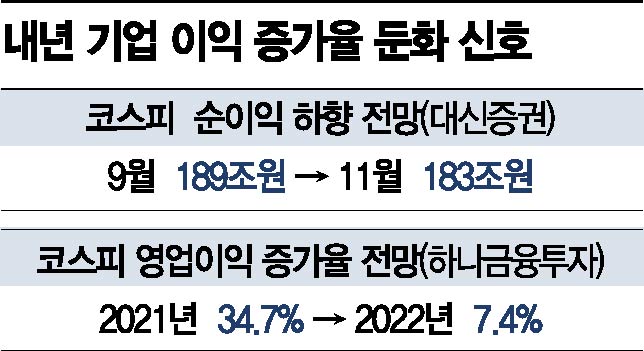

[Asia Economy Reporter Lee Seon-ae] As corporate profit growth rates are expected to slow down next year, the securities industry is raising voices that detailed investment strategies are necessary due to the lack of growth potential.

According to the financial investment industry on the 8th, with the Q3 earnings announcements completed for 200 major companies mainly large corporations, the provisional operating performance of domestic companies is estimated at 46 trillion won. By industry, shipbuilding and life insurance, aerospace defense, shipping, game entertainment, steel, refining, and banking showed earnings surprises, while hotel leisure, home appliances, electrical equipment, distribution, display, and chemicals experienced earnings shocks. This is expected to affect next year's earnings outlook as well. The forecasted operating profit growth rate for next year is low at 7.4%. By industry, next year's operating profit growth rates are expected to slow compared to this year's growth rates, with semiconductors at 5% and automobiles at 12%, down from 57% and 212%, respectively.

Lee Kyung-soo, a researcher at Hana Financial Investment, said, "The annual KOSPI profit growth rate and profit momentum showed a clear inverse relationship, meaning that as market growth stagnated, the impact of stock price increases due to upward revisions in individual company earnings was higher," adding, "The most critical market trend expected going forward can be seen as a market where premiums on growth potential increase." This implies that stocks with downward earnings revisions tend to experience larger price declines. Accordingly, since the number of stocks with earnings improvements is likely to decrease and their market capitalization relatively lower, it is necessary to maximize investment performance by employing a price pullback strategy in an individual stock market. Additionally, attention should be paid to the few stocks with upward earnings revisions next year that have not yet seen significant institutional inflows. These include Poongsan, Kiwoom Securities, Lotte Chemical, Samsung Electro-Mechanics, Pan Ocean, Hyundai Department Store, Korea Line, Woori Financial Group, POSCO, Korea Shipbuilding & Offshore Engineering, BH, Hanwha Solutions, and Huchems.

Lee Jae-man, a researcher at Hana Financial Investment, also emphasized, "The KOSPI's net profit estimate for next year has been revised downward from 189 trillion won in August to 183 trillion won as of November," adding, "KOSPI net profits are closely related to domestic export amounts, and doubts are growing about whether next year's export volume can break the all-time record." He continued, "From now on, when selecting stocks, it is important to consider the 2022 profit growth rate and whether earnings estimates are being revised upward. So far, stock returns have been relatively low, but it is worth paying attention to stocks with relatively high 2022 profit growth rates and recent upward revisions in earnings estimates." Stocks of interest include Krafton, SK Innovation, Samsung Electro-Mechanics, Korea Shipbuilding & Offshore Engineering, Orion, Hyundai AutoEver, Hanmi Pharmaceutical, OCI, CJ, and Studio Dragon.

Kim Kyung-hoon, a researcher at KTB Investment & Securities, stated, "Next year marks the beginning of a full-fledged earnings market, so market attention will focus on stocks with visibly improving fundamentals," emphasizing, "Funds will inevitably flow to stocks with high asset turnover and high margins that show outstanding earnings growth." Related stocks include Pearl Abyss, Alteogen, AfreecaTV, Hana Materials, Hugel, EO Technics, Wizworks Studio, Chunbo, SK Hynix, Iljin Hysolus, Kangwon Land, Lotte Tour Development, Hwasung, SK Highitech, HYBE, Zinus, KMW, Myungshin Industry, Iljin Materials, HanAll Biopharma, SoluM, Daewoo Electronics Materials, EcoPro BM, and ST Pharm.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.