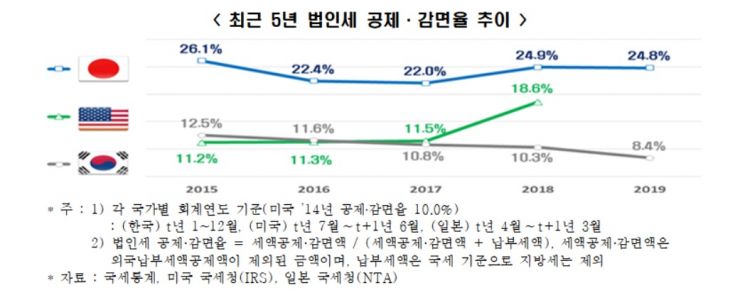

According to an analysis by the Korea Economic Research Institute (KERI) under the Federation of Korean Industries on the 10th, the proportion of corporate tax exempted through various deductions and exemptions out of the total corporate tax payable was 24.8% in Japan, 18.6% in the United States, and 8.4% in Korea as of 2019 (2018 for the US). This means that for every 100 won of tax, domestic companies received 8.4 won in deductions and exemptions, while American and Japanese companies received more than twice that amount, 18.6 won and 24.8 won respectively.

Looking at the trend of deduction and exemption rates over the past five years, the US rate steadily increased from 10.0% in 2014 to 18.6% in 2018, while Japan maintained a similar level with slight fluctuations, from 26.1% in 2015 to 24.8% in 2019. In contrast, Korea's deduction and exemption rate continuously decreased from 12.5% in 2015 to 8.4% in 2019.

Nominal vs. Effective Corporate Tax Rate Gap

US > Japan > Korea

Due to the low deduction and exemption rate, the gap between nominal and effective corporate tax rates was found to be smallest in Korea. Both the US and Japan had effective tax rates on average 3.3 percentage points lower than their nominal rates, whereas Korea's gap was only 1.4 percentage points, about half that of the US and Japan.

KERI explained that the effective tax rate reflects the actual tax burden after applying various deductions and exemptions, and a smaller gap between nominal and effective rates indicates that Korean companies receive fewer deduction and exemption benefits compared to those in the US and Japan. They pointed out that the low corporate tax deduction and exemption rate in Korea is due to insufficient tax support for large corporations. In fact, as of 2019, the deduction and exemption rate for large and medium-sized enterprises was only 5.1%, just one-quarter of that for small and medium-sized enterprises (20.1%).

Enhancing the Effectiveness of Deductions and Exemptions through Expanding Tax Credits and Abolishing Minimum Tax

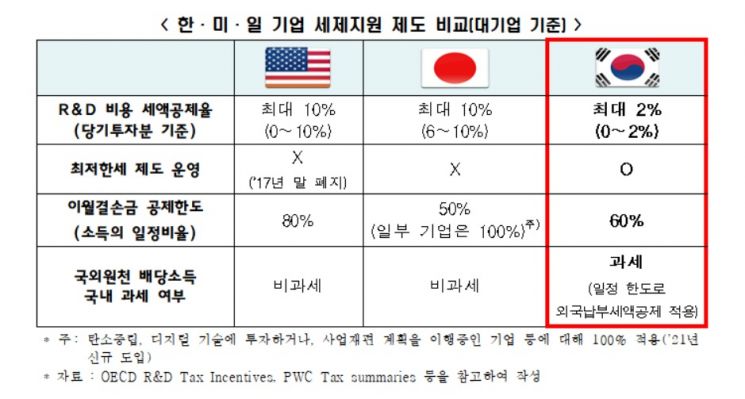

KERI argued that to raise Korea's corporate tax deduction and exemption rate to the level of the US and Japan, it is necessary to expand the research and development (R&D) tax credit, which accounts for more than half of domestic corporate tax deductions and exemptions. While the US and Japan allow large corporations to claim tax credits up to 10% of current R&D expenses, Korea's R&D tax credit rate for large corporations is only up to 2%.

They also emphasized the abolition of the corporate minimum tax system to increase the effectiveness of tax credit and exemption systems. The US abolished the minimum tax system at the end of 2017 along with a corporate tax rate reduction, and Japan does not operate a minimum tax system either.

Additionally, KERI argued that tax support should be strengthened by reducing taxable income itself through expanding income and expense deductions. The US allows carryforward loss deductions up to 80% of income, Japan allows 50-100%, and both countries actively utilize income deduction systems such as excluding dividend income received from foreign subsidiaries from domestic taxable income.

In contrast, Korea only allows carryforward loss deductions up to 60% of income for large corporations and includes all foreign-source income in domestic taxable income, indicating relatively insufficient support.

Choo Kwang-ho, Director of Economic Policy at KERI, stated, "An increase in corporate tax burden leads to a reduction in price competitiveness as well as a contraction in capacity for investment and employment, which in the long term acts as a factor that diminishes the vitality of the private economy." He added, "It is necessary to enhance corporate tax competitiveness by easing discriminatory tax support for large corporations and improving unreasonable tax systems."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.