[Asia Economy Reporter Lee Seon-ae] Securities firms are raising their target prices for Simtek in a flood of upgrades. This is based on the judgment that it is the top pick stock in the industry due to strong profitability improvement. Simtek produces package substrates used in semiconductor packaging.

According to the financial investment industry on the 7th, Shinhan Financial Investment, Hana Financial Investment, and Korea Investment & Securities simultaneously raised their target prices for Simtek.

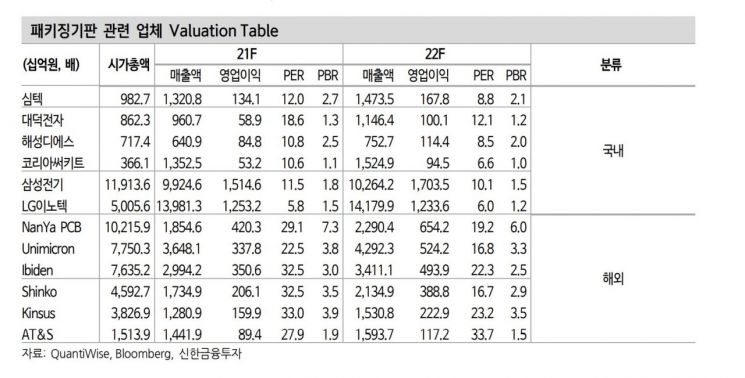

Park Hyung-woo, senior researcher at Shinhan Financial Investment, said, "We raised Simtek's target price to 46,500 KRW and significantly revised the 2022 operating profit forecast from 167.4 billion KRW to 230.4 billion KRW," adding, "The target price was calculated by applying a price-earnings ratio (PER) of 9.1 times of peer competitors to next year's earnings per share (EPS), and we maintain our top pick opinion for the IT components sector."

He continued, "Semiconductor companies are checking the trends of set and semiconductor demand more closely than the capital market, and these companies are showing more aggressive moves to secure packaging substrates despite some slowdown in sales of certain sets," adding, "This is evidence of substrate shortage, so attention should be paid to the packaging substrate industry beyond short-term performance."

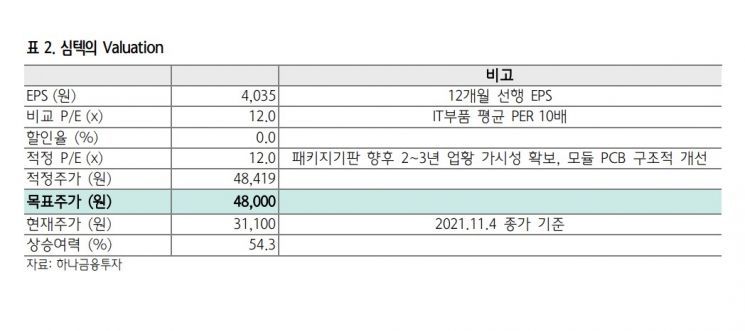

Korea Investment & Securities also forecasted that Simtek's profitability will improve thanks to the global substrate supply shortage as it expands the proportion of high value-added substrates. The target price was raised to 48,000 KRW.

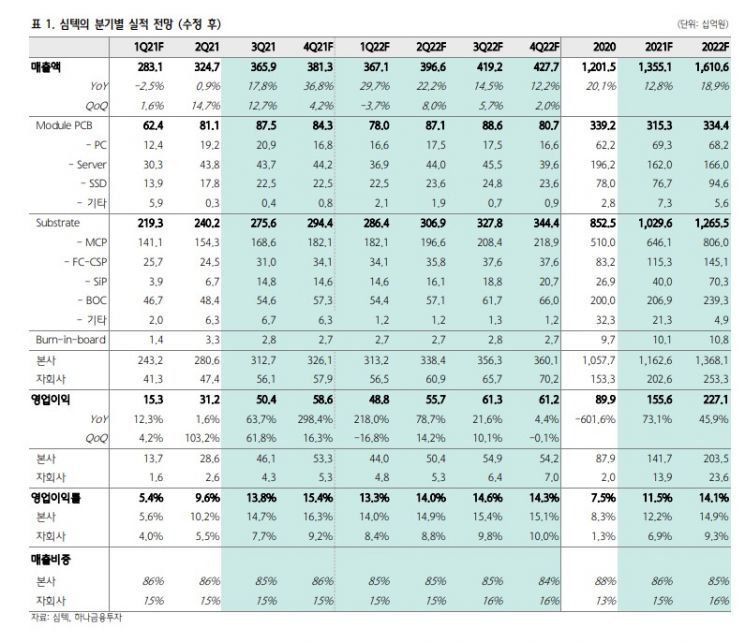

Simtek posted consolidated sales of 366 billion KRW and operating profit of 50.4 billion KRW in the third quarter. Sales increased by 17.7% and operating profit by 61.3% compared to the third quarter of last year. It is analyzed that the operating profit margin was raised by increasing sales of micro-scale manufacturing process (MSAP) substrates, which are considered high value-added products among package substrates.

Cho Cheol-hee, a researcher at Korea Investment & Securities, predicted that Simtek's operating profit margin will rise from 11.4% this year to 13.3% next year. Researcher Cho said, "Globally, the shortage of package substrates has worsened, raising the average selling price (ASP), and the exchange rate is also favorable," adding, "When the 10,000㎡ expansion of MSAP substrates is completed this year, Simtek's package substrate sales next year will increase by 27.8% compared to this year."

It is expected to achieve consolidated sales of 1.36 trillion KRW and operating profit of 155 billion KRW in 2021. Compared to last year's performance, sales will increase by 13.2% and operating profit by 73.1%.

Hana Financial Investment raised Simtek's target price to 48,000 KRW. This is due to upward revisions of operating profit by 16% and 22% for 2021 and 2022, respectively.

Kim Rok-ho, a researcher at Hana Financial Investment, said, "The package substrate market is expected to grow steadily in 2022, and Simtek is also expected to consider another expansion within 2022," adding, "The reason Simtek's PER was undervalued was due to the company's low overall operating profit margin, but now that the valuation discount factor has been removed, it is time to enjoy the package substrate market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)